SPENDING BY companies and individuals on IT is on a tear, resulting in many IT-related companies listed on the Singapore Exchange enjoying a boom in profit in recent quarters .

We have attended a number of these companies’ presentations to investors or analysts, and the companies have painted the outlook optimistically. Examples include:

a) SERIAL SYSTEM: Sterling $2.9 m profit in 1Q on semicon rebound

b) BROADWAY: Analysts' consensus target price upped to S$1.54

c) CHEUNG WOH TECH: 'Momentum strong, no impact from Greek crisis'

The one we attended yesterday was by ECS Holdings, a regional info-comm technology solutions provider, was in the same positive vein.

It has just reported 1Q net profit of $9.1 m, up by 31.4% year-on-year, making it the best first quarter in its 25-year history.

Revenue was up 16.2% to $830.7 million.

|

Giving snapshots of the industry trend, ECS chief financial officer Eddie Foo told investors at CIMB-GK Investment Centre that corporate IT spending froze in 2008/2009 and is now coming back.

Government and businesses are raising their IT spending as the economy recovers.

Gartner has forecasted a robust 22% rise in global PC shipments this year.

As a result, “we expect to continue to do well this year,” said Mr Foo.

ECS (www.ecs.com.sg) will ride the IT wave as a distributor of products such as notebooks, servers and printers.

ECS also has an Enterprise Systems Division which designs, installs and implements IT infrastructure for companies, while its IT Services Division provides professional, technical support and training services.

Rosy as the foreseeable future is, ECS’ business is a volume game as margins are thin. Net margin for the 1Q this year came in at 1.1%.

Mr Foo said ECS is looking for territorial growth in existing markets such as Indonesia and China, and in new markets such as Vietnam and India.

While this year’s IT spending outlook is positive, it is worth casting a look at the deep past of ECS.

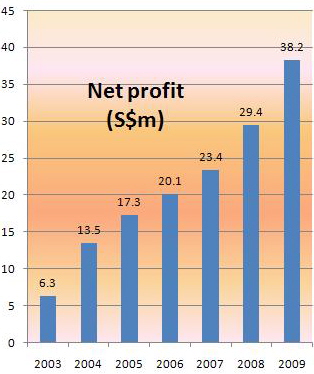

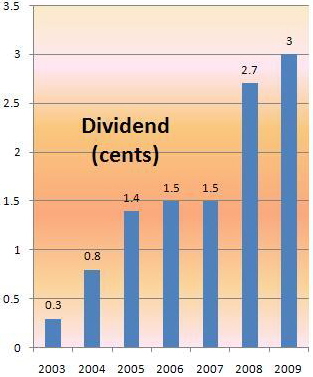

The company, which was listed in 2001, has reported steady growth in revenue, profit and dividends, making it an assuring stock for investors with a lower-risk appetite to buy and hold for dividend yield and capital appreciation.

As Mr Foo noted of the more recent past: “We have had 26 quarters of continuous profitability, and 26 quarters of consistent growth. For 26 quarters, we delivered our promises.”

One of ECS’ strengths is its large network of 21,400 channel partners in China and Southeast Asia, which attracts vendors such as IBM, HP, Cisco, Sun, Cisco and Microsoft.  “One of the reasons vendors are coming to ECS is we are big, we have a big network of resellers,” said Mr Foo.

“One of the reasons vendors are coming to ECS is we are big, we have a big network of resellers,” said Mr Foo.

He took on many questions from the audience after his presentation. Some highlights of the session:

Q: Comparing the North Asia and Southeast Asia profitability - North Asian margins are thin. Is your cost of doing business there much higher?

Mr Foo: It’s more competitive in China as there are local brands too that can compete with foreign-branded IT products.

Q Comparing the risk and reward of doing business in China, is it worth going into China?

Mr Foo:The single biggest risk in China is credit risk. We run a tight ship, in terms of credit policy. We normally do not extend any credit terms to new customers. We do collaterals and personal guarantees to tighten our credit risk. We have a team in China that has been around a long time – we have been there for 7 years.

Q: I understand that ECS is among the top 3 in Asean. Who are your listed competitors?

Mr Foo: We are in the pole positions in most of the ASEAN countries. Our main competitor in ASEAN is Ingram Micro – formerly Electronic Resources. In China, our main competitor is Digital China, a spinoff of Legend.

Q: Some years ago, ECS had a takeover. How has that affected the company?

Mr Foo: The takeover has not had any effect on our operations. In 2007, the takeover was by VST, which has not changed the business. They have a lot of trust in the management team. That’s why the team hasn’t changed since the takeover.

Q: What about the liquidity of your shares?

Mr Foo: We don’t have enough float in the market. We are constantly looking for ways to improve the liquidity.