The following was recently published on www.nracapital.com and is reproduced with permission. Kevin Scully, executive chairman of NRA Capital. NextInsight file photo

Kevin Scully, executive chairman of NRA Capital. NextInsight file photo

AEM's results had no major surprises. The company reported a small net loss of S$1.4mn following a provision of $2.6mn for a sales rebate.

Key highlights of the results:

a) revenue fell 24.9% to $74.9mn

b) pretax loss of $2.2mn compared to a profit of $8.8mn in 2011

c) net attributable loss for 2012 was S$1.4mn compared to a profit of $6.8mn in 2011

d) net cash was about $39.4mn up from the $24.1mn in 2011 mainly from the proceeds of the sale of a minority stake in MCT to SPIL in 2012

e) EPS for 2012 was -0.31 cents compared to 1.53 cents in 2011

f) NAV as at 31 Dec 2012 was 16.4 cents compared to 11.9 cents in 2011

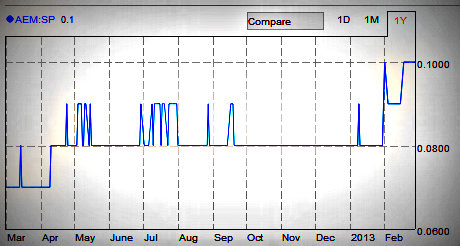

g) company has declared a final dividend of 0.35 cents in 2012, there was no dividend in 2011. AEM paid an interim dividend of 0.35 cents in 2012 payable in August 2012. AEM (stock price 9.9 cents) has a market cap of S$44 m, and a FY12 dividend yield of 7.1%.

AEM (stock price 9.9 cents) has a market cap of S$44 m, and a FY12 dividend yield of 7.1%.

AEM's management commentary is as follows: "In July 2012, Siliconware Precision Industries Co., Ltd invested US$20.5MM in the Group's subsidiary to upgrade our capabilities to better serve customers in the mobility space. The Group is in the process of qualifying these next generation substrates and performing trial production runs with several customers.

"Resulting from the launch of these new substrates programmes the Group expects to see higher revenues in 2H2013 compared to 1H2013.

"For the Group’s equipment business, the next generation programmes that are being developed with a major customer will still take a few more quarters to reach the mass production stage.

"Current low volume units are being field tested at the customer’s production sites. As a result, the Group expects to see a gradual recovery in FY2013."

This is consistent with my expectation that second half will be better - it remains an undervalued stock in My Stock Picks - which is supported by its cash and NAV.

Management is paying a final dividend of 0.35 cents which should keep shareholders happy as they wait for its new equipment and businesses to boost profits.

Previous stories:

KEVIN SCULLY: Three Value Stocks which I recommend now

KEVIN SCULLY: Takeaways from meeting with CEO of AEM