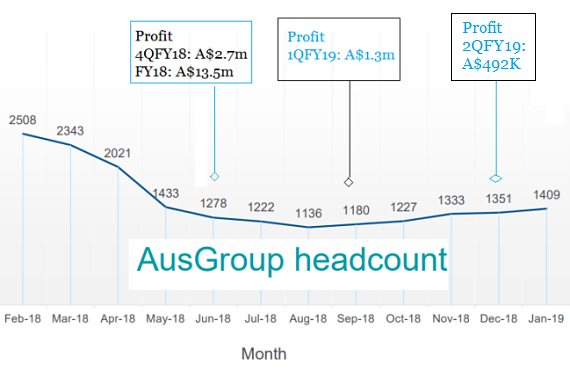

AusGroup has just reported a modest 2Q (Oct-Dec 2018) profit of A$492,000 on revenue of A$58.3 million.

The path going forward may be brighter, if you consider one barometer: the company's headcount. The numbers were included in the company's presentation material at its recent quarterly briefing.

Shane Kimpton, CEO of AusGroup.

Shane Kimpton, CEO of AusGroup.

NextInsight photo.CEO Shane Kimpton spoke about the 12-month headcount trend of the company, saying it is a barometer of its business because AusGroup's business is largely correlated to the workforce it deploys to projects.

In the half-year to June 2018, the headcount slid as major projects were completed.

The projects contributed to a A$13.5 million profit for the financial year.

From a low of 1,136 in Aug 2018, the headcount picked up -- gradually -- to 1,409 in Jan 2019, a 24% rise.

In a way, the headcount is a leading indicator. There's a major maintenance project with Chevron, a top-tier energy customer, which is in the planning stage and being worked on by 70-80 AusGroup staff.

When the project kick-starts in May or June this year, hundreds of workers will be deployed to the site, said Mr Kimpton. (See: Hundreds of jobs up for grabs in Chevron LNG shutdown )

The 2QFY19 net profit was lacklustre but it is AusGroup's ninth successive quarter of profitability.

The gross profit margin (10.5%) was higher than 2QFY18 (7.5%) and was at the top end of AusGroup's target range of 7% to 10%.

| Increasing opportunities in lithium sector | ||||||||||||||||

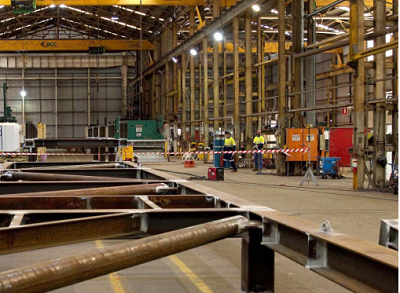

In particular, AusGroup is vying for jobs in the recovering resources sector (iron ore, lithium, gold, etc) in Australia, and is well placed to fabricate, modularise, construct and maintain the projects. Already, with two contracts on hand -- valued at A$50 m and A$17.7 m -- AusGroup considers itself to be a leading contractor for lithium plants in Australia. Its total work in hand stood at A$167m as at 31 Dec 2018, which was similar to 1QFY19's A$165m. AusGroup is seeking work at the growing number of planned lithium projects in Western Australia as companies mine rich lithium deposits. In AusGroup's presentation materials, 9 projects are listed.  AusGroup's Kwinana facility provides integrated mechanical, fabrication and access services to the lithium market. Photo: CompanyAusGroup's Mr Kimpton reiterated that the company's stronger balance sheet and lower debt (arising from the redemption of some outstanding notes) would enable AusGroup to win customers who might otherwise be concerned about its financial strength. AusGroup's Kwinana facility provides integrated mechanical, fabrication and access services to the lithium market. Photo: CompanyAusGroup's Mr Kimpton reiterated that the company's stronger balance sheet and lower debt (arising from the redemption of some outstanding notes) would enable AusGroup to win customers who might otherwise be concerned about its financial strength. The company executed a share placement and rights issue in Dec 2018 which resulted in: • an injection of A$17.3m in working capital and • a reduction in borrowings by A$31m since 30 June 2018 to A$89.9m. (Look out for a reduction in finance costs from 3QFY19 onward)  Ching Chiat Kwong, executive chairman of Oxley Holdings. NextInsight file photo.Another outcome: A significant change in the shareholders of AusGroup, with AOC Acquisitions (which is majority owned by Asdew Acquisitions led by Alan Wang, together with Ching Chiat Kwong and Low See Ching of Oxley Holdings and Han Seng Juan and Loh Kim Kang David of Centurion Corp) replacing Ezion Holdings as AusGroup’s controlling shareholder with a 26.8% stake. Ching Chiat Kwong, executive chairman of Oxley Holdings. NextInsight file photo.Another outcome: A significant change in the shareholders of AusGroup, with AOC Acquisitions (which is majority owned by Asdew Acquisitions led by Alan Wang, together with Ching Chiat Kwong and Low See Ching of Oxley Holdings and Han Seng Juan and Loh Kim Kang David of Centurion Corp) replacing Ezion Holdings as AusGroup’s controlling shareholder with a 26.8% stake. In addition, Bernard Toh has increased his shareholding to 11.7% and Melvin Poh, a current Director of AusGroup, has increased his shareholding to 9.8%. (See: AUSGROUP: New funds position it to ride lithium boom in Australia) |

||||||||||||||||