Excerpts from analysts' report

|

|

Saudi-shale showdown. Stocks have been hammered by Saudi Arabia’s refusal to cut output despite excess supply as it seeks to slow US shale production growth. This is a short-term gambit.

Saudi-shale showdown. Stocks have been hammered by Saudi Arabia’s refusal to cut output despite excess supply as it seeks to slow US shale production growth. This is a short-term gambit. 10 of 12 Organisation of the Petroleum Exporting Countries (OPEC) members are in fiscal deficits and default risks in shale producers have spiked. Production cuts by either/both should occur soon and we expect 2015 crude oil prices to rebound towards USD80/barrel (bbl).

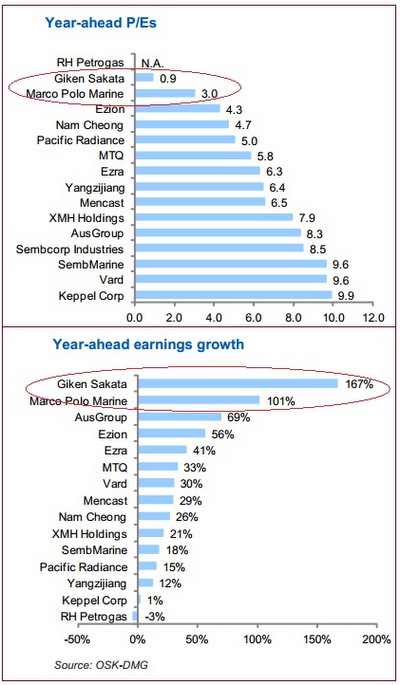

Growth prospects undiminished. In a subdued price environment, P/Es may not re-rate but earnings growth can still drive stock price.

We like firms with long-term charters – Ezion (EZI SP, BUY, TP: SGD2.65) and Pacific Radiance (PACRA SP, BUY, TP: SGD1.55) – and those with solid industry positions and business economics, ie Nam Cheong (NCL SP, BUY, TP: SGD0.61), Giken (Giken) Sakata (GSS SP, BUY, TP:SGD0.65) and Marco Polo Marine (MPM) (MPM SP, BUY, TP:SGD0.60).

Sydney Yeung, Group CEO of Giken Sakata and the No.1 shareholder via his wholly-owned Roots Capital Asia.

Sydney Yeung, Group CEO of Giken Sakata and the No.1 shareholder via his wholly-owned Roots Capital Asia. NextInsight file photoShallow-water operations focus is a must for downside risk protection. Across our coverage, average year-ahead net profit growth is 40%. Giken and MPM take top spots.

After the crash? We find 10-year correlations for large-caps Keppel (KEP SP, BUY, TP: SGD12.60) and Sembcorp Marine (SembMarine) (SMM SP, NEUTRAL, TP: SGD3.80) to oil price at 0.82 and 0.85, rising to 0.93 and 0.96 in the last six months respectively.

Nam Cheong has had negative 0.42 correlations since listing, rising to 0.44 when oil prices began sliding. Prices should stabilise soon and a breakdown of the recent positive correlation should occur as company fundamentals get re-priced into valuations again.

Nam Cheong has had negative 0.42 correlations since listing, rising to 0.44 when oil prices began sliding. Prices should stabilise soon and a breakdown of the recent positive correlation should occur as company fundamentals get re-priced into valuations again.

Industry capex cuts likely to fall on deepwater. Of the 92m barrels of oil produced globally, c.70% is onshore, c.20% in shallow water, and c.10% in deepwater. In the 1980s recession, oil demand fell by only10%. Hence, shallow-water is now the new onshore, ie recession-proof.

Capex cuts will hit deepwater much harder. We are most negative on Vard (VARD SP, SELL, TP: SGD0.57) and its mostly deepwater-focused orderbook, and PACC Offshore (POSH, NR) and Ezra (EZRA SP, NEUTRAL, TP: SGD0.82) who have significant deepwater exposures.

Capex cuts will hit deepwater much harder. We are most negative on Vard (VARD SP, SELL, TP: SGD0.57) and its mostly deepwater-focused orderbook, and PACC Offshore (POSH, NR) and Ezra (EZRA SP, NEUTRAL, TP: SGD0.82) who have significant deepwater exposures.

Maintain OVERWEIGHT. The recent sector underperformance has set the stage for a strong rebound in 2015. Stocks have priced in realistic bear case scenarios and some have overshot to even below worst case intrinsic values. Recoveries to even bear case valuations ought to generate significant alphas.

Recent story: @ GIKEN SAKATA AGM: CEO on why oil price volatility has had no impact so far

Recent story: @ GIKEN SAKATA AGM: CEO on why oil price volatility has had no impact so far