|

Like everyone in leadership, oil industry veteran Wang Yanjun knows that criticism usually comes with the territory. He believes instead in taking the unpleasantness out of criticism and turning every situation into an opportunity to listen - and learn. “My first response towards criticism from shareholders or investors is to remind myself not to be in a hurry to defend myself,” said the Chief Executive Officer of SGX-listed jet fuel trader China Aviation Oil (Singapore) Corporation Ltd (CAO). “Rather, my priority is to reflect upon my own actions, and find reasons, if any, for these criticisms, then understand and improve on my shortcomings, as well as make a commitment to ensure such incidents do not recur. That’s my usual strategy when I face setbacks at work.” In addition, Wang believes in being prudent but not conservative, progressive but not aggressive. “I would say that honesty, integrity and decisiveness are the key elements of my leadership style,” he added. |

Since assuming the role of CEO in September 2018, those attributes have helped Wang to entrench CAO’s position as the largest physical jet fuel trader in Asia Pacific and key supplier of imported jet fuel to China’s civil aviation industry.

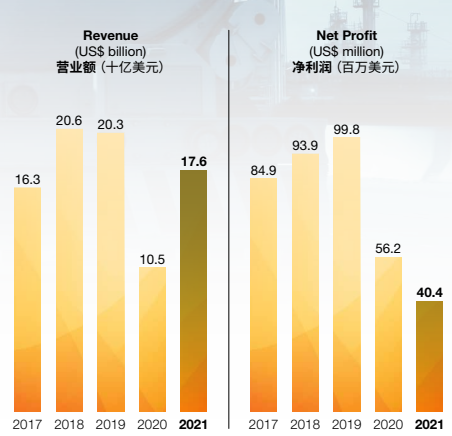

“We’ve experienced great turbulence and many challenges over the past four years,” Wang said. “While we were able to achieve a record net profit for the Group in 2019, the subsequent outbreak of COVID-19 and global travel restrictions impacted our performances for 2020-2021.”

The steep fall in crude prices also exacerbated the credit crunch faced by many oil trading companies. “In 2020, we initiated a comprehensive risk assessment of our counterparties, and managed to avert the significant spike in default risks that arose from sharp declines in global oil prices,” he recalled.

“We decisively reduced exposure to high-risk counterparties and stepped up risk management measures. This helped CAO avoid material adverse impact and prevented operating losses in the ensuing market volatility, which forced many active trading companies into insolvency.”

Incorporated in Singapore in 1993 and listed on SGX Mainboard since 2001, CAO boasts a strong and growing presence at key international aviation hubs in Hong Kong, Los Angeles and Frankfurt.

CAO and its key wholly owned subsidiaries - China Aviation Oil (Hong Kong) Company (CAOHK), North American Fuel Corporation (NAFCO) and China Aviation Fuel (Europe) (CAFEU) - supply jet fuel to airline companies in Asia Pacific, North America, Europe and the Middle East.

The Group also engages in international trading of jet fuel and other oil products. It owns investments in oil-related businesses that are synergistic to its supply and trading activities, with a portfolio of assets along an integrated global supply and trading value chain, comprising storage, pipelines and airport refuelling facilities.

China National Aviation Fuel Group (CNAF) is the single largest shareholder of CAO, with a 51.31% stake. CNAF, a state-owned enterprise, is the largest aviation transportation logistics services provider in China, providing aviation fuel procurement, storage, transportation and refuelling services at over 200 airports in the country. BP Investments Asia, a subsidiary of oil major BP Plc, is also a strategic investor of CAO, with 20.17% shareholding. CAO: Record net profit in 2019, followed by falls due to Covid impact on travel.

CAO: Record net profit in 2019, followed by falls due to Covid impact on travel.

Transformation Journey

To fuel its longer term growth, CAO has embarked on a transformation journey, Wang said.

“CAO has grown from strength to strength. As part of its next phase of growth, we will need to transition from a conventional trading company to a digitally driven, “future-smart” trading company,” he pointed out.

Since the beginning of 2021, the Group has actively sought to develop and enhance three key information systems, namely, a global aviation fuel analysis and decision management system, a global operations monitoring and management system, as well as a risk management and early warning monitoring system.

“Through the use of these systems, our teams are able to make more informed and accurate business decisions. Within a three-year plan timeline, we envision these systems will gradually become a unique core competitive advantage for our digitally driven trading business,” Wang noted.

CAO also plans to increase investments in oil-related assets by capitalising on synergistic market opportunities within the global supply value chain. “This will support the global expansion of our supply and trading network,” he added.

Next on the Group’s priority list is embracing the challenges of transitioning from fossil fuel energy to green energy.

“Conventional fossil fuel energy remains CAO’s core business. However, with the continued drive to reduce carbon emissions both in China and internationally, CAO is actively seeking to expand beyond its conventional fossil fuel business by investing in new green energy opportunities in the aviation industry,” Wang added.

In 2021, as part of its corporate social responsibility initiative, CAO established accounts with carbon registries such as Switzerland-based carbon registry. The Gold Standard Foundation. It also joined the advisory team of Taskforce on Scaling Voluntary Carbon Markets, making concerted efforts to have its voice heard in the area of greenhouse gas (GHG) emissions.

Additionally, CAO initiated its first carbon emissions reduction business through the purchase of carbon credits to achieve carbon neutrality for two shipments of aviation fuel to counterparties in Pudong.

It has also completed a preliminary market study on sustainable aviation fuel (SAF) for the European market, and has reached out to major SAF producers to explore investment and collaboration opportunities as part of its move to expand into the trading and supply of SAF.

|

Surmounting Challenges However, along with these growth opportunities, several industry challenges exist, Wang admitted. “One issue that is currently at the top of our minds is de-globalisation. Contrary to the previous globalisation drive, the emergence of unilateral and protectionist policies by certain governments are complicating the geopolitical landscape and adding to risk of global economic decline,” he noted. “Multinational corporations such as CAO will undoubtedly bear the brunt of this uncertainty, with the need to rethink global operations, investments, expansion, the introduction and utilisation of technology, as well as ensuring funding support for the Group’s overseas operations.” Another worry is uncertainty in post-pandemic aviation fuel demand and the reliability of supply sources. “While our Singapore, North America and Europe operations have seen a steady rise in demand for aviation fuel, the Russian-Ukraine conflict and the ensuing international sanctions on Russia have exacerbated price and supply volatilities in the global oil market,” Wang noted. “These volatilities will undoubtedly challenge our risk management capabilities and our ability to sustainably generate higher returns for our business. That’s why with carbon neutrality in mind, we’ve initiated carbon trading, and are currently exploring sustainable energy options, in particular, the development of sustainable aviation fuel.” In particular, the escalation of the Russia-Ukraine conflict has highlighted the importance of risk management. “With rising complexity in the operating landscape, we’ve to be mindful of more complex credit and settlement risks, potential sanctions-related risks, as well as trade execution and contract risks arising from volatile oil prices and structural changes in the oil market,” he said. “To mitigate potential market losses for the Group, we’re closely monitoring our hedging strategies and hedging instruments, which have seen reduced market liquidity owing to the uncertain operating environment. In addition, we need to exercise prudence, and implement risk-mitigated business strategies to drive the Group’s continued growth.” Despite such challenges in the operating environment, Wang, who is in his 50s, remains passionate about his role in CAO which he has helmed for the past four years. “What motivates me is the sense of professional responsibility that I’ve developed over the years,” he said. “Choosing to do what is right, and doing my utmost in my endeavours to achieve the best results, are two key principles that keep me going and get me out of bed every morning.” |

China Aviation Oil (Singapore) Corporation Ltd

CAO is the largest physical jet fuel trader in the Asia Pacific region and the key supplier of imported jet fuel to China’s civil aviation industry. CAO and its wholly owned operating subsidiaries - China Aviation Oil (Hong Kong) Company, North American Fuel Corporation and China Aviation Fuel (Europe) - supply jet fuel to airports outside China, including Asia Pacific, Europe, North America and the Middle East. The CAO Group engages in international trading of jet fuel and other oil products, and owns investments in various strategic oil-related businesses. CAO, a subsidiary of China National Aviation Fuel Group, is a component stock in the FTSE ST China, FTSE ST Small Cap and MSCI Singapore Small Cap Indexes.

The company website is: www.caosco.com

Click here for the company's StockFacts page.

For the full year ended 31 December 2021 financial results, click here.

About kopi-C: the Company brew

Text: Jennifer Tan-Stanisic

Photo: Company file

This article was originally published in kopi-C, a regular column on the SGX Research website that features C-level executives of leading companies listed on Singapore Exchange. These interviews are profiles of senior management aimed at helping investors better understand the individuals who run these corporations.

For previous editions of kopi-C: the Company brew, please click here.