Excerpts from Phillips Securities Research report

We advocate a lower-beta equity portfolio for 2019. Until economic data starts to stabilise, our emphasis is on dividend-paying stocks.

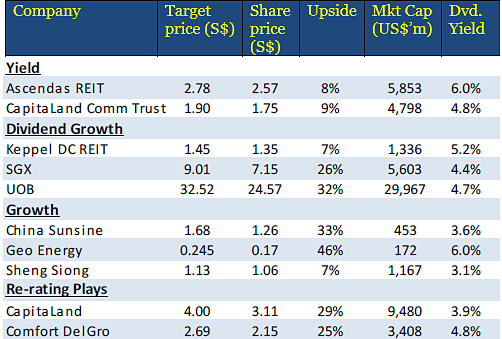

For our 2019 absolute return portfolio, our top 10 picks - The Phillip Absolute 10 - are:

Analyst: Chen Guangzhi Analyst: Chen GuangzhiChina Sunsine Chemical Holdings Ltd Growing production in 2019 ♦ Expect 50% and 12% production growth for insoluble sulphur and TBBS in 2019e ♦ Expect GPM and NPM sustain at around 30% and 15% in 2019e ♦ To reach a billion RMB of net cash by FY18. We expect dividends to jump 50% in FY18e Background  Tong Yiping was promoted in Mar 2016 to CFO of China Sunsine after more than 2 years as its Finance Controller. NextInsight file photo.China Sunsine Chemical Holdings Ltd (CSSC) the largest producer of rubber accelerators in the world and the largest producer of insoluble sulphur in China. It is engaged in the production of specialty chemical, rubber accelerators, antioxidant, and insoluble sulphur. Meanwhile, it also produces and supplies heating power for internal usage and to external customers. Tong Yiping was promoted in Mar 2016 to CFO of China Sunsine after more than 2 years as its Finance Controller. NextInsight file photo.China Sunsine Chemical Holdings Ltd (CSSC) the largest producer of rubber accelerators in the world and the largest producer of insoluble sulphur in China. It is engaged in the production of specialty chemical, rubber accelerators, antioxidant, and insoluble sulphur. Meanwhile, it also produces and supplies heating power for internal usage and to external customers. Investment Merits/Outlook 1. New capacity will enter into production in 2019. 9M18 total sales volume of major products including rubber accelerators, insoluble sulphur (IS) and anti-oxidant grew by 10% YoY to 110.6k tonnes. The utilisation rate of the respective capacity arrived at 95.5%, 127%, and 86.7%. 10k tonnes of the capacity of IS has received the approval for the trial run in Nov-18, and 10k tonnes of that of TBBS was at the finalisation as of Nov-18. With the commencement of operation of both new capacities, the production growth is expected to be 50% and 12% for IS and TBBS respectively. 2. Stable GPM and NPM owing to the leading position in the niche market. In 9M18, respective GPM and NPM arrived at a record high of 34.9% and 21.2% (adjusted of one-time credit: 19.3%). Over the past decade, the respective average normalised GPM and NPM is 26% and 11% (8 of 10 years). The stable margins are attributable to the long-term business relationships with top-tier tyre producers and recognised quality by the market. 3. Expecting a billion of cash hoard by 2018. As of 3Q18, the cash in hand reached RMB822mn (up 65.8% YTD). We expect the amount of net cash will be more than RMB1bn (closed to one-third of the current market cap) by the end of FY18.CSSC holds zero debt. It is conserving cash in preparation for future capacity expansion. 4. GP margins are sustainable. We are expecting FY18e GPM and NPM would be above 30% and over 15% respectively. However, ASP had started to correct since 3Q18 (down 11.1% QoQ) due to the decrease in raw material prices and softer demands. We believe the fall in ASP and cost of raw materials are cyclical. The ramp-up of production will partially offset the drop in prices. CSSC will continue to maintain its leading position in the market. Accordingly, GPM and NPM are expected to sustain at around 30% and 15% respectively in 2019. Buy with TP of S$1.68

|

||||

Full report here.