Excerpts from analysts' reports

Maybank KE finds Dukang Distillers' 4.4X PE 'attractive'

Analyst: We Bin Dukang CEO Zhou Tao speaking at the FY2011 AGM at Marina Mandarin. NextInsight file photoØ We visited Dukang’s production plant in Luoyang where we were introduced the production process of baijiu, the Chinese national liquor.

Dukang CEO Zhou Tao speaking at the FY2011 AGM at Marina Mandarin. NextInsight file photoØ We visited Dukang’s production plant in Luoyang where we were introduced the production process of baijiu, the Chinese national liquor.

Dukang has a strong market presence in the key cities of Henan and enjoys strong support from local government. They are targeting 10% market share in Henan province.

Ø We think the biggest risk for Dukang is that downward pressure on price and consumption of premium baijiu brands, such as Moutai and Wuliangye, might pass down to mid-end brands in the future.

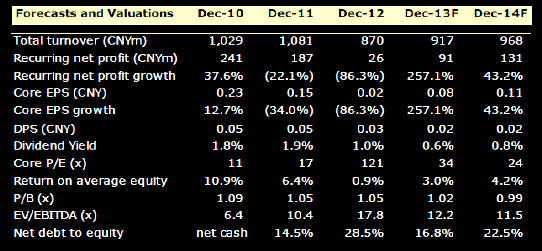

Ø Dukang’s current valuation of 4.4x 12m trailing PER and 0.6x PB is quite attractive when compared with its A-share listed peers. We think further enhancement in the brand value would probably narrow the valuation gap between Dukang and other top brands. Dukang's A-share peers trade at higher PE ratios although their sales growth rates are similar to, or lower than, Dukang's.

Dukang's A-share peers trade at higher PE ratios although their sales growth rates are similar to, or lower than, Dukang's.

Recent story: DUKANG DISTILLERS: 2Q2013 net profit jumps 52.5% to Rmb 144m

RHB Research maintains target of 75 cents for Midas

Analysts: Lynette Tan & Terence Wong, CFA

We recently hosted Midas on a roadshow in Singapore. Highlights are:

Management indicated that 1H13 will be challenging, but 2H could be stronger if things pick up.

Visibility on how soon the Chinese government will award high-speed rail contracts remains low, but management is optimistic of the government’s commitment.

Asian countries are planning to improve their connectivity by building highspeed railways to neighbouring countries and Midas is in a good position to ride on this trend.

Maintain BUY with a TP of SGD0.75, based on 1.5x FY13 P/B.

Recent story: KEVIN SCULLY: Stock Weakness provides good buying opportunity