Excerpts from analyst's report

OSK-DMG analyst: Lee Yue Jer, CFA (right)

OSK-DMG analyst: Lee Yue Jer, CFA (right)

King Wan posted an exceptionally strong 1QFY15 PATMI of SGD25.9m, boosted by a SGD24m profit from the sale of its Thai associates. Its orderbook of SGD164m provides two years of earnings visibility.

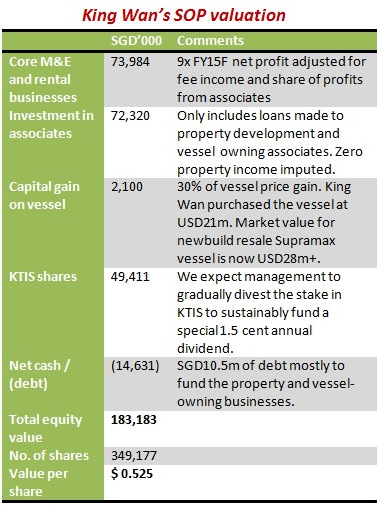

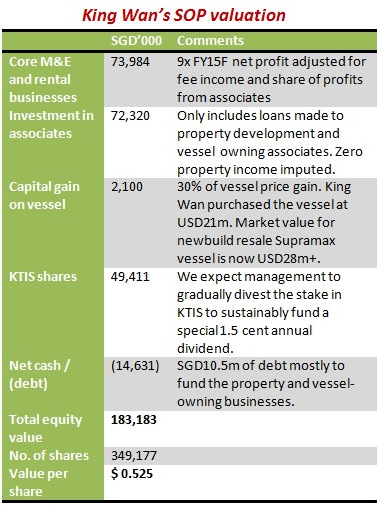

We continue to forecast a 3-cent dividend going forward, implying a 9.2% yield. Our SOP valuation stands at SGD0.525 per share, supporting our SGD0.43 TP based on a 7% required yield. Maintain BUY.

Strong core earnings. King Wan’s 1QFY15 revenue was 16% lower q-o-q due to its highly conservative accounting policy, but its gross margin grew 7.8ppts q-o-q to 24.9%, as variation orders were recorded this quarter.

Source: OSK-DMGStripping out the SGD24.1m gain on sale of its Thai associates, King Wan’s core PATMI was SGD1.8m. This prompts us to raise our FY15F core estimate by 30% to SGD8.7m as we continue to expect c.SGD100m of revenue this year, backed by its SGD164m orderbook, of which SGD25.5m were secured in the last five months.

Source: OSK-DMGStripping out the SGD24.1m gain on sale of its Thai associates, King Wan’s core PATMI was SGD1.8m. This prompts us to raise our FY15F core estimate by 30% to SGD8.7m as we continue to expect c.SGD100m of revenue this year, backed by its SGD164m orderbook, of which SGD25.5m were secured in the last five months.

KTIS shares at record high above IPO level. King Wan owns c.3% of Kaset Thai International Sugar Corp PCL (KTIS TB, NR) after the sale of its Thai associates to KTIS. On King Wan’s books, these are carried at SGD42.2m.

However, KTIS shares just hit THB10.90 per share, 10% higher than the IPO price, and King Wan’s stake is now worth SGD49.4m. We believe that management would be happy to sell a small part of its holdings to fund the 1.5-cent special dividend.

40% below SOP valuation of SGD0.525. Our sum-of-parts (SOP) valuation for King Wan stands at SGD0.525 per share (see table on the right), valuing its FY15F earnings on the core M&E business at 9x, investments in associates at book value (not imputing any profits), the capital gain on the vessel, the KTIS shares at market value, and subtracting net debt.

Re-rating hinges on confirmation of 9.2% yield. We believe that King Wan’s shares will not trade at a 9.2% forecast yield indefinitely. All that is required for a re-rating is a confirmation of the yield and its sustainability. We believe such a trigger may come in its 2Q15 results and dividend declaration. We continue to recommend a BUY with a SGD0.43 TP, based on a 7% required yield.

Full report here.

See also posts on NextInsight forum.

OSK-DMG analyst: Lee Yue Jer, CFA (right)

OSK-DMG analyst: Lee Yue Jer, CFA (right)King Wan posted an exceptionally strong 1QFY15 PATMI of SGD25.9m, boosted by a SGD24m profit from the sale of its Thai associates. Its orderbook of SGD164m provides two years of earnings visibility.

We continue to forecast a 3-cent dividend going forward, implying a 9.2% yield. Our SOP valuation stands at SGD0.525 per share, supporting our SGD0.43 TP based on a 7% required yield. Maintain BUY.

Strong core earnings. King Wan’s 1QFY15 revenue was 16% lower q-o-q due to its highly conservative accounting policy, but its gross margin grew 7.8ppts q-o-q to 24.9%, as variation orders were recorded this quarter.

Source: OSK-DMGStripping out the SGD24.1m gain on sale of its Thai associates, King Wan’s core PATMI was SGD1.8m. This prompts us to raise our FY15F core estimate by 30% to SGD8.7m as we continue to expect c.SGD100m of revenue this year, backed by its SGD164m orderbook, of which SGD25.5m were secured in the last five months.

Source: OSK-DMGStripping out the SGD24.1m gain on sale of its Thai associates, King Wan’s core PATMI was SGD1.8m. This prompts us to raise our FY15F core estimate by 30% to SGD8.7m as we continue to expect c.SGD100m of revenue this year, backed by its SGD164m orderbook, of which SGD25.5m were secured in the last five months. KTIS shares at record high above IPO level. King Wan owns c.3% of Kaset Thai International Sugar Corp PCL (KTIS TB, NR) after the sale of its Thai associates to KTIS. On King Wan’s books, these are carried at SGD42.2m.

However, KTIS shares just hit THB10.90 per share, 10% higher than the IPO price, and King Wan’s stake is now worth SGD49.4m. We believe that management would be happy to sell a small part of its holdings to fund the 1.5-cent special dividend.

40% below SOP valuation of SGD0.525. Our sum-of-parts (SOP) valuation for King Wan stands at SGD0.525 per share (see table on the right), valuing its FY15F earnings on the core M&E business at 9x, investments in associates at book value (not imputing any profits), the capital gain on the vessel, the KTIS shares at market value, and subtracting net debt.

Re-rating hinges on confirmation of 9.2% yield. We believe that King Wan’s shares will not trade at a 9.2% forecast yield indefinitely. All that is required for a re-rating is a confirmation of the yield and its sustainability. We believe such a trigger may come in its 2Q15 results and dividend declaration. We continue to recommend a BUY with a SGD0.43 TP, based on a 7% required yield.

Full report here.

See also posts on NextInsight forum.