This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 30 June 2017. The article is republished with permission.

This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 30 June 2017. The article is republished with permission.

|

Food Empire founder and Executive Chairman Tan Wang Cheow. Food Empire founder and Executive Chairman Tan Wang Cheow.

(Photo by Sheryl Sim)

Nearly three decades ago, Tan Wang Cheow embarked on an odyssey that spanned two continents and turned the computer salesman into a coffee kingpin.

Tan, founder and Executive Chairman of SGX-listed food and beverage manufacturer Food Empire Holdings Ltd, started out as a dealer in personal computers and disk drives in the 1980s, exporting electronics products to Eastern Europe.

Monthly chartered flights from Singapore, carrying consumer electronics goods ranging from video recorders and hard disk drives to TVs and fax machines, were offloaded to local distributors in both Moscow and Almaty.

"In the '80s, telephone directories didn't exist, and phone lines were few and far between. We built our network from scratch, and many of these distributors became our friends," he recalled.

|

I got my Kazakh distributors to try them, and they were interested. Their first order turned out to be 22 container loads! I got my Kazakh distributors to try them, and they were interested. Their first order turned out to be 22 container loads!

- Tan Wang Cheow

Executive Chairman

Food Empire

|

This network later played a key role in Tan's transition to the food and beverage industry.

Winters in Eastern Europe and Central Asia - where temperatures sometimes plummet to as low as minus 30 or 40 degrees Celsius - can be brutal. Aside from drinking shots of vodka and buying coffee from hotels, there were few convenient ways of getting a hot beverage to keep warm.

On one of his trips to Kazakhstan, Tan brought along a few sachets of instant 3-in-1 coffee mix. "I got my Kazakh distributors to try them, and they were interested. Their first order turned out to be 22 container loads!"

That proved to be a fortuitous turn of events. At the time, margins in the consumer electronics distribution business were razor-thin and shrinking continuously.

"In 1994, we decided it was way too competitive to continue our electronics distribution business - the technology was changing so quickly, and it was becoming extremely risky, considering the long-distance logistics factor," Tan said.

"In comparison, the distribution of instant coffee products was relatively stable. We felt this was something we could build on, and create a brand of our own."

As a result, the MacCoffee trademark was born.

|

Sweet Indulgence

And the timing was perfect.

After the Berlin Wall fell in 1989 and the Soviet Union was dissolved in 1991, Eastern Europe began its transition to a market economy, and foreign investments were warmly welcomed. In particular, instant food and beverage products were regarded as a novelty.

Today, MacCoffee's sales volumes have grown exponentially to more than 10,000 twenty-foot equivalent container units (TEUs) annually, from only about two TEUs per month in 1994.

"If you had asked me in 1995 whether we could achieve such sales numbers, I would have told you flatly, 'No way, very difficult!'. I didn't think we could even sell 100 container units then," Tan recalled.

No one could have guessed the Singaporean brand would become all the rage in Moscow, thanks to burgeoning demand by the local community.

"Russia has traditionally been a tea-drinking country - it was never coffee. So we needed to convert the consumer mindset, and a newly reforming Russia was more open to trying new things," Tan said.

|

For 80% to 90% of these consumers, their first taste of MacCoffee is like their first love, something they remember for years, even if they've migrated to other beverages. For 80% to 90% of these consumers, their first taste of MacCoffee is like their first love, something they remember for years, even if they've migrated to other beverages.

- Tan Wang Cheow

Executive Chairman

Food Empire

(Photo: Company)

|

For the new Russians, MacCoffee opened up a world of aromatic possibilities.

"Our 3-in-1 mix recipe has a very pleasant taste - it has no bitter or sour notes, and this creates a sense of sweet indulgence after drinking," he added.

"For 80% to 90% of these consumers, their first taste of MacCoffee is like their first love, something they remember for years, even if they've migrated to other beverages."

After 1994, Food Empire diversified its product range to include regular and flavoured coffee mixes and cappucinos, chocolate drinks, instant tea and confectionery under the MacCoffee, MacChocolate, MacTea and MacCandy labels.

In 2007, it also bought domestic coffee brand Petrovskaya Sloboda, which had a loyal following dominated by elderly Russians. Its snacks and frozen convenience food products were launched after 2000, under the Kracks and OrienBites brands respectively.

"These were different product permutations that catered to various market segments, at differing price points, and at different times. Along the way, new products were born, while others got terminated," Tan said.

| ♦ Influential Brand |

|

Food Empire listed on the Mainboard of Singapore Exchange in 2000. It exports and sells its products to over 50 countries globally, and has established 24 offices - representative and liaison - across Eastern Europe, Middle East and Asia. The Group also operates six manufacturing plants and three production facilities located across the two continents.

The MacCoffee flagship label has been consistently voted as the leading instant coffee brand in the Group's core markets, including Russia, Ukraine and Kazakhstan. Food Empire holds a dominant 50% share in the Russian instant coffee mix segment, and the country is the Group's largest market, accounting for nearly half of total revenues in 2016.

Food Empire has also been recognised as one of the "Most Valuable Singapore Brands" by IE Singapore. It was named twice by Forbes Magazine as one of the "Best Under a Billion" companies in Asia, and awarded one of "Asia's Top Brands" by Influential Brands.

For the year ended 31 December 2016, the Group swung to a net profit of US$13.8 million (S$19.1 million) from a net loss of US$131,000 the previous year. Revenues rose 4.2% year-on-year to US$242.2 million (S$334.5 million).

In the 2017 year-to-date, Food Empire shares have generated a total return of 44.9%, outperforming the broader Straits Times Index's 13.4% and the FTSE ST All-Share Index's 13.1%.

| Stock price |

65c |

| 52-week range |

28c - 76.5c |

| Market cap |

S$346.8m |

| Price/Book |

1.5 x |

| Price Earnings |

15.0 x |

| Dividend yield |

0.89% |

| Source: SGX StockFacts |

The Group, however, has experienced its fair share of speed bumps along the way.

The first was the 2008 Global Financial Crisis. "Asia's recovery from the mother of all financial crises was relatively quick, but that was not the case in Eastern Europe and the Commonwealth of Independent States - the process was much slower there," Tan noted.

The second blow came in early 2014, when Russian military incursions into Ukraine and annexation of Crimea prompted the US and EU to apply sanctions against Russia and Ukraine. This in turn spurred Russia to respond with sanctions of its own.

Together with the near-halving in crude oil prices in the second half of the year, these developments contributed to the collapse of the Russian rouble and the onset of the Russian Financial Crisis.

"In the old days, the rouble was trading 31 or 32 to the US dollar. It sank to 80 to the dollar, before rebounding to around 59 to the dollar now," Tan said.

"While the Russian economy has not seen a full recovery, and sanctions are still in place, there are signs of stabilisation. Despite the difficulties in this market, the Group managed to return to profit last year."

|

Growth Catalysts

The 2014 crisis proved to be a transformative learning experience.

"It taught us the importance of diversifying geographically, and over the past few years, we've been venturing outside the Eastern European bloc into Asia, as well as pursuing vertical market integration," Tan said.

Food Empire has built its own manufacturing facilities for potato crisps and non-dairy creamer in Malaysia. Besides investing in a tea-processing plant in Sri Lanka, it has also set up a tea chain with its partner, and expects to open more than three tea houses in Colombo by year-end.

Earlier this year, it opened a state-of-the-art instant coffee manufacturing facility in Andhra Pradesh, India, which makes 10 different types and qualities of spray-dried instant and granulated coffee.

The Group has also acquired a minority stake in South Korea's Caffe Bene, which has a network of more than 600 domestic franchise outlets, and another 100 in Malaysia, Taiwan, Mongolia, Saudi Arabia and the US.

With both upstream and downstream operations in place, a diversified geographical footprint stretching from Eastern Europe to Asia, as well as an established network of manufacturing facilities, Food Empire is ready for its next stage of growth.

Vietnam, Myanmar and China are likely to be near-term growth opportunities as the Group deepens its penetration in these markets. "We're also exploring new possibilities in countries like India and Africa," Tan added.

|

We were banging our heads against a brick wall in Vietnam, losing money for many years, before we found a niche - iced coffee. We were banging our heads against a brick wall in Vietnam, losing money for many years, before we found a niche - iced coffee.

- Tan Wang Cheow

Executive Chairman

Food Empire

|

But with geographical diversity comes a myriad of challenges. "Different markets are at different stages of growth and change, and have varying consumption habits," he noted.

In order to attack market segments with customised solutions, understanding the consumer mindset is critical. "You need to comprehend their culture of drinking, their home and office habits, as well as norms of socialising."

Vietnam is a case in point. Food Empire hit a snag when it tried to break into the Indochinese market, which had a rich coffee-drinking culture, primarily drip coffee combined with the heavy sweetness of condensed milk.

"We were banging our heads against a brick wall in Vietnam, losing money for many years, before we found a niche - iced coffee," Tan said.

"After that, we turned the business from less than US$5 million to US$40 million a year. Again, having the first mover advantage in the iced coffee segment was important. But we can't be complacent - we need to continue to defend our space in the market."

Vietnam accounts for the bulk of Food Empire's Indochina sales, contributing about 17% to group revenues. Its iced coffee mix brand - Café Pho - enjoys significant traction, and has been ranked among the country's top five coffee players.

| ♦ No Regrets |

|

It's about building customer loyalty, and facilitating the shift from shelf space to mind space, Tan pointed out. "The question is how do you implant the values of your brand into consumers' minds, such that they will go and look for your brand on the supermarket shelf?"

Finding the right talent is another hurdle. "We need independent, enterprising and passionate people to do business in emerging markets," he said.

"Many decisions are made on the fly, and on the ground. While there's a lot of freedom, there's also heavy responsibility, because in these unstructured markets, regulations can change at the drop of a hat."

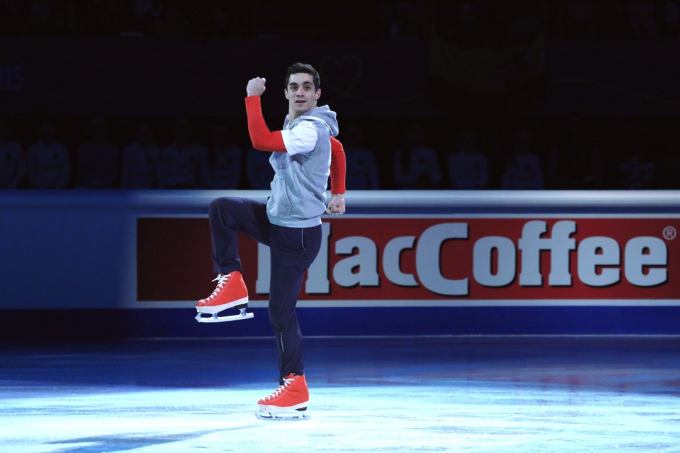

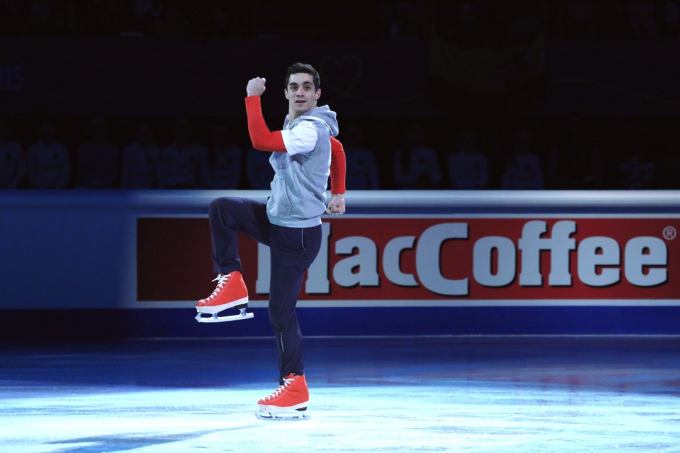

MacCoffee has been the official sponsor of European Figure Skating Championships, one of world's oldest and most prestigious sporting events, for more than decade. (Photo: Company) MacCoffee has been the official sponsor of European Figure Skating Championships, one of world's oldest and most prestigious sporting events, for more than decade. (Photo: Company)

Tan's epic journey has been nothing short of exhilirating, with multiple lessons learnt along the way.

"The one thing I developed was perseverance - even if you fall, you have to get up and move on. If you want to fight in a market outside your comfort zone, you need to be very aggressive - moving faster than the locals, and thinking ahead of them," he said.

Living life without regrets is also essential. "In primary school, and all the way through university, my teachers called me a daydreamer. Sometimes, while the lesson was going on, I would stare into space, and my mind would wander, thinking of what I should do next, what I had planned for tomorrow."

The father of four - three sons and a daughter aged 21 to 31 years old - is a firm advocate of Confucian values. "Parents can educate their children all their lives, but are they teaching them what is important? Are you imparting to them the virtues of righteousness, integrity, compassion and filial piety?"

And in business, your word must be your bond, he added. "One is one, and two is two. A contract is never as good as your spoken word. It's all about integrity and building trust."

When he's not thinking about business, Tan, 60, enjoys travelling, reading, and of course, sipping his favourite brew.

The self-confessed coffee addict admits he has developed rather distinctive taste buds over the years - certainly a job hazard. "I enjoy Columbian coffee - it has a unique aroma and acidic taste, which blends well with me."

At the same time, Tan appreciates pungent brews that pack a punch, produced mostly from roasted Robusta beans, at the local kopitiam.

"I'm very Singaporean - I still go for my cup of kopi-o at the coffee shop with friends."

|

Financial results

Year ended 31 Dec

(US$ '000) |

FY2016 |

FY2015 |

FY2014 |

FY2013 |

| Revenue |

242,210 |

232,427 |

249,514 |

262,886 |

| Profit / Loss before tax |

17,457 |

-791 |

-16,362 |

12,691 |

| Profit attributable to equity holders |

14,520 |

210 |

-13,237 |

11,696 |

| Quarter ended 31 March (US$ '000) |

1QFY2017 |

1QFY2016 |

yoy chg |

| Revenue |

62,440 |

50,510 |

23.6% |

| Profit before tax |

7,810 |

4,813 |

62.3% |

| Profit attributable to equity holders |

6,308 |

3,973 |

58.8% |

Source: Company data

|

Outlook & Risks |

|

- As currencies of the Group's key markets - Russia, Kazakhstan and the CIS countries - begin to stabilise, together with the possible recovery in oil prices, the Group expects the economies of its key markets to fare better compared to a year ago.

- The Group continues to look for opportunities to expand into new geographies outside its core markets, so as to provide a more balanced portfolio. Building on the Group's successful diversification efforts in Indochina, the Group plans to replicate its proven business model in other markets in Asia.

- The Group's upstream projects (non-dairy creamer plant and the instant coffee plant in India, as well as its snacks manufacturing facility in Malaysia) continue to gain growth momentum. The successful vertical integration of its supply chain has provided the Group with greater control over the supply and production of raw materials. The Group plans to ramp up its production scale to improve profitability.

- Besides organic growth, the Group also intends to tap on strategic mergers and acquisitions to expand upstream and downstream, as well as enter new markets.

|

Food Empire

Food Empire Holdings Ltd, which listed on the SGX Mainboard in 2000, is a global branding and manufacturing company specialising in the food and beverage industry. The Group produces a wide variety of instant beverages, such as regular and flavoured coffee mixes and cappuccinos, chocolate drinks and flavoured fruit teas. It also markets instant breakfast cereal, assorted easy-to-prepare frozen foods and snack items, such as potato crisps and corn sticks.

Food Empire's strength lies in its proprietary brands - including MacCoffee, Petrovskaya Sloboda, Klassno, Café Pho, CafeRite, NutriRite, Hillway, Hyson, OrienBites and Kracks. Its products are sold to over 50 countries, including Russia, Ukraine, Kazakhstan, Central Asia, China, Indochina, the Middle East, Africa, Mongolia, Europe and the US. The Group, which has 24 offices worldwide, operates six manufacturing facilities (two in Malaysia, Myanmar, Russia, Ukraine and Vietnam) and three production facilities (two in Malaysia and one in India).

For its 1st quarter results for the period ended 31 March 2017, click here.

The company website is: www.foodempire.com.

The ccompany's Stock Facts page is here.

This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 30 June 2017. The article is republished with permission.

This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 30 June 2017. The article is republished with permission.

I got my Kazakh distributors to try them, and they were interested. Their first order turned out to be 22 container loads!

I got my Kazakh distributors to try them, and they were interested. Their first order turned out to be 22 container loads!