Source: GSH annual report 2013

Source: GSH annual report 2013 Mah Bow Tan.

Mah Bow Tan.

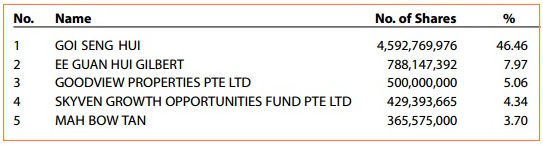

File photoFormer Cabinet minister Mah Bow Tan, 65, has increased his stake in GSH Corporation, becoming its No. 5 biggest shareholder.

The newly-released 2013 annual report shows that Mr Mah owned (as at 18 Mar 2014) 365,575,000 shares with a current market value of about S$28 million (based on stock price of 7.7 cents).

In the 2012 annual report, his shareholding was 165,000,000 shares and he was the No.6 largest shareholder.

The increase can largely be attributed to a 1-for-1 rights issue that took place in May 2013.

It appears that Mr Mah subscribed for his entitlement of 165 million rights shares and successfully applied for 35,575,0000 excess rights shares that were not subscribed by other shareholders.

If the latter did not take place, then it follows that Mr Mah bought the 35,575,000 shares on the open market.

Mr Mah first appeared in the top 20 shareholder list of the 2012 annual report of GSH (previously JEL Corporation).

It was in 2012 that Sam Goi was appointed the new chairman, and GSH set off to develop property as its core IT distribution business was not giving good returns.

Aside from Mr Mah, another notable item in the 2013 shareholder list is the emergence of Far East Organization as a substantial shareholder with a stake of 5.06 per cent.

This is held through investment vehicle Goodview Properties, which bought 500 million shares in August 2013 at 7.25 cents apiece in a married deal.

Currently, GSH is developing three properties in Kuala Lumpur and Kota Kinabalu. |

Previous story: GSH (fka JEL) sale by Koh Boon Hwee; ANWELL buys Thai electricity biz

The increase can largely be attributed to a 1-for-1 rights issue that took place in May 2013.

It appears that Mr Mah subscribed for his entitlement of 165 million rights shares and successfully applied for 35,575,0000 excess rights shares that were not subscribed by other shareholders.

If the latter did not actually take place, then it follows that Mr Mah bought the 35,575,000 shares on the open market.

Unquote.

In 2013, the subscription price for right shares was 5 cents and market trading price was around 8 cents. So he either paid (35,575 excess + 165,000 entitlement) x $50 ==> subscribe to rights)

or (165,000 x $50) rights subscript + (35,575 x $80)open market

Refer to SGX website.

RIGHTS

Ex.Date: 03 May 2013

OFFER OF 1 FOR 1 @ SGD 0.05

Actually, this is the market value of his GSH. His purchase price --anyone can estimate? Could be a fraction.

365575000 shares = 365575 lots = 365575 x $77 = $28 millions and not $2.8 million right?

Am I wrong?