Click on the above short video for glimpses of the people and activities at the AGM.

Venue: Grand Mercure Roxy Hotel

Venue: Grand Mercure Roxy HotelTime & Date: 10 am, Thursday, 28 March 2013.

THE STOCK PRICE of Roxy-Pacific Holdings has gained 139% from the start of 2012 through to last week, reflecting its strong underlying business performance. It drew shareholder praise at the AGM.

A shareholder stood up and told the board of directors: "I bought Roxy shares 5 years ago and you have made them worth 3X more than what I paid. I thank you very much -- and please continue to work hard."

Roxy-Pacific achieved a 13% rise in net profit to $58.3 million last year, its 8th consecutive year of record earnings. More importantly, it has about $860 million in revenue from pre-sold projects which it will recognise over the next four years. (see below for more information)

At the AGM, there were a couple of questions from shareholders, two of which are as follows:

Q: Please explain the company's long-term liabilities of S$91 million and the interest on it.

CFO Koh Seng Geok: This is mainly relating to term loans for our hotel. Considering that the hotel's valuation is more than S$400 million, in terms of gearing, the loan is not unreasonable. As for interest, we are in a favourable interest environment: the interest rate is less than 2% per annum on average.

Q: In the last year, the management has done very well and most us here are very happy. But we are concerned that the government's cooling measures mean that the residential market is going to be very tough. What is the management's plan going forward? Do you intend to go more into commercial and industrial properties, and even venture overseas?

Chairman/CEO Teo Hong Lim: The residential market is the main target of the government. We believe there is a reasonable stability and as you can see the buying demand is quite strong. We continue on a very regular basis to look for opportunities.

We don't want to be very specific in terms of what areas we go into. We have a broad skills set: We have done retail shops, we have done offices, we have done residential but not industrial. On a regular basis, we cast our net very wide as we talk to agents and consultants.

Artist's impression of Jade Residences which will be launched soon, in April 2013, by Roxy-Pacific. The project near the Serangoon MRT station will have 171 residential units in four 5-storey blocks. For overseas projects, we evaluate regularly but our main focus will still be Singapore. We have built up our team and knowledge of sites here over many years.

Artist's impression of Jade Residences which will be launched soon, in April 2013, by Roxy-Pacific. The project near the Serangoon MRT station will have 171 residential units in four 5-storey blocks. For overseas projects, we evaluate regularly but our main focus will still be Singapore. We have built up our team and knowledge of sites here over many years. If someone tells us that a particular plot of land is good overseas, we won't know head or tail -- we have to fly there first.

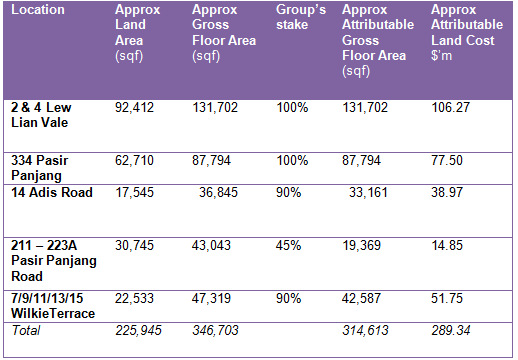

We secured 5 freehold sites in Singapore last year and are targeting to launch the projects in the next 3-4 months.

We have just completed the showflat for Jade Residences in Lorong Lew Lian. It was the second largest en-bloc transaction last year with land size of over 90,000 sq ft.

Final dividend of 0.924-cent; 5 projects to be launched soon

At the AGM, shareholders approved the payment of a 0.924-cent final dividend. An interim dividend of 0.67 cent was paid in August 2012 which, it should be noted, came after a bonus share issue in April whereby 1 bonus share was given for every 2 shares held.

Going forward, Roxy-Pacific has an assured and strong base of revenue to book because as at end-Dec 2012, it had S$861.7 million of properties already pre-sold but not recognised yet in its books.

These properties are being built and the sales revenue will be reported in Roxy's financial statements from this year till 2016 according to the percentage of completion (for residential projects) and upon TOP (for commercial projects).

To put the S$861.7 million in perspective, it is equivalent to more than 6X the $138.7 million revenue achieved by Roxy's property development business in FY2012.

High as it already is, the order book will be boosted, barring an unexpected plunge in buyer sentiment, in the next few months when Roxy-Pacific launches 5 new projects. The details of the projects are given below.

The biggest is Jade Residences whose indicative pricing can already be found on various property websites. Using that information, our back-of-the-envelope calculation suggests that the project could garner around S$200 million in sales, if 100% sold.

Recent stories:

ROXY-PACIFIC, CAPITALAND: What analysts now say

ROXY-PACIFIC: $862 million in property revenue to be recognised over 4 years

Some comments.

1. Disappointed that company didnt do a presentation before the AGM proper. They could ideally present a simple slideshow on where the company has been in the past 12 months.... and what shlders can expect in the years ahead, especially the details with regards to the existing landbank. Instead they went straight into the Resolutions. During the Q&A, CEO Teo Hong Lim answered elaborately all questions raised. The other plus point abt Mr Teo is his friendliness which was evident during the mingling session after the AGM ended. He comes across as someone unassuming, dependable and sincere. He waited patiently before we each finished talking before he speak.... never once did he try to interrupt any long winded comments. I am sure we can all call him Hong Lim when we see him again.

2. Questions were frequently asked on venturing outside SGP. To add on to the article written above, Mr Teo explained to us that he did look closely at Iskandar but reading between the line, his team ain't too comfortable with it yet, citing the instability of the home prices there and secondly, the rising cost of construction in JB (shortage of labour is one contributing factor).

If the mgt ain't comfortable or confident with venturing abroad, then its best not to proceed. While some players like Chip Eng Seng has ventured abroad in Australia, leaders like Fragrance has grown swiftly to a mkt cap of $1.7billion (ie 3x of Roxy) by operating largely within SGP.

3. I came back from the AGM feeling satisfied that the mgt under Hong Lim is honest and competent. Though the salary the Teo brothers paid themselves seems lavish, as long as they continue the good work that they have been doing , I am sure nobody is bothered. The CFO & ED Koh Seng Geok (not within the immediate family) was paid $1.5m - $1.75m range last year. He looks competent and quick-witted.