Excerpts from Maybank Kim Eng's 55-page report released yesterday

Ng Wee Siang, CFA, head of researchAnalysts: NG Wee Siang (left) & team

Ng Wee Siang, CFA, head of researchAnalysts: NG Wee Siang (left) & team

Stay selective. At 13.5x forward P/E and 1.4x forward P/BV, the Singapore market valuation looks modest from both the historical and regional perspectives.

An improving macro outlook supports our view that the FSSTI would hit 3,500 by end-2014, based on 15x 2014E EPS or an implied P/BV of 1.6x, providing a 10.5% upside.

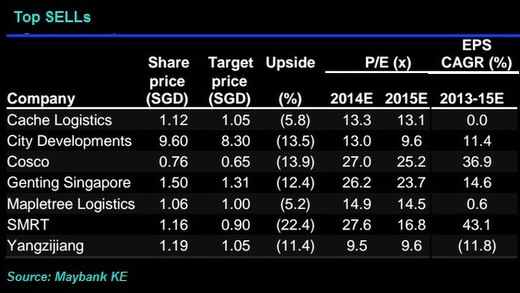

We would recommend that investors stay selective, with aviation services, banks, healthcare and offshore and marine our preferred sectors.

Ng Wee Siang, CFA, head of researchAnalysts: NG Wee Siang (left) & team

Ng Wee Siang, CFA, head of researchAnalysts: NG Wee Siang (left) & teamStay selective. At 13.5x forward P/E and 1.4x forward P/BV, the Singapore market valuation looks modest from both the historical and regional perspectives.

An improving macro outlook supports our view that the FSSTI would hit 3,500 by end-2014, based on 15x 2014E EPS or an implied P/BV of 1.6x, providing a 10.5% upside.

We would recommend that investors stay selective, with aviation services, banks, healthcare and offshore and marine our preferred sectors.

A year of Fed tapering. The US Federal Reserve’s move to taper its quantitative easing programme will be the key feature of the year.

This would eventually lead to higher interest rates, which would be positive for banks, especially DBS, but negative for the property sector as it could trigger a recalibration of overheated prices.

While property cooling measures may be fine-tuned, we expect a soft approach that will hardly change the oversupply situation in 2015-2016.

Office and retail properties in Suntec City (above) are held by Suntec REIT. Photo: InternetFor exposure, we recommend CapitaMalls Asia (market leadership in Singapore’s retail scene and successful inroads into China) and Suntec REIT (strong DPU CAGR of 17.8% over 2013E-2015E).

Office and retail properties in Suntec City (above) are held by Suntec REIT. Photo: InternetFor exposure, we recommend CapitaMalls Asia (market leadership in Singapore’s retail scene and successful inroads into China) and Suntec REIT (strong DPU CAGR of 17.8% over 2013E-2015E). We would shun industrial property REITs such as Cache Logistics and Mapletree Logistics on fears of significant NAV erosion.

Events to watch out for. The upcoming Budget 2014 on 21 February could bring some good news to healthcare names like Raffles Medical Group and IHH Healthcare, as private medical services are made more accessible.

The conclusion of the acquisition of Singapore Cruise Centre and the opening of the Singapore Sports Hub in April could renew interest in SATS.

The opening of the ninth aircraft hangar and Trent XWB launch will be key milestones for SIA Engineering.

The first parliamentary debate on a casino bill in Japan may rekindle interest in Genting Singapore, even if short-lived. We would advise investors to sell into strength.

On the transportation front, there should be better clarity on fare adjustment and changes to the business models of bus and rail operations.

The conclusion of the acquisition of Singapore Cruise Centre and the opening of the Singapore Sports Hub in April could renew interest in SATS.

The opening of the ninth aircraft hangar and Trent XWB launch will be key milestones for SIA Engineering.

The first parliamentary debate on a casino bill in Japan may rekindle interest in Genting Singapore, even if short-lived. We would advise investors to sell into strength.

On the transportation front, there should be better clarity on fare adjustment and changes to the business models of bus and rail operations.

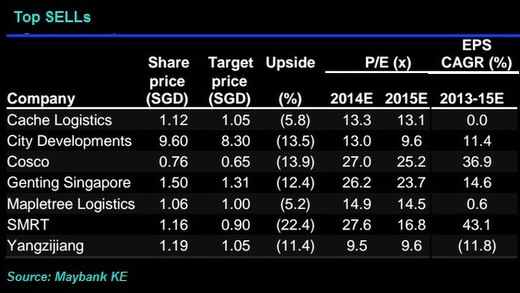

Offshore and marine likely to shine. The offshore and marine stocks should continue to bask in more order wins with our preferred picks being SembCorp Marine, Ezion, Mermaid Maritime and Nam Cheong. We are sceptical of a recovery in China’s shipbuilding sector and would recommend SELLs on Cosco and Yangzijiang.

Curbs on foreign labour inflow. Immigration policies are expected to remain tight in 2014. This will continue to push up labour costs amid a very tight employment market, boding ill for Sheng Siong and SMRT (we have a SELL on both counters). The SME sector, too, could suffer but a stronger economy may ease the pain, reducing risks to the banking sector.

Recent story: My Stock Picks: DBS Group, Raffles Medical, REX Int’l

Recent story: My Stock Picks: DBS Group, Raffles Medical, REX Int’l