Excerpts from CGS-CIMB report

Analyst: William Tng, CFA

AEM Holdings Ltd

■ 1H22 revenue of S$540.5m was 3.0% above our S$525.0m forecast. 1H22 revenue formed 72% of our/Bloomberg consensus full-year forecast.

■ Reiterate Add. TP is reduced to S$6.54 as we use a lower target P/E multiple given the higher interest rate environment and slowing economic growth. |

||||

1H22 results: slightly above expectation

1H22 revenue rose 181% yoy to S$540.5m driven by the volume ramp up for its new generation System Level Test Handlers, Burn-In Test Handlers and the consolidation of its CEI acquisition.

1H22 revenue was 3% above our S$525.0m forecast and formed 72% of our/Bloomberg consensus full-year forecast. 1H22 net profit jumped 180% yoy to S$82.8m and was similarly 3% above our S$80.4m forecast.

| Cash balance of S$180.9m (end-Jun 22) available for M&A growth. Net gearing (based on bank borrowings) as at end-Jun 22 was 0.178x, providing AEM with debt headroom if further cash resources are required for larger size M&A. |

1H22 net profit formed 70% of our/Bloomberg consensus full-year forecast. Gross profit margin fell 3% pts yoy from 34% in 1H21 to 31% in 1H22 due to increased cost pressure from supply chain challenges.

AEM managed to defend its profit before tax (PBT) margin of 18.8% in 2Q22, just 0.2% pt lower than the 19% achieved in 1Q22.

Legal costs spiked from S$3.4m in 1H21 to S$10.8m in 1H22 due to an ongoing confidential arbitration. Removing legal costs, 1H22 PBT margin was 20.9% in 1H22 vs. 20.2% in 1H21.

An interim DPS of 6.7 Sct (25% payout policy) was declared.

Outlook: Raised revenue guidance but expects weaker 2H

AEM revised its FY22F revenue guidance from S$700m-750m previously to S$750m-800m and guided that it expects 2H22F revenue to be lower than 1H22.

On new customer wins, AEM also announced that it was recently selected as a supplier for a leading High-Performance Computing (HPC)/Artificial Intelligence (AI) company and consequently, received orders for its customised test handling solutions and another customer that supplies chips used in mobile applications.

The group also acquired an initial 53.3% stake in a South Korean company, Nestek Korea Co Ltd (Unlisted) that specialises in the design and manufacture of pins and sockets.

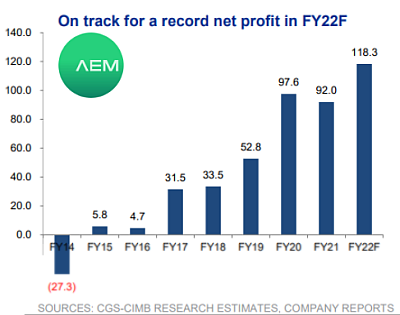

Recommendation: reiterate Add with a TP of S6.54 William Tng, CFA.We raise our FY22-24F EPS slightly by 0.2-0.3% as we think higher operating costs many be required to support our increased revenue forecasts. William Tng, CFA.We raise our FY22-24F EPS slightly by 0.2-0.3% as we think higher operating costs many be required to support our increased revenue forecasts. We reiterate our Add call with a TP of S$6.54, based on 14.9x (2 s.d. above its Jan 17 to Aug 22 average forward P/E multiple) our FY23F EPS forecast of S$0.44. Previously we used a 15.62x (10% premium to AEM’s 2 s.d. above its FY17-21 average forward P/E multiple). We removed the 10% premium to factor in the risk of slowing economic growth. Re-rating catalysts are stronger-than-expected orders from its major customer and earlier-than-expected success in securing orders from other potential customers. Downside risks are delivery delays and the loss of its sole supplier status. |

Full report here