To reach Geo Energy's BEK coalmine project, the Singapore delegation flew on a propeller plane over jungles and rivers from the seaport city of Balikpapan in East Kalimantan.Visuals by Sim Kih

To reach Geo Energy's BEK coalmine project, the Singapore delegation flew on a propeller plane over jungles and rivers from the seaport city of Balikpapan in East Kalimantan.Visuals by Sim Kih

WHAT HAPPENS to the world's largest coal exporter (Indonesia) when economic growth of the world's largest coal importer (China) loses momentum?

High stockpiles of coal and sliding coal prices have caused net profits of Indonesia's largest coal mining companies (listed in Jakarta) to either nosedive or go into the red. Its largest coal producer, PT Bumi Resources, booked a net loss of US$62.9 million in 1Q2013.

Yet, SGX-listed coalmining specialist Geo Energy Resources was able to increase its 1Q2013 net profit attributable to shareholders by 20% year-on-year to US$5.1 million.

Geo Energy's net margins expanded 6.7 percentage points to 28.9%, thanks to greater revenue contribution from a new mining concession, as well as greater revenue from its mining services and equipment rental business. Geo Energy CEO Dhamma Surya (left) with Religare Capital Markets (HK) natural resource analyst Tracy Huang in front of coal stockpile.

Geo Energy CEO Dhamma Surya (left) with Religare Capital Markets (HK) natural resource analyst Tracy Huang in front of coal stockpile.

The company started producing coal from its first mining concession Bumi Enggang Khatulistiwa (BEK) in February 2012.

BEK has a lower strip ratio averaging 6.5 compared to other mine sites under its coal offtake agreements.

The company's average strip ratio decreased from 16.4 in FY2011 to 7.8 in FY2012, resulting in better production efficiency.

(The strip ratio is the unit amount of overburden that must be removed to access a similar unit of coal.)

NextInsight travelled to East Kalimantan recently to visit its coalmining projects with AmFraser and Religare analysts.

The business is helmed by two Indon Chinese families - the Melati and Surya families who jointly hold a 68% stake in the company. Geo Energy Chief Investment Officer Mark Zhou (right) with Religare Capital Markets investment banker Clarence Chong at open pit of coal mine.

Geo Energy Chief Investment Officer Mark Zhou (right) with Religare Capital Markets investment banker Clarence Chong at open pit of coal mine.

Its appointment of a professional chief investment officer, Mark Zhou, (unrelated to the two families) speaks volumes about its long term strategy.

It has no intention of morphing into an investment holding company and the investment banker was not brought on board to dabble with stocks and commercial real estate investments.

Rather, it wants to sustain earnings growth through savvy investments in coalmining concessions and improvements in production efficiency.

Will the former third-party coalmining contractor services provider prove itself more savvy than large and established Indon coalminers in the face of sliding coal prices?

We saw its first coalmining concession at BEK, covering 4,570 hectares of coal-bearing basins of weighted average coal quality exceeding 3,400 kcal/kg in calorific value (GAR).

The BEK project has a mine life of 6 years based on 12.5 million tons of proven coal reserves. As at 31 March 2013, it had already produced about 1.4 million tons of coal for Geo Energy.

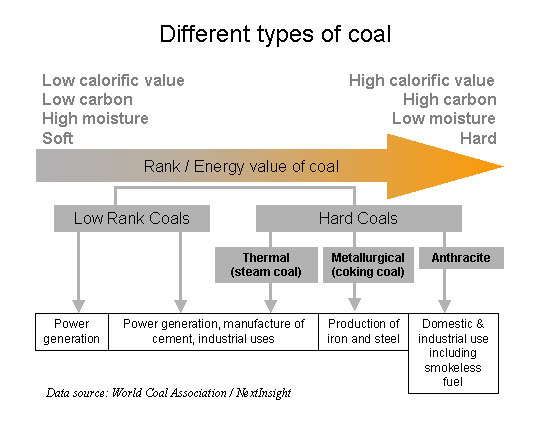

Coal with GAR values of less than 5,100 kcal/kg is considered "low rank", priced lower and commonly used in power plants, unlike metallurgical grade coal which can be used in steel mills.

"There is demand for coal from the BEK concession which we own and operate. We have secured coal sales contracts for production scheduled for the rest of the year," said Mark Zhou.

| Click on arrow for a glimpse of our journey to a coalmining project in the jungle regions of East Kalimantan. | |

| . |

To increase profitability, the company intends to acquire mining concessions with higher rank coal reserves, which carry higher calorific value and, therefore, command better prices.

From February to April 2013, it inked conditional sales and purchase agreements to buy five additional mining concessions with coal quality ranging from 4,000 kcal/kg to 7,200 kcal/kg GAR as well as semi-coking coal.

Pending the independent technical reports commissioned by the vendors and shareholders’ approval, Geo Energy targets to complete the acquisitions collectively by the end of the year. Reserves at Geo Energy's new coalmine concessions are mostly thermal grade coal, compared to the low rank coal in its first concession at the BEK project. It also has some semi-coking coal, which can be mixed with coking coal and sold to steel mills.

Reserves at Geo Energy's new coalmine concessions are mostly thermal grade coal, compared to the low rank coal in its first concession at the BEK project. It also has some semi-coking coal, which can be mixed with coking coal and sold to steel mills.

The next day, we drove 8 hours on bumpy dirt roads to check out the Bumi Jaya Prima Etam (BJPE) mining project, where Geo Energy is a third-party mining services provider for overburden removal, coal haulage and coal sales.

Next article: Geo Energy's business growth strategy and barrier to entry story told first-hand from the BJPE mine site.

Related stories:

@ GEO ENERGY, SAN TEH: Independent Directors Buy Shares

@ GEO ENERGY's AGM: Jim Rogers In The Limelight