Excerpts from analysts' reports

CIMB lowers Straco's target price to 79 cents on Singapore Flyer acquisition

Analysts: Jessalynn CHEN and Kenneth NG, CFA

|

|

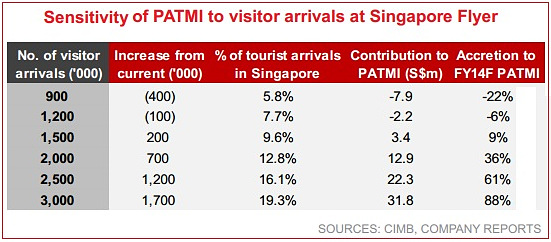

What Happened  Singapore Flyer is the world’s largest Giant Observation Wheel. Photo: Singapore FlyerStraco announced that it has acquired a 90% stake in the Singapore Flyer, the iconic giant observation wheel, for S$126m. The remaining 10% will be held by WTS Leisure Pte Ltd, a strategic partner in the local tourism industry that owns and operates a fleet of 350 tour buses in Singapore. The acquisition will be funded via cash and bank debt. Plans for the Singapore Flyer will be revealed when Straco officially takes over in 2-3 months’ time. Singapore Flyer is the world’s largest Giant Observation Wheel. Photo: Singapore FlyerStraco announced that it has acquired a 90% stake in the Singapore Flyer, the iconic giant observation wheel, for S$126m. The remaining 10% will be held by WTS Leisure Pte Ltd, a strategic partner in the local tourism industry that owns and operates a fleet of 350 tour buses in Singapore. The acquisition will be funded via cash and bank debt. Plans for the Singapore Flyer will be revealed when Straco officially takes over in 2-3 months’ time. What We Think The total purchase consideration of S$140m represents a 42% discount to the Singapore Flyer’s initial cost of S$240m. While Straco was bidding against several other parties for the asset, we believe that it would not overpay given its measured approach towards expansion. The asset is expected to bring in positive cash flows immediately but we estimate that it is mildly dilutive for EPS in the near term (2-3% dilution) and will only be accretive in FY17 and beyond as visitor arrivals pick up. The operating structure is similar to that of Straco’s aquariums as the bulk of operating costs are fixed; this means that operational efficiencies can only be reaped above a breakeven point which we estimate to be 1.4m visitors/year. We believe that a turnaround story hinges on 1) stronger visitor arrivals in Singapore, driven by the return of Chinese tourists, 2) channelling tour groups to the Singapore Flyer through its partner, WTS, 3) redevelopment of the area by adding attractions, and 4) better tenant mix.  What You Should Do We believe the recent share price run-up was fuelled by expectations of immediate earnings accretion from the acquisition. However, the Singapore Flyer has seen declining business over the last six years and a strong turnaround may be difficult in the near term. We expect the share price to react negatively to this news, hence our downgrade from add to Reduce. We will turn more positive when visitor arrivals gain traction and bring efficiency gains. Full CIMB report here. Recent story: STRACO target raised to 96 c; KIM HENG still a buy, 30-c target |

OSK-DMG revises Hiap Hoe target to SGD1.03, based on a 40% discount to its RNAV

Analyst: Goh Han Peng

We met up with Hiap Hoe (HIAP SP) recently following its interim results. The following are our takeaways:

Ramada Hotel @ Zhongshan Park in Balestier area. NextInsight file photo1) Occupancy for its 2 hotels (Days Hotel and Ramada Singapore) at Zhongshan Park has steadily ramped up to 80-90% in the last few months. The group has been able to build up a broad corporate and leisure clientele, capitalizing on its location to tap into niche segments such as medical tourists, sporting events and aircrew businesses. Meanwhile, occupancy for its retail and office components are close to 100%;

Ramada Hotel @ Zhongshan Park in Balestier area. NextInsight file photo1) Occupancy for its 2 hotels (Days Hotel and Ramada Singapore) at Zhongshan Park has steadily ramped up to 80-90% in the last few months. The group has been able to build up a broad corporate and leisure clientele, capitalizing on its location to tap into niche segments such as medical tourists, sporting events and aircrew businesses. Meanwhile, occupancy for its retail and office components are close to 100%; 2) On the residential front, the group has sold 92% and 75% of Skyline 360° and Waterscape at Cavenagh, respectively. The proposed bulk sale of Treasure@Balmoral at SGD1850 psf has received interest from several bidders with negotiations still on-going;

4) The group recently launched its maiden overseas project, Marina Tower, in Melbourne. Marina Tower comprises of 461 residential apartments and a 269-room hotel to be managed by Sheraton under the Four Points brand, The group has sold 70% of the residential units and targets to complete selling the remaining units by year-end.

The launch of its second Melbourne property, 380 Lonsdale Street, is slated for next year, while 206 Bourke Street (Melbourne) and Sterling Street, Perth will be kept for recurring income, having secured these at attractive cap rates of 8.5-9%. Hiap Hoe intends to build on its hospitality business, building on its success in Singapore.

Recent story: Sumer: My Take On HIAP HOE's 2Q Results