THIS WEEK'S edition of The Edge Singapore offers some investing ideas for stocks that are “laggards, undervalued, overlooked and could play catch-up.”

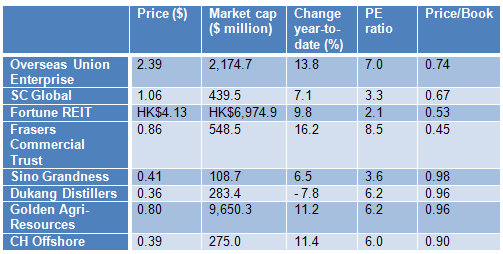

The stocks trade below book value, and at less than 10X historical earnings.

And they have some kind of hard assets on their books – plus positive analyst coverage.

“Further judicious selection” led to eight stocks (see table above).

The Edge article authored by Joan Ng then goes into the fundamentals of the eight stocks, which you can read by buying a copy from the newsstands at $3.80.

And you should also do your own research on any of these that capture your attention.

Two of these are S-chips and have lagged the most in year-to-date performance – Sino Grandness and Dukang Distillers.

Sino Grandness is described as a “possible gem in the rough” in the article.

The company’s beverage division is the star, contributing revenue and gross profit that exceeded that from canned asparagus (the erstwhile best performer) for the first time in FY2011.

Then there is Dukang Distillers which makes baijiu (or white wine).

Despite a 22% increase in revenue for the quarter ended December 2011, and a 55.2% increase in earnings, the shares of Dukang are down 7.8% this year.

Recent stories:

LIAN BENG target 71-c, SINO GRANDNESS 70-c, SG property stocks bearish

DUKANG DISTILLERS: Rated 4 chillies out of 5 by Maybank Kim Eng