Excerpts from analysts' reports

Phillip Securities Research ups target for Lantrovision to 72 cents

Analyst: Colin Tan

What is the news?

Phillip Securities Research ups target for Lantrovision to 72 cents

Analyst: Colin Tan

What is the news?

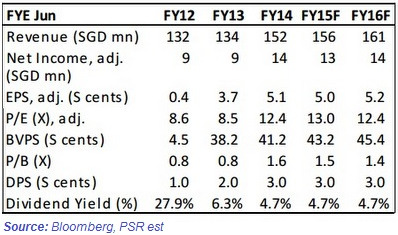

Lantro announced its full-year results on 20th August 14. Higher revenue was attributable to more installation projects in Malaysia, China and the Philippines, contributing to higher installation works revenue at S$116.8m for FY14 (FY13: S$100m).

Lantro announced its full-year results on 20th August 14. Higher revenue was attributable to more installation projects in Malaysia, China and the Philippines, contributing to higher installation works revenue at S$116.8m for FY14 (FY13: S$100m). Net profit for the quarter gained 30%y-y at S$3.1m while a full year net profit was > 50%y-y at S$13.9m.

Though no surprises of special dividends, final dividend was raised to 3 cents per share, implying at least a potential dividend yield of 4.7% at current price.

Lantrovision is a structured cabling system integrator. It provides installation, maintenance and support services for structured cabling systems, and also engages in the distribution of cabling systems and their components. Its client base includes the finance & banking, IT and electronics/manufacturing sectors. Photo: Company

Lantrovision is a structured cabling system integrator. It provides installation, maintenance and support services for structured cabling systems, and also engages in the distribution of cabling systems and their components. Its client base includes the finance & banking, IT and electronics/manufacturing sectors. Photo: Company Investment Action

We continue to be positive in our outlook for Lantro, in view of growing demand trend for data centres and quality structured cabling in Asia-Pacific region while remaining cautious on costs pressure that may arise from a tight labour market.

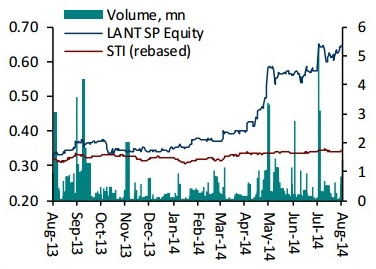

We continue to be positive in our outlook for Lantro, in view of growing demand trend for data centres and quality structured cabling in Asia-Pacific region while remaining cautious on costs pressure that may arise from a tight labour market.We revise our 12-month target price to S$0.720, implying 11.6% capital upside and 7.8x FY15F PE ex-cash from current price. We maintain our Accumulate rating.

Recent story: LANTROVISION -- cash rich; NAM CHEONG -- higher earnings forecast

Recent story: LANTROVISION -- cash rich; NAM CHEONG -- higher earnings forecast