Excerpts from latest analyst reports.....

OCBC initiates coverage of ROXY-PACIFIC with 55-c fair value

Analyst: Eli Lee

Roxy-Pacific Holdings (ROX) is a specialty property and hospitality group in Singapore. ROX primarily develops domestic residential projects, and also owns two investment properties and a hotel, Grand Mercure Roxy Hotel (GMRH).

We believe ROX's four landbank projects (expected to launch in FY11-12) will add at least $20m to RNAV. In our opinion, results at these launches will cause the market to recalibrate its share price upward.

Also, given the recent share price performance, we think the market is overly pessimistic on ROX's prospects for accretive acquisitions. Thoughtful risk-weighted acquisitions in FY11 will likely be catalysts for price upside.

Finally, taking into account the fundamental value held in GMRH and already sold-out projects, we think the downside is capped for patient investors who take on prudent exposure. Initiate on a BUY with a fair value of $0.55 (at a 25% discount to RNAV of $0.73.)

Recent story: ROXY-PACIFIC: Why the stock price is resilient

Nomura raises target price of YANGZIJIANG to $2.30

Analysts: Yuan Yiu Tsai & Lisa Lee

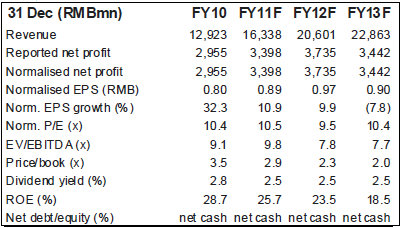

Addressing investor concerns at our recent ASEAN Corporate Day, YZJ management said its diversification (ie, plans to invest in property development) and growing cash management activities are intended to mitigate the imminent earnings decline in 2013F after its high-margin orders are delivered over 2011-12.

Management reiterated its focus on growing the firm’s core business, as exemplified by the recent consolidation of the Xinfu Shipyard, which will significantly boost YZJ’s shipbuilding capacity by as much as 100% in 2013, on our estimates.

Although the market does not appear to favour management’s diversification strategy, we believe the current share price (down 12% from its recent peak vs STI’s -9.5%) presents an attractive entry level, with 27% potential upside as implied by our PT. We highlight our Street-differentiating SOTP methodology which values the company’s core shipbuilding franchise at 2.5x FY13F P/B (reflecting normalized ROE post-crisis) and its excess net cash/investments at book value.

Catalysts: containership new orders, offshore M&A

We think the market has under-appreciated the potential of the ten 10,000 TEU containerships (~US$1bn) that YZJ is discussing with a European ship-owner as we believe a recovery in the container shipping market will accelerate the deal closure. While margins will be low, it will be a significant technological breakthrough for YZJ.

With a net-cash balance sheet and strong government support, YZJ is also well-positioned to acquire, we believe. If Cosco’s premium valuation (FY11F: 17.5x P/E, 3.3x P/B) is any guide, we believe acquisition of a meaningful offshore exposure at a reasonable valuation would be a key re-rating factor for YZJ. Another key event to watch out for in 2Q11: potential HK listing of New Century.

Recent story: YANGZIJIANG: FY2010 revenues up 22% at Rmb 12.9bn, unveils more diversification plans