| Subsequent to our article last week (MEDTECS: Big, big winner but SG price has catch-up to do to Taiwan price), an investor 'Golden Apple' posted on his blog his analysis of the potential profits of Medtecs. In reading it, bear in mind the key assumptions about ASPs and profit margins, which may or may not be accurate. For what it's worth, he estimates that Medtecs can achieve nearly S$200 million profit this year, a whopper compared with S$1.7 million in 2019. Here are excerpts from his blog. |

Let us look at MED’s current capacity. I have collated MED’s capacity based on publicly available information. As demand continues to be tight while supply of good grade medical PPE are still low, these figures may be too conservative.

|

Monthly Production Capacity (MM) |

Cambodia

|

Philippines

|

Total

|

|

Gowns |

8.00 |

- |

8.00 |

|

Coveralls |

2.50 |

- |

2.50 |

|

Shoe Covers |

4.00 |

- |

4.00 |

|

Face masks |

- |

10.00 |

10.00 |

The sources of the capacity are from the following:

• Cambodia factory capacity:

https://www.phnompenhpost.com/national/kingdom-produces-ppe-gear

• Philippines factory capacity:

https://www.bworldonline.com/boi-approved-investments-plunge/

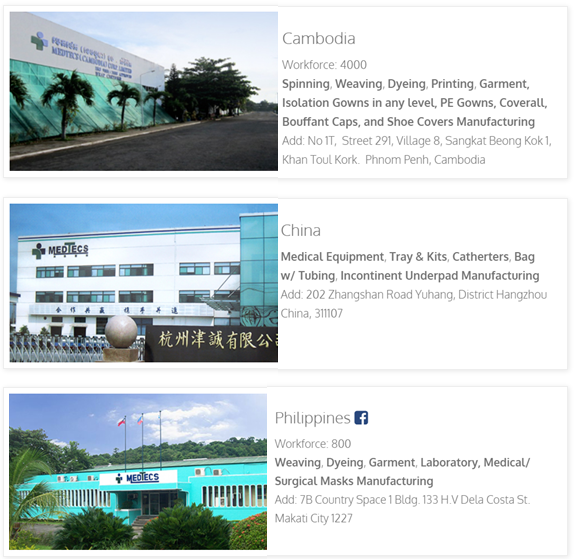

Does this figure make sense? We look back to MED’s factory description on the company website.

The production line in terms of what products are being produced where checks out.

We go on to factor in PPE prices (I think it’s easy to search for prices online so I’m leaving the links out for this one).

|

Monthly |

Cambodia

|

Philippines

|

Price/

|

No. of Months

|

Total 2H20 Revenue (US$’m) |

|

Gowns |

8.00 |

- |

4.00 |

6 |

192.00 |

|

Coveralls |

2.50 |

- |

6.00 |

6 |

90.00 |

|

Shoe Covers |

4.00 |

- |

1.00 |

6 |

24.00 |

|

Face masks |

- |

10.00 |

1.50 |

6 |

90.00 |

|

|

|

|

|

|

396.00 |

MED had already announced that they have orders filled up to next year. Applying gross profit margins and net profit margins of 30% and 25% respectively.

I had conservatively reduced margins lower for 3Q 2020 and 4Q 2020 to factor in higher labor costs as a result of significant ramp in capacity utilization.

This means that MED’s 3Q 2020 net profit is expected to register at least 40% QoQ jump from 2Q 2020.

|

|

31-Dec-18 |

31-Dec-19 |

|

Revenue |

68,304 |

68,977 |

|

Gross Profit |

10,284 |

10,531 |

|

Gross Profit Margin |

15.1% |

15.3% |

|

Net Income attributable |

914 |

1,166 |

|

Net margin |

1.3% |

1.7% |

|

Earnings per share (USD) |

$0.0017 |

$0.0021 |

|

|

1Q 2020 (actual) |

2Q 2020 (actual) |

3Q 2020F |

4Q 2020F |

FY 2020F |

|

Revenue |

39,811 |

122,798 |

198,000 |

198,000 |

558,609 |

|

Gross Profit |

7,154 |

44,268 |

59,400 |

59,400 |

170,222 |

|

Gross Profit Margin |

18.0%

|

36.0%

|

30.0% |

30.0% |

30.5% |

|

Net Income |

3,672 |

35,218 |

49,500 |

49,500 |

137,890 |

|

Net margin |

9.2% |

28.7% |

25.0% |

25.0% |

24.7% |

|

Earnings per share (USD) |

$0.0067 |

$0.0641 |

$0.0901 |

$0.0901 |

$0.2510

|

|

Note: Outstanding shares: 549,411,240 |

|||||

Again, margins may be higher because we know US and Europe actually have medical standards in place even for PPE that hospitals can purchase (this is one of the greatest strength that MED enjoys as an incumbent of the PPE industry as opposed to makeshift/ repurposed factories from clothing lines and small businesses popping up in India and China).

This point on medical standards cannot be more clear, as we read from the media as far back as February 2020 that clothing manufacturers have repurposed their factories to produce PPE/masks/gloves/ventilators in the US.

However, average selling prices in April to June did not fall. This means that the supply of good grade PPE products are still in shortage.

| As at the close of trading on 7 September 2020, MED is trading at S$1.44 or 4.2x FY2020 results. So where does that leaves us? A good comparison will be medical gloves counters trading on SGX. These guys are very well publicized, please look for Top Glove, Riverstone and UG Healthcare. These guys are all trading well above 12x FY2020 PE. MED is a cheaper stock to buy. |