Executive Chairman Michio Tanamoto. File photo

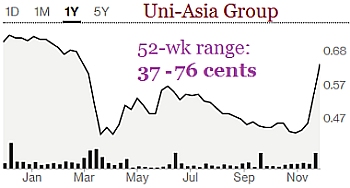

Executive Chairman Michio Tanamoto. File photo Chart: BloombergThe share price of Uni-Asia Group has rebounded from a low of 40 cents in late Oct 2020 to 65 cents this week.

Chart: BloombergThe share price of Uni-Asia Group has rebounded from a low of 40 cents in late Oct 2020 to 65 cents this week.

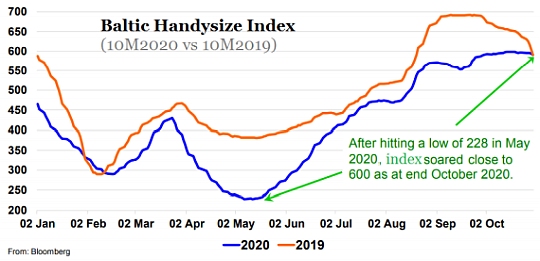

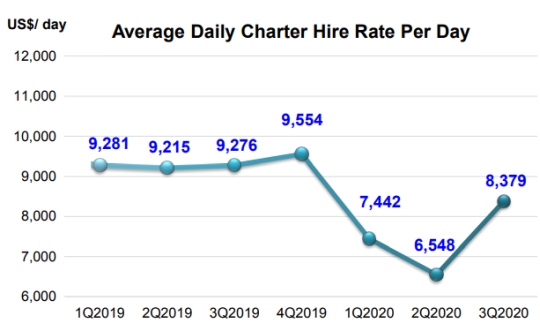

That movement is underpinned by a recovery in the handysize dry bulk shipping market following lows in May 2020 due to the Covid pandemic.

Here's an update on 3 areas of Uni-Asia's business:

Uni-Asia's wholly-owned fleet consists of 10 handysize dry bulkers whose time charter rates are linked to the Baltic Handysize Index. It also has jointly invested in 8 handysize dry bulkers. Its total charter income in 9M2020 amounted to US$22.1 million (9MFY19: US$27.4 million). |

| Property investment in HK |

In the property segment, Uni-Asia has invested in 8 projects in HK.

Three have been completed and sold while five are ongoing, as follows:

|

Ongoing projects in HK |

Investment |

Current status |

|

#4. Commercial office building |

HKD25.0 million (2.5% effective ownership) |

Target construction completion in 4Q2020 and presale will be launched when HK inbound travel is resumed. |

|

#5. Industrial building |

HKD26.81 million (7.5% effective ownership) |

Target construction completion in 4Q2020 and presale will be launched when HK inbound travel is resumed |

|

#6. Industrial building |

HKD48.2 million (3.825% effective ownership) |

Superstructure and basement construction will start in 4Q2020. |

|

#7. Commercial office building |

HKD53.75 million (8.27% effective ownership) |

Basement construction is underway. |

|

#8. Industrial building |

HKD33.00 (3.0% effective ownership) |

Architectural design submitted to the government for approval. |

The property outlook, according to Uni-Asia:

CEO Kenji Fukuyado• A new segment of China companies is slowly making inroads into the Hong Kong office market. Such companies include distribution companies and suppliers (i.e. logistics), Fintech, retailers and social media companies. These firms prefer core locations such as Central, Tsim Sha Tsui and Wanchai/Causeway Bay. CEO Kenji Fukuyado• A new segment of China companies is slowly making inroads into the Hong Kong office market. Such companies include distribution companies and suppliers (i.e. logistics), Fintech, retailers and social media companies. These firms prefer core locations such as Central, Tsim Sha Tsui and Wanchai/Causeway Bay. • China’s policies to foster development of Greater Bay Area (GBA) would benefit the Hong Kong office market in the long run. • The People’s Bank of China, the Hong Kong Monetary Authority and the Monetary Authority of Macao have jointly announced the introduction of the cross-boundary wealth management connect pilot scheme (Wealth Management Connect) in the GBA. This allows residents in the GBA to invest in wealth management products distributed by banks in the region. And it would facilitate capital flows into the GBA, driving the growth of wealth management firms and GBA economies, leading to demand for commercial property space in Hong Kong. |

| Residential property investment in Japan |

CFO Lim Kai ChingIt is somewhat surprising but Uni-Asia's residential property segment in Japan has not been affected by the pandemic.

CFO Lim Kai ChingIt is somewhat surprising but Uni-Asia's residential property segment in Japan has not been affected by the pandemic.

The Group continues to expand its small-residential development projects named ALERO in 2020.

It has invested JPY500 million in the projects in 9M2020, exceeding the full-year amounts (JPY478 - 496 million) of 2017, 2018 and 2019. Masahiro Iwabuchi,

Masahiro Iwabuchi,

executive director.Typically, Uni-Asia's stake in projects ranges from 20% to 100%, with an average investment period of less than 2 years with sums of of up to USD3m per project.

The Group’s ALERO projects have been generating consistent profits.

In 9M2020, including construction management projects, the Group started 9 new projects, completed 7 projects, with 13 projects still ongoing.

For more information, see the Powerpoint presentation here.