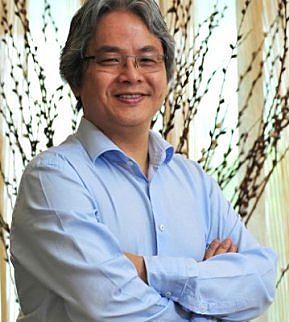

A/Prof Mak Yuen Teen of the NUS Business School.A/Prof Mak Yuen Teen and his colleague at the NUS Business School, Adjunct A/Prof Richard Tan, have released a 48-page report "Avoiding Potholes In Listed Companies" which is particularly useful for retail investors.

A/Prof Mak Yuen Teen of the NUS Business School.A/Prof Mak Yuen Teen and his colleague at the NUS Business School, Adjunct A/Prof Richard Tan, have released a 48-page report "Avoiding Potholes In Listed Companies" which is particularly useful for retail investors.

Below are the executive summary and the section on "Legal Representatives and company chops for Chinese companies".

Executive Summary Adjunct A/Prof Richard Tan Chuan LyeCompanies do not implode from accounting and corporate governance scandals overnight. Often, there are early warning signs, followed by more serious red flags. The business model may be questionable to start with. Fissures in the corporate governance of the company may be evident. Adjunct A/Prof Richard Tan Chuan LyeCompanies do not implode from accounting and corporate governance scandals overnight. Often, there are early warning signs, followed by more serious red flags. The business model may be questionable to start with. Fissures in the corporate governance of the company may be evident. Certain reporting deficiencies may start appearing. More serious red flags such as sudden resignation of independent directors, qualified accounts, and delays in reporting and holding annual general meetings may follow. Regulatory actions may then be directed at the company. Finally, the full scale of the problem unravels. Companies may perform poorly or fail because of changes in the business environment, industry disruption or other business challenges. Companies with good corporate governance, such as a highly experienced and independent board, competent senior management and good risk management practices, are better placed to navigate such challenges. Nevertheless, doing business involves taking on risk, and risks of poor performance or business failure are unavoidable. Capital market investors should be prepared to accept such risks when they invest in companies. However, investors have the right to expect that those who control, govern and manage companies have in place proper corporate governance practices and act with integrity. How can public investors, especially retail investors, with little technical knowledge and no access to non-public information monitor the risks of companies running into trouble from poor corporate governance, before they invest and as long as they remain invested in the company? Or to paraphrase Mr Buffett, how can they spot the “cockroaches” that may tell them that there is infestation in the “kitchen”? |

Legal representative and company chops for Chinese companies1

S-Chips are subject to the People's Republic of China (PRC) Company Law, which requires the appointment of a Legal Representative (LR) by every business registered in China, whether domestic or foreign. The LR is appointed by the board of directors or the shareholders in accordance with the Articles of Association of a company.

The appointment or change of the LR shall be subject to registration with a competent government authority. The LR need not be an employee of a company and he or she may not actually be participating in a company’s daily management and operation. This person is the designated principal of the company and is conferred with the legal right to represent – and enter into binding obligations on behalf of – the company. A company can only have one LR.

All actions by the LR are binding on the company even if they were beyond the LR’s authorised scope, so long as laws and the company’s Articles of Association were not violated. Consequences that arise must be borne by the company. A LR thus possesses broad powers and potentially unlimited personal liability.

In China, chops are used to legally authorise corporate documents, often substituting a signature. The LR chop is a carved stamp bearing the LR’s own name that is held by the LR. The LR may also use his chop to appoint or dismiss employees of the firm as well as issue documents to the authorities – powers typically reserved for the board.

Shareholders or the board of directors can resolve to discharge a LR from his or her responsibilities. However, the company chop is required to officiate the appointment of the new LR so that he or she can perform a full takeover of responsibilities.

Should the company chop be in possession of the displaced LR and he or she refuses to return the chop, the company remains bound to all agreements entered by the former LR and corporate control is not truly regained in practice.

Selection and appointment of the Legal Representative

Investors should be aware of the person designated as the company’s LR. The removal process can be a very onerous undertaking if the LR is, for example, a Chairman who is a substantial/controlling shareholder of the company. While PRC Company Law mandates the LR to be the Chairman, an executive director or a manager of the company, the risk can be mitigated by greater power distribution.

As the LR need not be a shareholder, nor are there residence or citizenship requirements, a nominal LR who holds the title of manager or director but is not really involved in management or a substantial shareholder is prudent. Although a Singaporean director as the LR would be the ideal, this is impractical in reality.

Termination agreement and veto power

|

|

The LR’s signature is not always required for his/her removal if the LR is not concurrently serving as a member of decision-making body that can remove him/her. However, if the LR is also a director or shareholder of the company and his/her signature is necessary for his/her removal as LR, the LR can be asked to sign an undated removal letter upon appointment.

Limiting Legal Representative’s power via the Articles of Association

Acts of the LR are binding on the company only if they are not in violation of the company’s Articles of Association. Hence, stipulating the scope of the LR’s responsibilities and authority reduces the potential abuse of power. However, investors should note that such limitations in authority may be ineffective if the third party had reasonably and genuinely relied on the representations made by the LR.

According to the PRC contract law, a contract executed by and between the LR and a third party will generally be deemed valid, even if such LR does not have the authority to do so. If the company claims that such a contract should be invalid due to the defect of the LR’s authority, the company shall bear the burden to prove that (i) the LR does not have the authority or has exceeded his or her authority, and (ii) the third party knew or should have known the defect of the LR’s authority before or when signing the contract.

For example, if the company has notified the scope of authority of its LR to the third party in written form, then the company will not be bound by the act that is in excess of the authority conducted by its LR. In practice, it could be very difficult to prove whether the third party “knew or should have known” the defects of a LR’s authority.

Therefore, in most cases, the company will be held liable for acts of its LR. After assuming the responsibilities to the third party, the company has the right to claim compensation against the LR on the basis of tort liability.

| ♦ Controls over the company chops |

| Various other chops exist besides the LR’s chop, each serving a different purpose. The most powerful of all is the company chop as it can cover the functions of all the other chops except the customs chop and the invoice chop. Segregation of duties should be in place to curtail the already broad powers of the LR. No other chops, particularly the company chop, should be assigned to the LR, notwithstanding his or her role as the Chairman, ED or manager. As previously mentioned, the removal of a rogue LR alone is ineffective if possession of the company chop is not simultaneously regained. Repossessing the chop is a lengthy and arduous process as even if the company were to seek a court order, either the signature of the current (rogue) LR or the company chop must be presented to obtain approval. It is thus important to regain custody of the company chop prior to replacing the LR. A strong system of internal controls must also be in place to prevent misuse. This includes keeping records of when the chop is used, who it is used by, and the purpose it is used for. Robust physical controls such as keeping the company chop in a locked safe on the company’s premises at all times are imperative. The possibility of having supervisory or dual access controls may be explored as well. Under the latter, the company chop can be removed from its safe only with the approval of two authorised individuals. The authorisation to access and use the company chop cannot be delegated to other employees. If properly enforced, no employee will be able to single-handedly abscond with the company chop. The best practice is to separate the “approval right” and “access and use right”. The “approval right” is usually held by the LR or heads in relevant departments, and the “access and use right” is usually held by the custody department (such as legal department or finance department). When the company chop is going to be used, the chop requester first goes through the approval process, and then asks for the custody department to stamp with the approval email. The custody department checks the approval and keeps the record of the use of the chop. This way, the whole process of using the chop can be monitored and controlled. If the former LR refuses to release the company chop, the company should timely apply for carving a new chop, notify main partners and report to police. Such a series of actions show a cautious and responsive attitude and can minimise potential liabilities of the company. The company may also sue the former LR to return the company chop with the evidence supporting his removal. |

1. The material in this Appendix benefited significantly from comments provided by Ms Cindy Pan of Morgan, Lewis & Bockius in Shanghai.