Serial CFO Alex Wui (standing) at yesterday's briefing for analysts. Photo by Cheng Siew Hooi

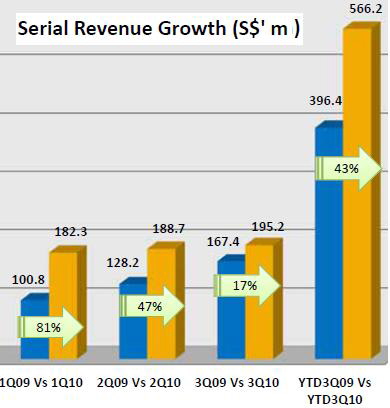

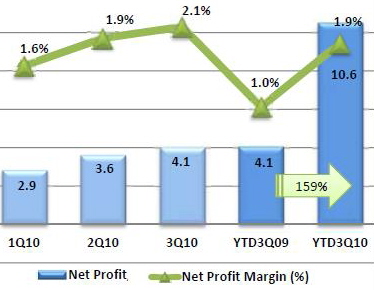

SERIAL SYSTEM achieved record revenue of $195.2 million in 3Q - and a record net profit of $4.1 million for the quarter.

The sterling performance, which was announced yesterday, marks a strong quarter-on-quarter growth since the start of this year (see charts).

That’s up a whopping 158% from the start of the year when the stock was 6 cents.

The 15.5 cent stock price translates into a PE of 8, assuming earnings per share of 1.94 cents for this year based on an assumed net profit of $4.1 million in 4Q (similar to 3Q) and share capital of 757.3 million.

Explaining the driver for the revenue growth, Serial CFO Alex Wui said Greater China (ie China and Hong Kong) contributed 59% of the revenue in the first 3 quarters of this year.

Greater China’s revenue of US$236.5 million in the first 3 quarters grew 56% year on year as Serial sold more components to meet demand in diverse industries ranging from consumer electronics to security, from automotive to medical devices.

Overall, Serial has a wide distribution network comprising 46 sales offices and 560 employees serving over 4,000 customers.

With this network, Serial is able to increase its net profit faster than its revenue growth. That is why, in the 3 quarters of this year, net profit grew 159% year-on-year on the back of a 43% growth in revenue.

“It’s about economies of scale. Over the past few years, we have expanded rapidly our offices and staff in China. So now, as an example, instead of selling one part to a customer, we now sell three parts using the same resources,” said Mr Wui.

As a result, expenses as a percentage of sales has dropped from 9% last year to 8% this year, he said.

Turning to dividends for shareholders, he noted that Serial had paid 0.28 cent a share as interim dividend.

Based on the company’s guidance of a 40-50% payout on the net profit for the full year, shareholders could be paid 0.5 cent or so as final dividend.

If that turns out to be the case, the total full-year dividend of 0.78 cent would far exceed last year's 0.51 cent a share.

Recent stories:

SERIAL SYSTEM: Heading for Taiwan listing for better valuation

SERIAL SYSTEM: 'Significant room to grow....'