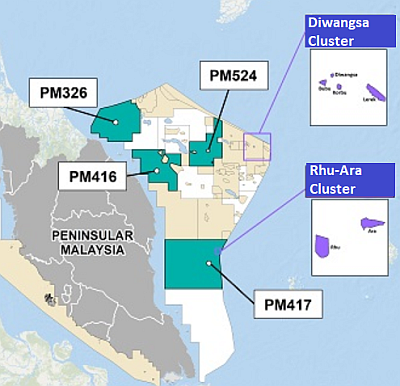

| Rex International has interests in producing oilfields in the seas off Oman and Norway. The Singapore-listed company has now added projects nearer home -- off the coast of Peninsula Malaysia. A technology-driven exploration and production company, Rex and Malaysian partner, Duta Marine Sdn. Bhd, today signed two Production Sharing Contracts (PSCs) awarded by Petroliam Nasional Berhad (PETRONAS), Malaysia’s national oil corporation. These contracts relate to the development and production of the Rhu-Ara and the Diwangsa Clusters.  The Diwanga and Rhu-Ara clusters are previously discovered fields. Total estimated recoverables: 12.7 MMstb for the Rhu-Ara Cluster and 10.7 MMstb for the Diwangsa Cluster. Map: Petronas The Diwanga and Rhu-Ara clusters are previously discovered fields. Total estimated recoverables: 12.7 MMstb for the Rhu-Ara Cluster and 10.7 MMstb for the Diwangsa Cluster. Map: Petronas |

Rex de-risks its portfolio of exploration and development assets using its proprietary liquid hydrocarbon indicator Rex Virtual Drilling technology, which can locate oil reservoirs in the sub-surface using seismic data. Since its listing in July 2013, Rex has achieved four offshore discoveries, one in Oman and three in Norway.

The Rhu-Ara Cluster contains two discovered oil fields while the Diwangsa Cluster contains four discovered oil fields.

The Clusters are awarded following the Malaysia Bid Round 2020.

The terms include an up-to-two-year pre-development phase followed by a two-year development and a ten year production period.

Rex and DMSB hold 95% and 5% interests, respectively, with Rex being the operator of the contracts.

“Rex is very pleased to have been awarded two PSCs in Malaysia and looks forward to working with PETRONAS to rapidly and cost effectively develop the resources contained within the Clusters. Over the next two years, our focus will be on the pre-development phase of the Clusters. The anticipated production will further grow the Group’s production and reserves base. We will leverage on our experience in Oman, where we have proven to be an effective operator, to make these assets a success.” “Rex is very pleased to have been awarded two PSCs in Malaysia and looks forward to working with PETRONAS to rapidly and cost effectively develop the resources contained within the Clusters. Over the next two years, our focus will be on the pre-development phase of the Clusters. The anticipated production will further grow the Group’s production and reserves base. We will leverage on our experience in Oman, where we have proven to be an effective operator, to make these assets a success.”-- Mr Dan Broström, Executive Chairman of Rex International |

| 1H2021 financial highlights | ||||||||||||||||||||

• Operational revenue: US$ 75.76 million net of government take from oil sales in Oman in 1H FY2021 • Strong cash position: Cash, cash equivalents, quoted investments and receivables (less Omani government's share) totalling US$84.54 million as at 30 June 2021 • Further strengthening of the results going forward by the acquisition of 33.84% interest in the producing Brage Field in Norway which will be effective from 1 January 2021 upon completion. This will add an estimated production of 3,440 barrels of oil equivalent per day net to Rex's subsidiary, Lime Petroleum. |

||||||||||||||||||||