GLOBAL INVACOM, a two-bagger stock pick of NextInsight forumer Joseph Yeo, bought back lots of its shares last week, stopping a recent downturn in its stock price.

• Tues (2 Sept 2014): 620,000 shares @ 44.5 cents a share.

• Wed (3 Sept 2014): 700,000 shares @ 44.2857 cents a share.

• Thurs (4 Sept 2014): 610,000 shares @ 44 cents a share.

• Fri (5 Sept 2014): 700,000 shares @ 44 cents a share.

Total: 2,630,000 shares for $1,165,907.

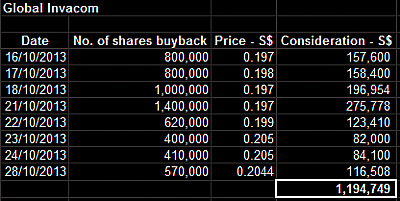

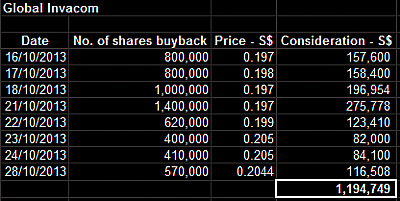

In this 2013 share buyback spree, Global Invacom paid an average of 19.91 cents a share.

In this 2013 share buyback spree, Global Invacom paid an average of 19.91 cents a share.

Global Invacom is one of seven major satellite communications equipment companies in the world with a global marketing reach, integrated manufacturing footprint and strong R&D capabilities.

It was listed on the mainboard of SGX via a reverse takeover of Radiance in July 2012.

Joseph Yeo first highlighted this stock on 22 Oct 2013 when it was trading at 20.5 cents.

See thread for his reasons, which included the intense share buyback programme of the company (see table above).

In that buyback spree, the company spent about S$1.19 million and ended the buying within two weeks.

With S$1.17 million already expended last week, is the buyback going to end this week? We'll just have to wait and see.

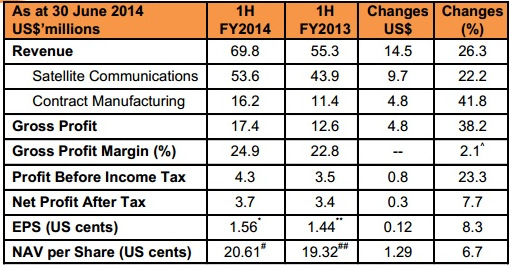

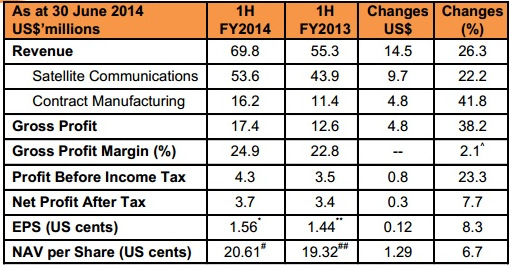

Meanwhile, looking at its 1H2014 financial performance, one can appreciate the double-digit rise in gross profit and revenue (table below). Notably, gross margin rose from 22.8% to 24.9%.

|

Tony Taylor was appointed MD of Global Invacom in 2006.On the balance sheet, borrowings were minimal, amounting to just US$0.5 million as at end-June 2014, compared to US$0.1 million at end-Dec 2013. Tony Taylor was appointed MD of Global Invacom in 2006.On the balance sheet, borrowings were minimal, amounting to just US$0.5 million as at end-June 2014, compared to US$0.1 million at end-Dec 2013.

Cash and cash equivalents were also almost unchanged at US$14.8 million and US$14.7 million, respectively, as at end-June 2014.

Subsequently, the cash level rose on July 2 with the placement of 44.6 million new shares totalling US$15.0 million (S$18.7 million) at 19.75 U.K. pence (S$0.42) per share in conjunction with the company's secondary listing on AIM in London.

Earlier in the year, the share price rose to as high as 55 cents but has since corrected to 44 cents -- where last week the company resumed buying its shares enthusiastically.

From being at a discount to NAV, the stock is now trading at a premium to its 26-SGD cent NAV (as at end-2014).

If you annualise the 1H earnings, the stock's current-year PE is about 13X -- which is not exactly at bargain basement levels.

However, excluding one-off professional fees for its AIM listing, 1H2014 net profit would have been US$4.9M.

Taking US$3.7 m for 1H and assuming US$4.9 m as net profit for 2H will give us a slightly more attractive current-year PE of 11X.

|

Global Invacom's Powerpoint material on its 1H2014 results can be viewed on SGX website.

Recent story: GLOBAL INVACOM: Positioning itself as a growth story

In this 2013 share buyback spree, Global Invacom paid an average of 19.91 cents a share.

In this 2013 share buyback spree, Global Invacom paid an average of 19.91 cents a share.

Let wait for the rally.