Shipping containers has not been this lucrative in a long time. Shipping containers has not been this lucrative in a long time.With high rates owing to consumer demand for goods and container scarcity at export hubs, Singapore-listed Samudera Shipping Line (SSL) is enjoying strong cashflow. (See: Shipping-Container Rates Top $10,000 From Asia to Europe) But because the Singapore Exchange has made it non-mandatory to report quarterly performance, how profitable Samudera was in 1Q2021 is a guessing game. The guessing can approximate reality, though. By a stroke of luck, SSL has a parent, PT Samudera Indonesia, which has lodged its 1Q2021 results to the Jakarta Stock Exchange. PT Samudera Indonesia owns 65.14% of SSL.  |

We look to the detailed analysis on a blog by an investor calling himself "Squirrel". The following is a summary:

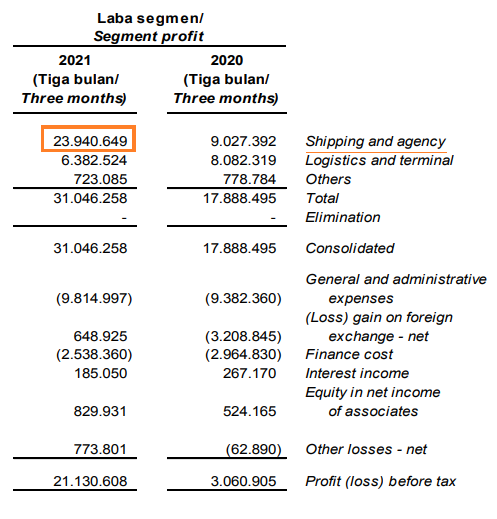

1. PT Samudera Indonesia, which has 3 business segments, reported US$23.9 million in shipping and agency segment profit.

2. Considering 2020 results of PT Samudera Indonesia, one may deduce that US$8.16 millon per year of gross profit in shipping and agency segment was derived from sources other than SSL. That works out to US$2.04 million a quarter, which means in 1Q2021 (US$23.9 m - US$2.04 m) = US$21.9 million may be attributable to SSL.

"Squirrel" decided to go with a lower gross profit figure of US$21.5 million after a different cross-check analysis which is too lengthy to reproduce here.

3. Next, annual expenses of SSL averaged US$12.7m over the last 2 years (excluding other expenses largely made up of one-time expenses, such as writing down value of assets).

A quarter of US$12.7 million would be US$3.2m.

4. Next, factor in a tax rate of 5% (corporate tax rate is 17% but there are some tax exemptions that the firm can rely on that drops the effective rate to around 5% in the last 4 years).

5. With that, SSL's net profit in 1Q2021 is estimated by "Squirrel" to be (US$21.5m - US$3.2m) * 0.95 = US$17.4m.

6. In Singapore dollars, that is about SGD 23.1m (or 4.3 Singapore cents per share).

How big is this (assuming it's anywhere close to the real figure)?

Well, it exceeds the US$7.2 million net profit of SSL in the entire FY2020!

7. On an annualised basis, SSL is trading at 1.86X PE and price/book of 0.6X (based on a recent stock price of 31 cents).

| "If this increased freight rate drags out, SSL is effectively raking in 1.4 SGD cents per share a month. Even though revenue stays relatively unchanged (I deduce that this is due to reduced India revenues from the Covid outbreak and the continuing shift from CY to FIO as mentioned in FY2020 AR balancing out increases due to higher freight rates), the higher profit margin is effectively churning out cash for SSL for their next phase in building out dry bulk and tanker business. The extra cash would also likely result in special dividends and likely buybacks." -- Squirrel |

"Squirrel" posted the following in Valuebuddies.com:

| "....it is obvious that the freight rates have not let up up till last Friday. That’s another 2 solid months of of cash generation from Samudera’s container shipping business. From its parent company’s results, Samudera Shipping Line is profiting from the boom at circa 1.4 sgd cents a share per month if the container shipping rates continue to stay high. A rough estimate would give a book value of circa SGD$0.561 per share up to May and if this carries on, SGD$0.575 per share by Jun 2021 with cash balances likely surpassing its current market capitalization. I hope my interpretation of the parent results are right. If it is, we are in for a big upside surprise when Samudera Shipping Line releases its 1H results. Profits will be at a multiple of full year results." -- Squirrel |