Excerpts from OSK-DMG report

OSK-DMG says MTQ is one of 4 top picks in oil & gas sector

Analyst: Lee Yue Jer

Kuah Boon Wee, CEO of MTQ.

Kuah Boon Wee, CEO of MTQ.

NextInsight file photoAs MTQ shares went ex-bonus 1-for-4 today, we recalibrate our TP based on the number of new shares outstanding. All other estimates remain unchanged. We see this bonus issue as an initial step towards improving liquidity in the stock, which is one of our top picks in the oil & gas sector. We reiterate our BUY recommendation on MTQ for its strong growth profile at value multiples, with a revised SGD1.76 TP.

Bonus shares to help compress liquidity premium. MTQ shares are trading at a low multiple, in part due to its low liquidity, for which we believe a premium has been priced in. Management has been working towards improving liquidity in the stock and we see the bonus issue as a first step in this direction. We expect the compression of the stock’s liquidity premium to result in better valuations over the medium term.

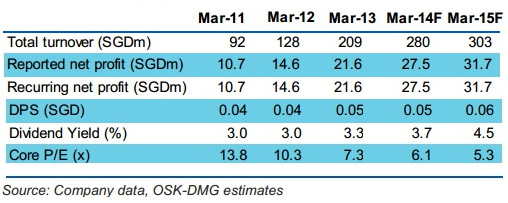

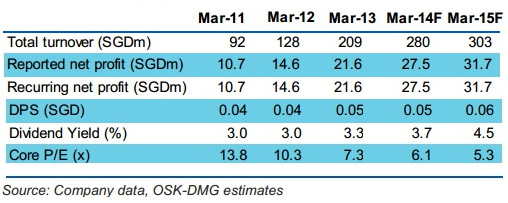

Bonus shares eligible for final dividend. Recommend taking scrip! The bonus shares are eligible for the final 2-cent dividend, taking the full-year equivalent to 4.5 cents. We expect the dividend to go up over the next two years as the company’s bottomline expands, but peg our forecasts at a conservative 5 cents and 6 cents for FY14F/15F respectively, which translates into still-healthy forward yields of 3.7% and 4.5%. That said, since we also expect the scrip dividend to be declared at a 10% discount to the market price, and the fact that we still view MTQ as a deeply-undervalued stock, we strongly recommend that investors take up the company’s scrip dividend instead of cash.

Strong growth at value multiples. MTQ has been delivering 36% and 48% net profit growth in the last two years. With its recent acquisition of Neptune Marine Services on top of its growing core operations, we are forecasting for 28% growth this year, but there is some upside potential since our assumptions for Neptune are somewhat conservative. Investors can buy into this growth for a mere 6.1x forward P/E.

Maintain BUY, adjusting TP to SGD1.76. We continue to value MTQ at 8x FY14F EPS, while our TP is adjusted down simply by the factor of the increase in the number of shares (1.25x to be precise). MTQ remains one of our top picks in the oil & gas sector.

Recent story: MTQ CORPORATION: FY2013 net profit doubles, stock price surges 11%

Kuah Boon Wee, CEO of MTQ.

Kuah Boon Wee, CEO of MTQ.

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors