Excerpts from AmFaser Research's report dated 31 January 2012.

Analysts: Lau Wei Chong, Lee Yue Jer, Sarah Wong

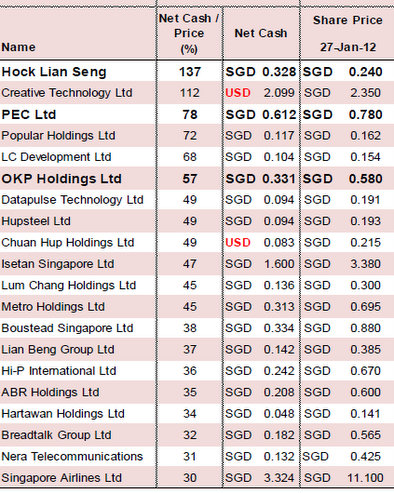

WE CONDUCTED this research to identify high net cash companies listed on the SGX.

Net cash companies have cash holdings in excess of their bank borrowings.

As the global economy spirals into a downturn, cash-rich companies stand in a better position than debt-laden ones in making strategic acquisitions and/or in turn becoming potentially attractive acquisition targets.

A 30% net cash to share price was used as a cutoff point for this theme paper.

Coincidentally, SMB United had also traded at this level prior to the takeover offer by Tokyo-listed Osaki Electric Co.

In terms of net cash per share, two companies which stand out are Hock Lian Seng Holdings and Creative Technology. They both have net cash per share in excess of their share prices.

However, investors should be cautioned that technology firms (like Creative Technology) are likely to have a higher cash burn-rate for research & development, which may lead to fluctuating cash positions.

On top of net cash to price, we have also analyzed growth in DPS (dividend per share) and dividend yield for our shortlisted picks.

We highlight stocks such as Boustead Singapore, OKP Holdings, Metro Holdings and Hi-P International for having both strong DPS growth in past 3 FYs and high current dividend yield.

Hock Lian Seng Holdings, PEC, OKP Holdings and Lian Beng have the strongest combination of high net-cash/price and stable or growing earnings.

The first three have high net cash to price above 50% and are supported by stable earnings.

While Lian Beng has relatively lower net cash, it makes up for it by being the only company with strongly growing profits.

Based on this theme, our top picks are Hock Lian Seng Holdings ($0.240, UNRATED), PEC ($0.780, BUY), and OKP Holdings ($0.580, UNRATED).

All three stocks are highly cash-rich, resulting in balance sheets so strong that Current Assets are 187% of Total Liabilities on average (HLSH: 149%; PEC: 234%, OKP: 177%).

Hock Lian Seng and OKP have increasing / strongly increasing DPS, and all three exhibit earnings stability in the last three years.

Even though it is net cash, the management had not been "shareholder" friendly.

lOOK AT Page 36 of its latest financial report.

Just looked at the number of warrants outstanding, the number of private placements to individuals (for funding group exspansion or related projects). However, the fund raised of $10mil is well within what the company has in Cash of $97mil.

So the question is why isit not using the cash in its book to fund the project but instead increase the number of shares thru private placement.

Do note that even though the ROA,ROE,ROIC is high, it is not reflected in it's bookvalue which has been growing at a dismal 6% compounded rate of $0.213 in 2007 to $0.283 in 2011.

So you have to ask yourself, how come?? Is it director fees is too high? Is the private share placement and warrants conversion too dilutive ?

2. Jameskuwe: Fujian and Fibretech are S-chips. The study specifically excluded S chips -- for obvious reasons.

Ok lah, no one can be certain the cash in S-chips really exist. LOL. Those asses in China have destroyed their own reputation till hardly anyone is 100% confident of their accounts.

money receive for projects will be offset with liability elsewhere.

a. Of the $167m cash, $112m is money received for contract work not done yet. There are expenses yet to incur for the work.

b. Order book has been going down ever since IPO two years ago.

c. Recently clinched tender for industrial land for $78 m. Will build industrial assets. This project will draw down big part of the cash now in the HLS bank account.