DrizztBy day, Drizzt is a software and system support specialist. By night, he shares on his blog (http://www.investmentmoats.com/) his escapades in money management, investing and his love for all things technology. Drizzt holds a degree in Computer Science from the National University of Singapore and is certified at many levels in systems and software competency.

DrizztBy day, Drizzt is a software and system support specialist. By night, he shares on his blog (http://www.investmentmoats.com/) his escapades in money management, investing and his love for all things technology. Drizzt holds a degree in Computer Science from the National University of Singapore and is certified at many levels in systems and software competency.WHEN A LOT OF us look at a company's large cash holding, we think that we have a value proposition there.

We figure that the cash holding can pay for many years of dividends.

Often we realize too late that the cash holding actually serves as working capital.

It looks really good during good times but in the face of lukewarm long-term or short-term operational issues, or cyclical downtimes, the cash can turn rather fast.

Often we realize too late that the cash holding actually serves as working capital.

It looks really good during good times but in the face of lukewarm long-term or short-term operational issues, or cyclical downtimes, the cash can turn rather fast.

Nam Lee Pressed Metals Industries, which designs, manufactures, supplies, and installs steel and aluminum products,was trading at a rather good valuation not too long ago.

It has a current market cap of SGD 77 million but it traded as high as SGD 89 million.

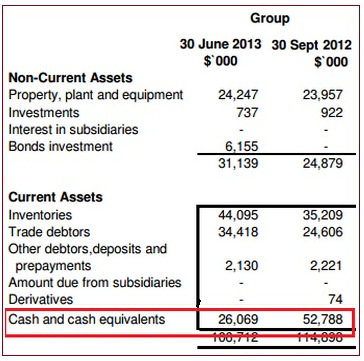

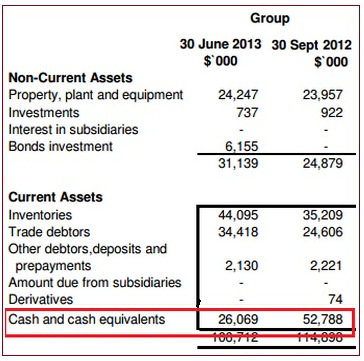

Its cash holding 1 year ago was SGD52 million with no debt. The enterprise value works out to be SGD$37 million.

The stock had appeal as it had a low PE or EV/EBITDA.

It would seem that at 2012 EBITDA of SGD19 million, the EV/EBITDA could possiblly be 1.94 times.

This means that you can buy Nam Lee and recover your investment in 2 years if it earns the same EBITDA.

And surely it can operate for more than 2 years, so that is where the value is.

Investors have to assess whether that EBITDA is due to an extra special good order book period, which is unlikely to be repeated for some time.

If so, you are actually valuing it on an exceptional cash flow and not a conservative cash flow.

If so, you are actually valuing it on an exceptional cash flow and not a conservative cash flow.

Investors also have to assess debt financing and reduction in cash holdings.

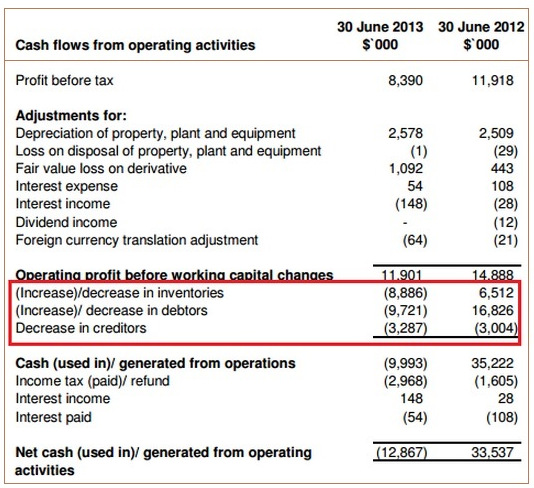

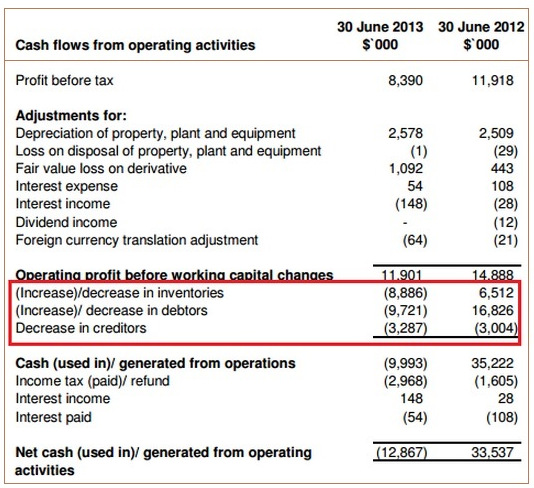

Nam Lee said cash of S$52.8 million as at 30 September 2012 fell to S$26.1 million as at 30 June 2013 mainly due to payment of S$4.8 million dividend, investment of S$6.2 million in quoted bonds and increase in working capital of $15.1 million.In three quarters (Oct 2012-June 2013), the company's very nice cash holding, which was 67% of market cap, was halved.

Nam Lee said cash of S$52.8 million as at 30 September 2012 fell to S$26.1 million as at 30 June 2013 mainly due to payment of S$4.8 million dividend, investment of S$6.2 million in quoted bonds and increase in working capital of $15.1 million.In three quarters (Oct 2012-June 2013), the company's very nice cash holding, which was 67% of market cap, was halved.

Nam Lee said cash of S$52.8 million as at 30 September 2012 fell to S$26.1 million as at 30 June 2013 mainly due to payment of S$4.8 million dividend, investment of S$6.2 million in quoted bonds and increase in working capital of $15.1 million.In three quarters (Oct 2012-June 2013), the company's very nice cash holding, which was 67% of market cap, was halved.

Nam Lee said cash of S$52.8 million as at 30 September 2012 fell to S$26.1 million as at 30 June 2013 mainly due to payment of S$4.8 million dividend, investment of S$6.2 million in quoted bonds and increase in working capital of $15.1 million.In three quarters (Oct 2012-June 2013), the company's very nice cash holding, which was 67% of market cap, was halved.What if the same operating conditions prevail for the next 1-3 years? Then, you can really see the cash holding dwindle.

Of course, this is a quarterly statement, and inventory, receivables and payables in future quarters may improve the cash level.

What investors can learn from this

> Ultimately, the sustainability of operations creates consistent free cash flow, which pays for dividends, pays off debts and adds to cash holdings. Cash flow is different from cash holdings.

> Always evaluate the earnings, and free cash flow profile of a business across a long time frame. Evaluate 5-10 years of annual reports to assess whether you are using a conservative, baseline or exceptional earnings and cash flow.

> Evaluate the working capital usage pattern.

> While some forecasts can be wildly optimistic, some balance sheets on a historical basis may look wildly pessimistic. As in the case of Valuetronics, a business profile may improve and the historical balance sheet is a pale indication of future improvement, and so there may be value there.

For NextInsight forum's thread on Nam Lee Pressed Metals, click here.

For NextInsight forum's thread on Nam Lee Pressed Metals, click here.