Excerpts from analysts' reports

UOB Kay Hian unrated report highlights potential of Sinjia Land's new fuel cell business

Analyst: Loke Chunying

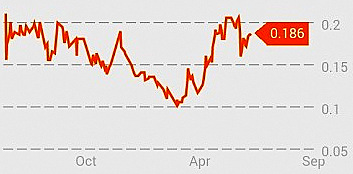

Sinjia Land currently has a market cap of S$27 million. Chart: Bloomberg.Sinjia Land (Sinjia), formerly HLN Technologies, has set up a 50:50 JV with Real Time Engineering Pte Ltd (RTE). The JV will be the exclusive licensee for the manufacturing of a proprietary fuel cell power plant that uses hydrogen to produce clean and green electric power.

Sinjia Land currently has a market cap of S$27 million. Chart: Bloomberg.Sinjia Land (Sinjia), formerly HLN Technologies, has set up a 50:50 JV with Real Time Engineering Pte Ltd (RTE). The JV will be the exclusive licensee for the manufacturing of a proprietary fuel cell power plant that uses hydrogen to produce clean and green electric power. The patent for the fuel power cell is currently held by Mr S Y Wong, the founder of RTE, and will be ultimately transferred to the JV.

The contract will be based on pay per usage, and will be at a 5% discount to the current rates charged by Singapore Power. The plant is expected to start generating electricity from Aug-Sep 14.

While we see great potential in the green fuel cells (eg recurring income from sales of electricity and oil), educating consumers and gaining market acceptance are the key initial risks.

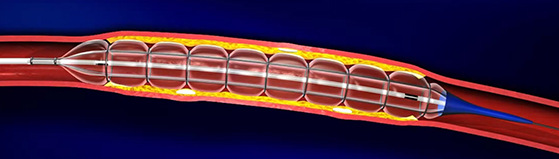

DBS Vickers' unrated report says QT Vascular (53.5 cents) is trading at stretched valuations Develops and markets products for vascular diseases. QT Vascular’s (QTVC) flagship product is the Chocolate PTA, a percutaneous transluminal angioplasty (PTA) Balloon approved for the treatment of Peripheral Artery Diseases (PAD). Stock catalyst in product approvals. QTVC is awaiting approvals for some of its products in Japan and China. If approved for sale, these products could positively impact its future earnings and stock price. Risks. Factors that may cause the company’s earnings to underperform include competition from stents and other balloons, failure to attain product approvals, poor take-up rates from commercialisation of products, adverse clinical trial data on QTVC’s products, and loss of distributorship. Trading at 15x P/S, above peers. It is not meaningful to value QTVC on earnings and EV/EBITDA multiples since the company is loss making. This leaves P/S multiple as the most relevant valuation matrix, albeit its short listing history. |