Excerpts from UOB KH report

Analysts: John Cheong & Singapore Research Team

Small Mid-Cap Strategy – Singapore

| Position For Recovery Plays Backed By Deep Value We highlight stocks based on the following criteria:

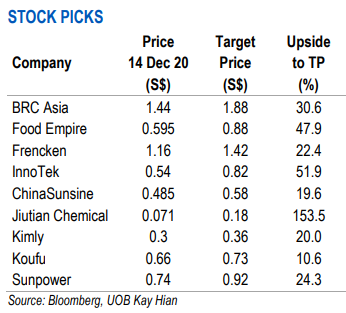

We continue to recommend investors to selectively accumulate deep-value names with good track records. We continue to recommend investors to selectively accumulate deep-value names with good track records. Our top picks are BRC Asia, Food Empire, Frencken and InnoTek. |

WHAT’S NEW

• Laggard quality small-mid cap backed by solid earnings – Food Empire, Frencken and InnoTek.

We highlight stocks that have resilient earnings despite being impacted by COVID19 and are trading at inexpensive valuations.

Furthermore, these names are backed by strong balance sheets – net cash position and low net gearing. Food Empire is the No.1 seller of instant coffee in Russia. Note the Russian ruble has strengthened against the US dollar in the past month, gaining 8.5% since 1 Nov 20.

Food Empire is the No.1 seller of instant coffee in Russia. Note the Russian ruble has strengthened against the US dollar in the past month, gaining 8.5% since 1 Nov 20.

• Leveraging off China’s recovery – Jiutian Chemical, China Sunsine and Sunpower.

Recent key domestic macro data from China reaffirms the countries’ recovery trajectory from COVID-19, with industrial production already recouping losses since returning to growth territory in Apr 20, bringing 10M20 gains of 1.8% yoy.

The country’s Purchasing Managers’ Index was expansionary for both the manufacturing and non-manufacturing sectors in Nov 20, affirming the sustained recovery in 4Q20.

UOB Global Economics & Markets Research expects China’s 4Q20 GDP growth to come in at 6.2% yoy, compared with 4.9% yoy in 3Q20.

With that, we highlight stocks with high revenue exposure to China, back by strong sets of results and undemanding valuations.

• Cyclical recovery – BRC Asia, Kimly and Koufu.

We highlight stocks that are beneficiaries of a normalised environment post-COVID-19 and have the ability to recover quickly. These include names in the construction and F&B services sectors.

Full report here.