That was a S$22 million jump, mainly driven by net operating cashflow of S$15.9 million. For perspective, Cordlife's market cap is S$97 million (stock price: 38 cents). The high net cashpile represents 73% of the market cap. Excluding cash, the stock's PE is an attractive 3.9X. This is obviously speculative but given a year or two, Cordlife's cash could get closer to 100% of its market cap, subject of course to assumptions such as unchanged stock price, no M&A deals and no deterioration in business. |

|||||||||||||||||||||||||||||||||

Here is a snapshot of how the increase in total cash and cash equivalents, fixed deposits and short-term investments came about:

|

• proceeds from the sale of long-term investments amounted to S$5.1 million. These were unquoted shares of CellResearch Corporation sold back to the vendors |

This was offset by:

| • purchase of property, plant and equipment and intangible assets of S$1.4 million and • dividend payment of S$2.5 million and • repayment of interest-bearing borrowings of S$310,000. |

|

Stock price |

38 c |

|

52-week range |

27 - 42 c |

|

PE |

14.7 |

|

Market cap |

S$96.7 m |

|

Shares outstanding |

254.5 m |

|

Dividend |

2.37% |

|

1-year return |

-0.1% |

|

Source: Bloomberg |

|

While Cordlife pivoted to digital marketing in its core cord blood banking business, it worked for months in the background to leverage its core competencies to create a brand new revenue stream.

Finally, this month, it announced that it had secured a licence from the Singapore Ministry of Health to offer what it called OptiQ.

| OPTIQ and partnership with private eye doctors |

This is how it works:

|

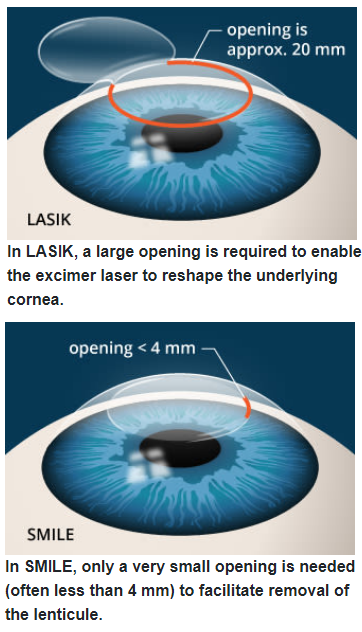

• Patients go to see their eye doctor to undergo a certain refractive eye surgery technique to correct their myopia or astigmatism or other eye condition. Potentially, the same lenticule can be implanted in the same patient to treat his presbyopia and other ocular conditions in the future. |

Source: www.allaboutvision.com

Source: www.allaboutvision.com

The target customers of OptiQ would be adults in their 20s and early 30s, who want to use their lenticule to correct the inevitable onset of presbyopia when they are past the age of 40.

Cordlife is offering two payment plans: either a $4,500 upfront payment for 20 years' storage, or a $1,800 payment for first year and $180 per year for the next 19 years of storage.

The technology behind OptiQ was invented by Professors Donald Tan and Jodhbir Mehta from Singapore Eye Research Institute (“SERI”), the research arm of Singapore National Eye Centre.

The expertise to store and re-implant a person’s corneal lenticule was developed by SERI and patented by Singapore Health Services Pte Ltd. Cordlife is the exclusive license holder of this patent.

Ms Tan Poh Lan, Cordlife’s Group CEO, said: “Cordlife has accumulated 20 years of experience in the banking of biological materials so offering the storage of corneal lenticules is a natural extension of our services. Our partnership with SERI fits perfectly with our commitment to providing innovative healthcare services.”

Cordlife, which is leveraging on its current facilities in Singapore and overseas, is not incurring new capex for OptiQ nor requiring additional manpower.

Cordlife is the first company in Asia to offer a "corneal lenticule" banking service.

How big is the market?

Ms Tan said an estimated 25,000 lenticular extractions are done a year in the markets that Cordlife currently operates in, including about 2,000 in Singapore.

"Cord blood banking is still our core business, and we are still focusing on that, working very hard to increase our penetration rate because it is really just the tip of the iceberg in many of the countries," added Ms Tan.

| For more, see press release on OptiQ here. Also, Cordlife's FY20 results presentation here. |