|

HARDLY A YEAR goes by without investors having to confront news of some lapse in corporate governance in a SGX-listed company. So, let's get back to the basics on who has what role and duty in a listed company, in this Q&A piece with Robson Lee, a partner at the legal firm of Shook Lin & Bok LLP. The content is adapted from presentations he is giving to clients this month and next. Robson ( |

Robson Lee will be presenting to clients in either English or Mandarin, depending on their preference. Photo: Company

Robson Lee will be presenting to clients in either English or Mandarin, depending on their preference. Photo: Company

Q: The SGX Listing Manual and Singapore Code of Corporate Governance (Code) recommends that the roles of CEO and Chairman be assumed by different persons. What is the rationale? The separation of roles is not universally practised in Singapore, is it?

Robson:The rationale is to ensure an appropriate balance of power, increased accountability and greater capacity for independent decision-making by the board of directors (Board). The division of responsibilities between CEO and Chairman should be clearly established, set out in writing and approved by the Board. The relationship between CEO and Chairman should be disclosed if they are immediate family members.

The peculiar situation in Singapore is that the CEO of a listed company is usually a controlling shareholder. The CEO is often also the Chairman and is able to exert control over the Board.

Q: Well, there is an extraordinary case just announced of Hewlett Packard handing the Chairman's role toCEO and President Meg Whitman....In Singapore-listed companies where CEO is also Chairman, what roles do Independent Directors (IDs) play?

Robson: IDs -- be they appointed to boards where the CEO is also the Chairman, or otherwise -- are expected to provide objective input to the Board’s decisions, and to exercise independent judgment on corporate affairs that is not subject to any influence from management.

In Singapore, the proposed IDs of a listing aspirant may be friends or persons who are well acquainted with the top management. Notwithstanding this, IDs must be conscious of their role, and must be able to maintain their independence and make decisions in the best interests of the Company.

An “independent” director is defined in the Code as someone who has no relationship with the Company, its related corporations, shareholders holding shares in the Company of 10% or more, or its officers, that could interfere, or be reasonably perceived to interfere, with the director’s independent business judgment to act in the best interests of the Company.

The Code sets out a non-exhaustive list of circumstances where a director shall be deemed non-independent, and provides guidance on how the independence of an ID should be assessed. For instance, the independence of a director who has served on the Board for more than 9 years should be subject to particularly rigorous scrutiny. The Board should also identify in the Company’s Annual Report each director that it deems to be independent.

Q: Tell us about key rules governing board composition.

Robson: As a general rule, to provide a strong and independent element to the Board, the Code provides that IDs should make up at least one-third of the Board.

IDs should make up half of the Board, and a lead ID should be appointed where:

(a) CEO and Chairman are the same person;

(b) CEO and Chairman are immediate family members;

(c) Chairman is part of the management team; or

(d) Chairman is not independent.

Companies which are required to increase the composition of IDs on their Boards in accordance with the Code should do so following the financial year commencing from 1 May 2016.

The Board should be as dynamic as possible, and the IDs must ensure that all corporate actions involving significant financial resources of the Company are undertaken only with proper due diligence verifications and competent professional advice.

Q: Corporate Governance is a much-talked about concept. How would you describe it?

Robson: Corporate governance essentially refers to the set of processes, customs, policies, laws and institutions affecting the way in which a corporation is directed, administered or controlled.

It is a multi-faceted subject that deals with important issues such as accountability and fiduciary duty, essentially advocating the implementation of policies and mechanisms to ensure best practices, transparency and complete and timely public disclosures.

Key elements of good corporate governance principles include transparency in Board decisions and management actions, trust and integrity, openness, performance orientation, responsibility and accountability, mutual respect, and commitment to the organisation.

|

Q: There is no shortage of examples of lapses of corporate governance. Robson:Yes, three cases come to mind. Ø Non-compliance by China Sky with SGX directive in November 2011 to appoint a special auditor after concerns were raised over certain interested person transactions, a failed land acquisition and expenses paid to related parties. Ø Legal proceedings were brought against China Sky’s ex-CEO by the Monetary Authority of Singapore in March 2012. China Sky was also investigated by the Commercial Affairs Department for potential breaches of the Securities and Futures Act. Ø Trading in China Sky shares has been suspended since November 2011. China Sky submitted a trading resumption application to the SGX on 12 May 2014, and is currently awaiting the SGX’s approval to resume trading. JPMorgan Chase – The “London Whale” Scandal Ø JPMorgan Chase trader, Bruno Iksil (nicknamed the London Whale) incurred more than US$6.2 billion in derivative deals from April to May 2012. Ø Failure of JPMorgan to keep watch over its traders - a complex portfolio was overvalued to hide massive losses. Ø The Board was deprived of necessary information to assess the bank’s problems and determine whether accurate disclosure was made to investors and regulators. Ø Two former traders faced criminal charges and, in 2013, JPMorgan Chase was made to pay almost US$1 billion in fines after admitting that it had failed to rein in loose trading practices. The IDs of Airocean were charged and convicted with: (a) recklessly failing to announce information which Airocean was required by law to announce; (b) making a false public announcement which was likely to have the effect of stabilising the market price of Airocean’s shares; and (c) insider trading. Materiality The Singapore High Court drew a distinction betweenprice-sensitive information, being information likely to effect a significant change in the price or value of shares, andtrade-sensitive information, being information which a reasonable person would expect to materially affect the price or value of shares, and it would, or would be likely to influence an investor’s decision to trade in those shares. The High Court clarified that that there are two separate regimes for materiality under the SFA. The test for misleading and non-disclosure offences - whether the information in question is price-sensitive; the test for insider trading offences - whether the information is trade-sensitive. The High Court ruled that the IDs did not act recklessly, as they had sought legal advice from external counsel on the need for disclosure, and had no duty to question such advice unless it was manifestly absurd, irrational or wrong. Conclusion The information was found to be trade-sensitive but not price-sensitive. The IDs were acquitted of the offences of making misleading statements and non-disclosure of material information. This landmark decision provides guidance on the regulatory framework regarding disclosure offences under the SFA, and clarifies the position of directors regarding their disclosure obligations and duties thereunder. |

Q: What would you define as risk management and internal controls?

Robson: Risk management is an institutionalised system for measuring, monitoring and controlling the financial or operational risks of a company.

It involves putting in place a framework or structure to identify the risks associated with a company’s business, and devising a set of documented procedures and processes to contain the risks associated with a company’s business.

Internal controls is a designed process that is implemented to provide reasonable assurance in ensuring the effectiveness and efficiency of the business operations in a company, the reliability of financial reporting and compliance with applicable laws and regulations.

A company should have a robust and effective system of internal controls that addresses financial, operational and compliance risks.

If one man is allowed to go on a frolic of his own and do things without checks and balances, it could spell trouble for the Company.

The Board:

(a) is responsible for risk governance;

(b) should ensure that management maintains a sound system of risk management and internal controls to safeguard shareholders’ interests and the company’s assets;

(c) should determine the nature and extent of risks which the Board may undertake; and

(d) should assess appropriate means to assist it in carrying out its responsibility of overseeing the company’s risk management framework and policies.

The Board should comment in the Annual Report on:

(a) the adequacy and effectiveness of the company’s risk management systems and internal controls, and

(b) whether it has received written assurance from the CEO and CFO that (i) the financial records have been properly maintained, and (ii) an effective risk management and internal control system has been put in place.

Of course, such disclosure requirements do not derogate or absolve directors from their statutory obligations under the Companies Act.

The SGX Listing Manual provides that if the Audit Committee becomes aware of any suspected fraud, irregularity or suspected infringement of a Singapore law, regulation or rule, which has or is likely to have a material impact on the company’s operating results or financial position, the Audit Committee must disclose this to the external auditor and report the matter to the Board.

Examples of past internal control failures include: Barings Bank (Nick Leeson), Singapore Airlines (Teo Cheng Kiat) and Asia Pacific Breweries (Chia Teck Leng).

Q: Within the Board there are the Audit Committee, Nominating Committee and Remuneration Committee. What are their roles?

Robson: Among other things, the role of the Audit Committee is to:

(a) review significant financial reporting issues and judgments to ensure the integrity of the financial statements of the company;

(b) review and report to the Board on the adequacy and effectiveness of the company’s internal controls and internal audit function;

(c) review the scope and results of the external audit, and the independence of the external auditors; and

(d) make recommendations to the Board on, inter alia, the appointment and re-appointment of the external auditors.

The Nominating Committee should make recommendations to the Board on all board appointments. The revised Code gives more clout to the Nominating Committee by extending its responsibilities to include, inter alia:

(a) leading the conducting of performance evaluations of the Board, its committees and directors;

(b) ensuring the company adheres to board composition rules;

(c) assessing the independence of IDs; and

(d) taking a lead role in succession planning for key figures within the company.

The role of the Remuneration Committee is to develop policies on executive remuneration and to recommend specific remuneration packages for the Board and key management.

Q: Regarding corporate conduct and ethics, how much regulation should there be?

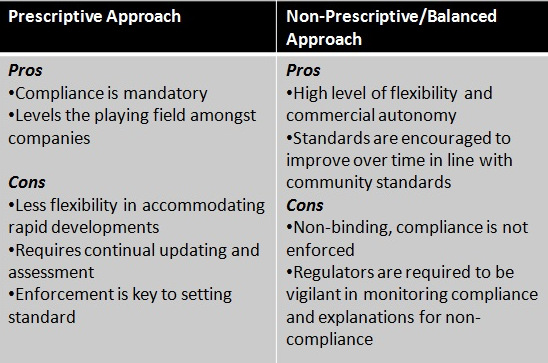

Robson: Regulation can be prescriptive, non-prescriptive or balanced.

The prescriptive approach requires companies to adopt specific corporate governance practices whereas the non-prescriptive (self-regulation) approach allows companies to determine their own corporate governance practices, subject to appropriate disclosures of corporate governance practices that are adopted.

The balanced approach specifies corporate governance best practices but allows companies to depart from these practices subject to appropriate disclosures and clear explanations for non-compliance.

An example of prescriptive regulation was the passing of the Sarbannes-Oxley Act 2002 by the US Congress in response to the corporate scandals of Enron, Tyco and WorldCom.

An example of balanced regulation was the issuance of the UK Corporate Governance Code (formerly the Combined Code) in 1992, which set out core governance principles and guidelines. The new edition of the UK Corporate Governance Code was published in September 2012 and applies to reporting periods beginning on or 1 October 2012.

Q: What are the duties of accountants and auditors? Can they be held responsible in cases of wrongdoing by directors?

Robson: Of course, whenever there is a corporate debacle, questions could be asked of whether the auditors could have detected the wrongdoing?

The default position is that the auditors are usually not held responsible for the negligence or wrongdoing of directors.

The 2003 UK case of Barings plc v Coopers & Lybrand established that an auditor is neither a ‘detective’, ‘insurer’, ‘paragon’ nor ‘prophet’ and this position was reiterated in the local case of JSI Shipping (S) Pte Ltd v Teofoongwonglcloong (a firm).

The SGX Listing Manual contains provisions providing guidance on the suitability of auditors, and sets out the prerogative of the SGX to require the appointment of a compliance adviser, object to the appointment of an auditor, or to direct an independent special audit.

The SGX Listing Manual requires a "negative assurance" statement from the board on interim financial results. In practice, IDs request the Company’s external auditors to perform and provide a written report to the Board in respect of certain agreed-on audit procedures and accounting reviews not amounting to a full audit, before the announcement of the interim results.

|

Seminal Court of Appeal cases on the issue of the duty of care owed by auditors: Ø PlanAssure PAC v Gaelic Inns Pte Ltd Ø Statutory auditors have a duty to be alive to the possible existence of fraud. Ø On the facts, the Court of Appeal held that the irresistible inference was that the auditor had failed to recognise from the striking facts before it that something was amiss, and was woefully deficient in the discharge of its duties. Ø JSI Shipping (S) Pte Ltd v Teofoongwonglcloong (a firm) Ø Court of Appeal clarifies and restates the law of professional negligence in the context of statutory audits. It specifically evaluates the standard of care expected of an auditor in relation to the objective verification of relevant financial particulars and discusses the principles of causation applicable in a claim for damages against auditors. Ø United Project Consultants Pte Ltd v Leong Kwok Onn. |

Media releases from the Institute of Singapore Chartered Accountants (ISCA):

Ø 09 January 2009 – ISCA emphasizes the need to adhere to important corporate governance standards

Ø 03 March 2009 – ISCA states that more members of Audit Committees of listed companies should possess formal accounting and financial qualifications and experience

Ø 26 January 2010 – ISCA issues final set of clarified Singapore Standards on Auditing

Ø 09 November 2011 – ISCA launches guide on Singapore Financial Reporting standards for Small Entities.

Ø 27 November 2013 – ISCA releases joint study with KPMG: Need for higher quality disclosures in Risks Governance.

Auditors must consider and identify the risk of fraud, and must continuously evaluate evidence throughout the audit to determine whether or not there are any fraud indicators or red flags. Where need be, there should be regular communication with the Board to help the auditors identify the potential fraud-risks areas.

Robson (extreme right) at the IPO launch party of KOP Limited on 15 May 2014. At extreme left of the picture is Ms Ong Chih Ching, the Executive Chairman of KOP Limited. She won the Outstanding Entrepreneur Award of the Asia Pacific Entrepreneurship Award 2014.

Robson (extreme right) at the IPO launch party of KOP Limited on 15 May 2014. At extreme left of the picture is Ms Ong Chih Ching, the Executive Chairman of KOP Limited. She won the Outstanding Entrepreneur Award of the Asia Pacific Entrepreneurship Award 2014.

The Chinese version of this article can be found here.

Recent story: ROBSON LEE: Duty of IFA and Board in Making Recommendation on Takeover or Exit Offer