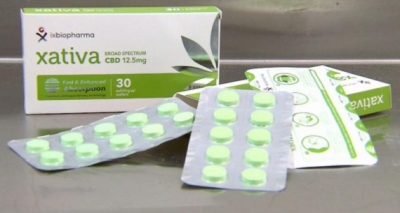

iX Biopharma (S$0.235, unchanged) announced that its has obtained export listing status for Xativa, its CBD (cannabidiol) sublingual wafer. Xativa’s inclusion in the Australian Register of Therapeutic Goods (“ARTG”) list of drugs approved for export paves the way for the Company to expand its customer base beyond Australia in line with its plans to build itself into a global medicinal cannabis provider. Xativa’s inclusion in the Australian Register of Therapeutic Goods (“ARTG”) list of drugs approved for export paves the way for the Company to expand its customer base beyond Australia in line with its plans to build itself into a global medicinal cannabis provider.Available in 12.5mg and 25mg doses, Xativa is the world’s first sublingual medicinal cannabis wafer developed using iX Biopharma’s patented WaferiX sublingual delivery technology. The export listing on the ARTG demonstrates that the product is compliant with strict standards that apply to products supplied domestically in Australia. |

Globally, the growing understanding of cannabis’ unique medicinal properties has driven the transformation of aƫ tudes towards the drug.

Notably, key markets such as the US, Australia, Canada, Europe, New Zealand have rapidly announced their legalisation of cannabis over the past four years.

The transition to cannabis legalisation is set to gain momentum and support the interest in and demand for medicinal cannabis.

Leveraging the export listing approval, the Company will commence supply of Xativa to Brazil, where it is collaborating with its partners to distribute and market the product to doctors and patients.

The market value for medicinal cannabis is forecast to surge from US$41.5 million in 2021 to approximately US$103.5 million by 2024.

“Obtaining export listing for Xativa is a significant milestone. It brings us closer to realizing our ambition of becoming a medicinal cannabis supplier to global markets. This positive development follows the timely expansion of our wafer production capacity, which will support our entry into the Brazil and other international markets. “Obtaining export listing for Xativa is a significant milestone. It brings us closer to realizing our ambition of becoming a medicinal cannabis supplier to global markets. This positive development follows the timely expansion of our wafer production capacity, which will support our entry into the Brazil and other international markets.“We expect to benefit from the sustained and dynamic growth in Brazil and are confident that this move will position us competitively to expand our footprint in markets beyond Australia.” -- Eva Tan, Chief Commercial Officer of iX Biopharma |

Apart from Brazil, the Company is also pursuing partnerships with other cannabis and pharmaceutical companies, as well as wholesale and retail distributors in other markets.

The Company currently supplies Xativa to patients with medical prescriptions in Australia via the Special Access Scheme and Authorised Prescriber Scheme.

At $0.235, market cap is $164mln and P/B is 9.9x.

The Group was loss-making in FY20 and did not pay any dividends.

According to Bloomberg, the average of the various analysts’ target prices on the stock is $0.44, representing an upside potential of 83%.