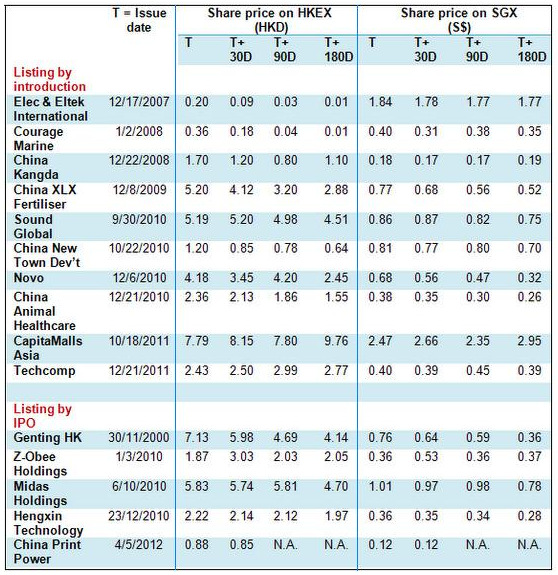

Share price for T+30D = share price 30 days after dual listing in HK. Source: Bloomberg

TECHCOMP HOLDINGS, which is Singapore-listed, is among a few stocks that have performed well after a dual listing in Hong Kong.

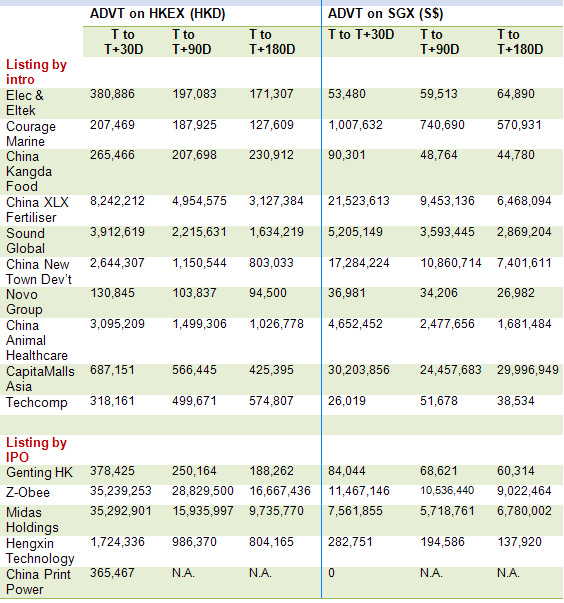

Its stock price has firmed up, as has the average daily value of its trading volume on the HK bourse, suggesting a rising interest in the stock in Hong Kong.

Headquartered in Hong Kong, Techcomp is a manufacturer of highly advanced scientific instruments, analytical instruments, life science equipment and laboratory instruments.

It is also a distributor for Hitachi of Japan.

Finanial PR (HK) has helped Techcomp in roadshows, media coverage and analysts reports to increase the liquidity of the stock and capture market attention.

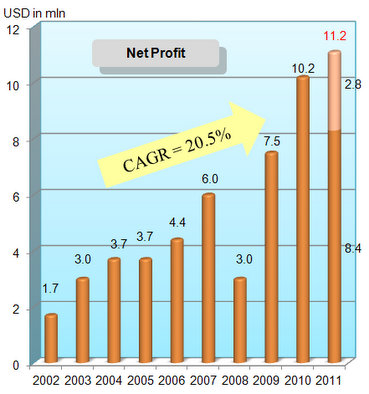

Techcomp had a commendable FY2011 financial result released in February.

Excluding non-recurring items (especially US$2.8 million in expenses for the dual-listing exercise), the adjusted net profit increased by 13.8% to US$11.2 million.

Another stock that has done well post-dual listing is CapitaMalls Asia.

Other points to highlight from the tables:

> Except for Techcomp, the dual listed stocks had a decline in daily trading value (in the periods subsequent to 'T-T+30D) on both HK & SGX.

> The dual listings happened at different times with some going back to 2007. The price and volume performance of a stock post dual-listing could be affected by several factors such as its earnings result and the prevailing market sentiment.

ADVT from T to T+30D = average daily value traded in the 30 days since dual listing. Source : Bloomberg

Recent stories:

TECHCOMP is 'attractive', ADAMPAK target 36 cents

TECHCOMP: Record US$11.2 m profit in 2011 after adjusting for one-offs

what the hell is going on??

Techcomp has a trading of almost 2 million shares in Hong Kong. The share price is HKD 3.04 (about SGD 50 cents)