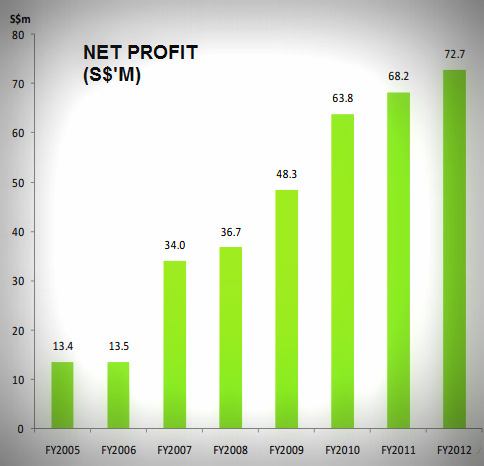

ARA's net profit just keeps on climbing, and elevating the ARA stock price along with it.

ARA's net profit just keeps on climbing, and elevating the ARA stock price along with it. THE SHARE price of ARA Asset Management has recently hit an all-time high of $1.975, lifted by its latest financial results and supported by its track record of high earnings quality. And global fund manager Franklin Resources has just become a substantial shareholder.

Net profit for FY12 weighed in at S$72 million, a record in the history of the company which is just 10 years old.

Its recently-released 1QFY13 results continued on a positive tone:

ARA stock gained 39% in 2012 and has since continued to top the chart, touching $1.975 recently. Bloomberg chart> Recurrent management fees from private funds and its REITs increased 15% year-on-year to S$26.7 million

ARA stock gained 39% in 2012 and has since continued to top the chart, touching $1.975 recently. Bloomberg chart> Recurrent management fees from private funds and its REITs increased 15% year-on-year to S$26.7 million> Recurrent net profit increased 14% to $12.2 million.

> Total assets under management jumped 9% to S$22.7 billion

The earnings quality could not have been better, considering that its net profit margin of 52% is a level regularly attained by very few, if any, SGX-listed companies. (Many manufacturing businesses, for example, typically achieve single-digit net margins).

Adding to that, ARA has kept up its return to shareholders. It has just executed a 1-for-10 bonus issue and paid out a final cash dividend for FY2012 of 2.7 cents per share. The bonus shares were also entitled to the 2.7-cent dividend.

Adding to that, ARA has kept up its return to shareholders. It has just executed a 1-for-10 bonus issue and paid out a final cash dividend for FY2012 of 2.7 cents per share. The bonus shares were also entitled to the 2.7-cent dividend.

ARA shareholders can look forward to the 2.7-cent final dividend and 2.3-cent interim dividend being maintained going forward.

"We believe that the continued expansion of the Group will allow us to maintain the current cash dividend per share, notwithstanding the increased number of shares post the bonus share issue,” it said recently.

It didn't say anything about future bonus share issues -- but ARA has the pleasant habit of issuing bonus shares. The recent one was its third in three years.

Listed in 2007, ARA has touched a record S$1.7 billion in market value recently with a historical PE of 23X that rightly reflects its blue-chip status and excellent economics.

The stock has recently attracted Franklin Resources' funds and managed accounts that are managed by investment advisers directly or indirectly owned by Franklin Resources.

With a purchase of 428,000 shares at an average price of $1.9155 on April 16, Franklin Resources' deemed interest rose above the 5% level, and it become a substantial shareholder. It holds a deemed interest in 42.3 million shares of ARA.

The stock price closed at $1.96 last Friday, exceeding the target prices set less than a fortnight ago by analysts from UOB Kay Hian ($1.91) and DBS Vickers ($1.95). However, it is still below Macquarie Equity Research's $2.12.

Recent accolades

It was awarded first place as the “Asia Firm of the Year” at the 2012 Private Equity Real Estate Global Awards.

ARA was recognized for its success in raising close to US$1 billion for two new funds (ARA Asia Dragon Fund II and ARA China Investment Partners, LLC) despite the challenging fund raising environment in 2012.

The stock has recently attracted Franklin Resources' funds and managed accounts that are managed by investment advisers directly or indirectly owned by Franklin Resources.

With a purchase of 428,000 shares at an average price of $1.9155 on April 16, Franklin Resources' deemed interest rose above the 5% level, and it become a substantial shareholder. It holds a deemed interest in 42.3 million shares of ARA.

The stock price closed at $1.96 last Friday, exceeding the target prices set less than a fortnight ago by analysts from UOB Kay Hian ($1.91) and DBS Vickers ($1.95). However, it is still below Macquarie Equity Research's $2.12.

Recent accolades

It was awarded first place as the “Asia Firm of the Year” at the 2012 Private Equity Real Estate Global Awards.

ARA was recognized for its success in raising close to US$1 billion for two new funds (ARA Asia Dragon Fund II and ARA China Investment Partners, LLC) despite the challenging fund raising environment in 2012.

The quality of its business is complemented by a board of directors that won the "Best Managed Board Award – Gold Award" at the Singapore Corporate Awards 2012.

At the individual level, its Group CEO and co-founder, John Lim, has garnered a number of accolades, the most recent being Overall Ernst &Young Entrepreneur of the Year 2012 Singapore award (click for slideshow below).

He is gunning for more for ARA, saying at the 10th anniversary dinner last year: "I have challenged the ARA team to a new 5-year vision for 2016: achieving $40 billion in assets under management."

Mr Lim owns about 33% of ARA, which means his stake is worth about S$560 million currently, and he is the largest single shareholder.

Click for slideshow above.

More growth lies ahead

ARA is going to have a busy and productive time ahead.

Among ARA's stable of six REITs, the mangement sees Fortune REIT, Suntec REIT and Cache Logistics Trust acquiring assets in the coming quarters.

If and when the acquisitions materialise, these REITs will lift earnings (through acquisition fees) and higher recurring income subsequently through an enlarged AUM (assets under management).

Among ARA's stable of six REITs, the mangement sees Fortune REIT, Suntec REIT and Cache Logistics Trust acquiring assets in the coming quarters.

If and when the acquisitions materialise, these REITs will lift earnings (through acquisition fees) and higher recurring income subsequently through an enlarged AUM (assets under management).

And the management is confident of hitting its target of growing its AUM by S$2 billion this year through initiatives such as the launch of a new REIT and a new private equity fund.

It could re-launch its plans to list Dynasty REIT, with an initial portfolio consisting of assets from its managed Asia Dragon Fund 1.

(In October 2012, ARA suspended the IPO of Dynasty REIT, saying that since the registration of the REIT's prospectus with the Monetary Authority of Singapore, there had been a marked change in overall investor sentiment as reflected by the performance of several IPOs and a gradual worsening of the overall market conditions. "In general, this weakness has been driven by lacklustre earnings results by large global corporations in the US and Europe.")

As part of its longer-term strategy, ARA is looking to develop and list new REITs focused on new market sectors and/or geographies.

Previous stories:

It could re-launch its plans to list Dynasty REIT, with an initial portfolio consisting of assets from its managed Asia Dragon Fund 1.

(In October 2012, ARA suspended the IPO of Dynasty REIT, saying that since the registration of the REIT's prospectus with the Monetary Authority of Singapore, there had been a marked change in overall investor sentiment as reflected by the performance of several IPOs and a gradual worsening of the overall market conditions. "In general, this weakness has been driven by lacklustre earnings results by large global corporations in the US and Europe.")

As part of its longer-term strategy, ARA is looking to develop and list new REITs focused on new market sectors and/or geographies.

Previous stories:

ARA ASSET, KING WAN CORP: What analysts now say

JOHN LIM is Ernst & Young Entrepreneur of the Year 2012