Excerpts from analysts' reports

OSK-DMG says Lian Beng Group is a high-conviction pick in the construction sector

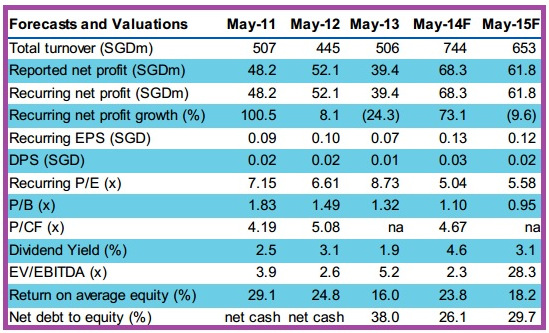

Analysts: Sarah Wong & Terence Wong, CFA Ong Pang Aik, executive chairman of Lian Beng Group. NextInsight file photo Lian Beng reported strong 3QFY14 results, and is well-poised to deliver SGD68.3m PATMI for FY14F (from SGD61.7m). Due to its growing, diversified businesses, we now value Lian Beng at SOTP-derived TP of SGD1.17.

Ong Pang Aik, executive chairman of Lian Beng Group. NextInsight file photo Lian Beng reported strong 3QFY14 results, and is well-poised to deliver SGD68.3m PATMI for FY14F (from SGD61.7m). Due to its growing, diversified businesses, we now value Lian Beng at SOTP-derived TP of SGD1.17.

The existing share price at 5.0x FY14F P/E underestimates its superior construction business that yields >10% net margins, incoming property development profits, its burgeoning dormitory and ready-mixed concrete (RMC) businesses with recurrent earnings.

Strong 3QFY14 results and raised FY14F earnings. PATMI grew 67.0% y-o-y to SGD50.3m in 9MFY14F.

This was driven by a one-off full recognition of profits from its 55%-owned industrial property, M-Space, as well as decent growth in the construction and RMC segment.

We raise earnings in FY14F by 10.7% to SGD68.3m from the previous SGD61.7m.

Growing a strong recurrent stream of earnings; changing earnings profile. Lian Beng has amassed a steady stream of recurrent earnings via its diversification into the dormitory and RMC business, which we estimate to contribute SGD15.1m in FY15F. With its latest venture into asphalt premix, Lian Beng’s recurrent earnings stream could potentially hit SGD20m by FY16F.

|

|

Recent story: LIAN BENG: Stock price up 17% in 4 weeks; 9MFY2014 net profit up 132%