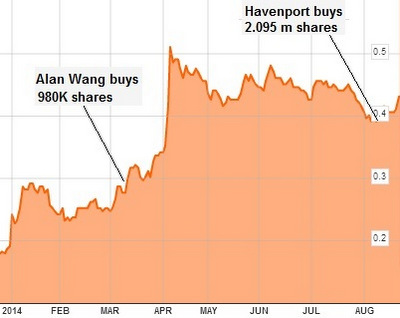

Loss-making in the 9MFY14, AusGroup (43 cents) has a market cap of S$279 million. Chart: Bloomberg.AUSGROUP has attracted a new substantial shareholder, Havenport Asset Management.

Loss-making in the 9MFY14, AusGroup (43 cents) has a market cap of S$279 million. Chart: Bloomberg.AUSGROUP has attracted a new substantial shareholder, Havenport Asset Management.The fund bought 1.35 m shares on Aug 7 at 39.5 cents apiece on average, lifting its holding to 32.869 million shares, or 5.07% of AusGroup.

The fund had earlier bought 745,000 shares on Aug 5 at 39.13 cents apiece on average. (See SGX filing)

Earlier, on 12 March, substantial shareholder Alan Wang had boosted his stake by 980,000 shares (at 27.65 cents apiece) to 37.5 million, or a 5.7846% stake in the company.

In addition, on 9 April, AusGroup announced that Ezion Holdings Limited had become a substantial shareholder in the company (6.9%).

It also marked the beginnings of a transformation in the business of AusGroup. See: AUSGROUP forays into marine logistics with acquisition of Ezion port

In a May update, AusGroup said that it is "seeing increased opportunities arising from LNG construction and maintenance projects that offset the slowdown in the minerals mining sector. We expect that trend will continue over the next 12-24 months."

|

Recent story: Massive S$127.8 m profit forecast for ROXY-PACIFIC "reasonable" |