|

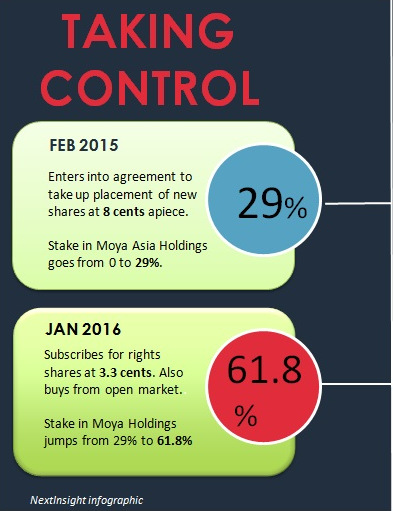

One event a year in the last three years led to the transformation of Singapore-listed Moya Holdings Asia into a very large water play -- in fact, the No.1 private water play in Indonesia.

In 2017 (June), Moya acquired Acuatico for US$245.18 million. |

||||||||||||||||||||||||

Moya's managing director, Irwan Dinata, fielded many questions at a 1H2017 results briefing recently:

Q: Does the Group have the ability to pass the cost of tariff to the end users?

|

|

Yes, however, the tariff structure is regulated and determined by the government. Usually the tariff would be higher for larger properties. The tariff ranges between 1,050 rupiah per cubic metre and 15,000 rupiah with an average of 7,500 rupiah.

Our last tariff adjustment for Aetra Air Tangerang was in April 2017. The water tariff will be adjusted every 27 months with an increment of 9-12% per annum each time.

Q: What is the water tariff for the projects?

The tariff for Moya Bekasi Jaya and Moya Tangerang is 2,800 rupiah and 2,300 rupiah per cubic metre respectively. For Aetra Air Jakarta and Aetra Air Tangerang, it is 7,400 rupiah and 7,900 rupiah per cubic metre, respectively.

Q: Is there seasonality in the sales?

Yes, sales are lower during Hari Raya period, other times should be quite constant. The workers will usually have two weeks of holidays and therefore lower water volume will be consumed.

Q: Does the Group aim for greater water sales or construction income?

The recognition for construction income is merely for accounting purpose. Our current revenue is contributed entirely by water sales. The Group derives no income from the construction of the water treatment plants as the construction revenue equates the construction expenses.

Q: How much were the professional fees incurred for the acquisition of Acuatico?

Around S$1.2 million has been recognized in 2Q2017, while the unrecognized fees would be less than S$1 million.

Q: What is the Group’s cost of borrowing?

For rupiah loans, 9-10% per annum. For USD loans, around 5% per annum. The cost of loan for acquisition of Acuatico is around 4.5-5%.

Q: What is the IRR for the projects?

IRR for Moya Bekasi Jaya and Moya Tangerang is between 14-16% without leverage. IRR with leverage would be 4-5% higher than IRR without leverage.

Q: Can the Group elaborate on the financing issue?

The loan for the acquisition of Acuatico is a bridging loan. We are still working on the structure of the financing, aiming to push part of the bridging loan in USD to IDR loan and the balance of the loan will be in semi-equity or equity. The margin contribution from Acuatico will be relatively low without the renewal of the loan.

|

Stock price |

11.8 c |

|

52-week range |

3.6 – 13.3 c |

|

PE (ttm) |

58 |

|

Market cap |

S$331 m |

|

Shares outstanding |

2.8 billion |

|

Dividend |

-- |

|

Year-to-date return |

123% |

|

Source: Bloomberg |

|

Q: Is it easy to renew the concession or the BOT projects?

It is possible to renew the contracts. The government would prefer that a third party maintain or manage the projects as it requires expertise and more than 1,000 staff to operate and manage the projects.

Q: Are additional fees needed to renew the contracts for the BOT projects?

No, but the Group has to come out with a new programme for the city. We have started to talk to the government on the renewal of contracts. We do not know how long it will take to renew the contracts.

Q: How does the Non-Revenue Water (NRW) work?

For an example, we have a NRW of 40% where we produce 100% to the customers but only bill the customers 60% of the total production. There are two types of losses -- physical loss and commercial loss. 80% of the NRW is from physical loss which arises from pipe leakage. 20% of the NRW is due to theft.

Q: What would be the capex for NRW improvement over the next few years?

Around US$150-200 million for the next 6 years. It would be financed through a combination of debt and internal cash flow.

Q: How would the Group reduce the NRW?

It cannot be reduced immediately as it takes 5 – 6 years to improve on the NRW. We have appointed a European consulting firm to help us. This firm has successfully helped Maynilad to reduce NRW from 63% to 27%.

Q: The Group’s loan is denominated in US dollar. However, the Group is collecting the revenue in rupiah. Does the Group have plans to hedge the currency?

Yes, we are practising hedging for the currency where we engaged 3 months forward hedging. In the long term, we will replace the loan in US dollar with rupiah

Q: What are the key challenges the Group faces during the construction of the 700km piping network?

For certain construction, it is relatively tough to find the exact location for the piping as Jakarta consists of old and new cities where the city planning is different. Besides, licenses are required to construct the piping network. We use high density poly-ethylene pipe -- of food-grade -- which is cleaner and can last longer than steel due to its food-grade (for potable water).

Q: Will there be an issue for the Group if the water level is low?

We have experienced low water level during 2015 due to dry weather. However, our plants were still running well but production cost increased due to more chemicals used. Therefore, it would not be an issue for the Group.

Q: Would the Group consider constructing piping network in Bali?

Yes, we have engaged a consultancy firm to do research in Bali. However, we are still in the early stage of planning.

Q: The Group’s plants have relatively low utilization rates. Why?

Production is dependent on the piping network. We are aiming to complete construction of the network by 2018.

Once the network is completed, there will be greater demand for the Group’s services. We aim to achieve total production of 1,300 litres per second by end of 2017. We are looking forward to achieve a utilization rate of 70-80% within these few years.

Q: How does the Group compute the interest income from the financial assets arising from service concession arrangements?

Firstly, we will calculate the total amount of the CAPEX and future cash flow. Then, using the Discounted Cash Flow model with certain IRR to compute the interest income.

Q: What is the Group’s dividend policy?

Currently, we do not have a dividend policy as we would like to focus on improving and expanding the Group’s operations. We will consider distributing dividends in the next few years.

Q: What is the rationale of partnering with Maynilad?

They are the largest player in the Philippines. They have expertise in wastewater treatment and have plenty of wastewater treatment units in Philippines. Leveraging on the expertise of Maynilad, we are looking to expand our business into wastewater treatment business in Indonesia. We have signed a non-compete clause with Maynilad where Myanilad can only collaborate with the Group when they intend to enter into any new water business in Indonesia.

Q: Why does the Group choose to list in Singapore instead of Indonesia?

The Group is a Singapore-registered company with business operations in Indonesia. In addition, the Singapore Exchange is a globally renowned transparent and responsive regulatory regime that is well regarded by investors and issuers. Being listed in Singapore serves as a platform for the Group to expand our business operations in Southeast Asia in the future.

For more info on the 1H2017 results, see press release.