Photos by Leong Chan Teik

HIGH GROWTH – that’s the course that Mencast Holdings is charting, as its chairman & CEO Glenndle Sim told 22 NextInsight readers who visited the company yesterday (Saturday,Oct 30).

That should not come as any surprise since even the global financial crisis of 2008 and 2009 did not interrupt the strong uptrend in Mencast’s business performance.

Its revenue grew at a compounded annual growth rate (CAGR) of 23% between 2005 and 2009.

Net profit rose an even faster 78% CAGR during that period.

Certainly such a track record would have caught the attention of value investors.

One of them, the well-known Gay Chee Cheong is the biggest buyer among 9 investors who are taking up a proposed placement of 15.5 million new shares of Mencast.

He is buying $2.8 million worth of shares at 35 cents apiece.

For the uninitiated, Mencast is a unique business listed on the Singapore Exchange: it manufactures sterngear for vessels, and repairs worn out or damaged stearngear.

Its stock price has gained 32% since the start of the year, rising from 31 cents to 41 cents recently.

Yesterday, NextInsight organized a visit for its readers to Mencast’s manufacturing facility in Tuas.

Mr Sim and his group financial controller, Benjamin Chan, later walked the visitors through a presentation on the business fundamentals of Mencast – and its high growth potential.

The latter will be underpinned by, among other things, a 19,266 sq m manufacturing plant that Mencast is building in Tanjong Penjuru Road and which will be fully operational next year.

Its key feature is 150 metres of waterfront land.

Mencast’s potential output will jump given that the land size of the new site is double the existing built-up area of its existing operating locations.

In Tg Penjuru, Mencast will make a quantum leap not only in its production capacity but also capabilities. “This site will be the gem of Mencast,” quipped Mr Sim, who took over the chairman’s post last year from his father, who founded the company in 1981.

The new facility will enhance Mencast’s strategic alliance with Germany’s Becker Marine Systems, which is a global leader for high-performance rudders and manoeuvring solutions for any type of ship.

Mencast is Becker’s preferred manufacturer of heavy rudder assemblies and high-end sterngear equipment in Asia, a favourable outcome owing to Singapore’s reputation for respecting intellectual property.

In its services segment, Mencast’s growth is boosted by its acquisition in 2009 of a long-time partner, Recon Propeller, and the business of Denfon Engineering.

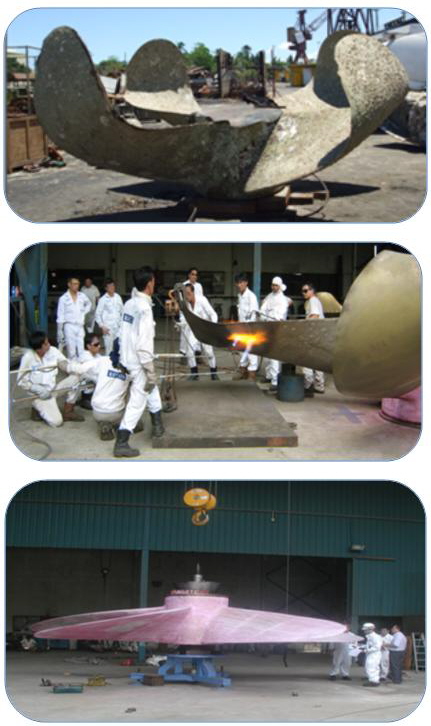

The following photos shown in a presentation by Glenndle Sim to NextInsight readers show a damaged propeller which Mencast repaired and restored to pristine condition, a difficult task that shipowners would only entrust to trusted specialists like Mencast. Repairing and servicing such sterngear equipment is a business that is rising in demand as the world's ship population has increased significantly in recent years.

Recent stories: MENCAST: Gay Chee Cheong among 9 buying new shares

MENCAST: 'Come meet our management, tour our facilities, have a Q&A session and ...lunch'