Analyst: Bobby Lu

|

§ |

What’s New

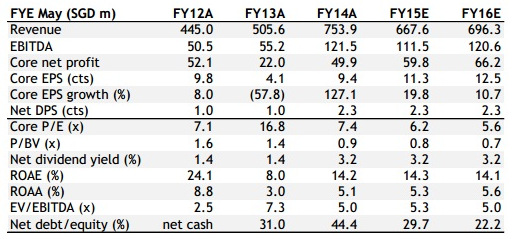

Lian Beng ended FYMay14 strong, driven by broad based improvements in almost all business segments. The construction orderbook is expected to remain over the $1b mark, while earnings from the property segment would be led by Spottiswoode and Midtown development.

Lian Beng’s recent diversification into the Leng Kee motor belt and Australia’s residential and hotel segment also suggests that management is proactive in seeking new market opportunities to offset the sluggish domestic residential property segment.

Recurring income base is expected to grow to 18% of pretax by FY16 with the addition of asphalt-premix, higher contributions from its workers dormitory in Mandai and concessions to a new granite quarry.

What’s Our View

What’s Our ViewWe believe that markets are not pricing in Lian Beng’s stellar margins in the construction business and future proceeds from its property development and investment segment.

The group’s growing stream of recurring income would help mitigate earnings volatility in an industry that is susceptible to cyclicality.

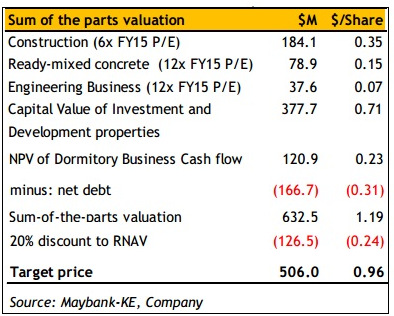

Using SOTP valuation methodology and a 20% holding discount, we derive an RNAV target price of $1.19.

Recent story: LIAN BENG: One-Off $8.45 m Boost From Sale Of Midlink Plaza