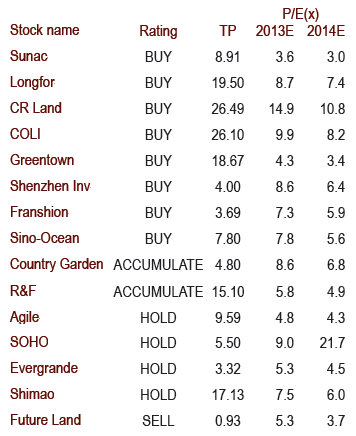

CICC has only one 'Sell' call in its property coverage.

CICC has only one 'Sell' call in its property coverage.Source: CICCCICC: Take Profit on SHIMAO, EVERGRAND, SOHO

CICC Research advises taking profit ahead of looming risks, in particular on Shimao, Evergrande and SOHO.

“We expect share price weakness in October and reiterate our cautious view for 4Q13.

“A pullback would present a good opportunity to accumulate quality names with strong financial flexibility and land-banking acumen, with our top picks being Sunac, Longfor, Shenzhen Investment, CR Land and COLI,” CICC said.

CICC’s recent marketing trips suggest investors generally hold bullish views on Hong Kong-listed Chinese developers given: 1) strong expectations on September/October sales; 2) relatively undemanding valuations and visible earnings growth; and 3) positions on property are still slightly, not heavily, over-weighted.

“Although we expect major developers to post solid September sales, we are less convinced on October due to a gradual tightening in mortgages.

“As for 4Q13, both Q-o-Q and Y-o-Y growth are likely to turn soft on a high base and a decline in new residential supplies and we expect GFA sold to post a 10% Y-o-Y decline in 4Q13 vs 5% Y-o-Y growth in 3Q13.”

Credit Suisse: HONG KONG PROPERTY ‘Market Weight’

Credit Suisse is maintaining its “Market Weight” recommendation on Hong Kong-listed property developers.

Wheelock has been an aggressive land bank builder of late among Hong Kong-listed property plays.

Wheelock has been an aggressive land bank builder of late among Hong Kong-listed property plays.Photo: Wheelock“Despite the Hong Kong government advocating at the beginning of the fiscal year that property supply will increase, supply in the first three quarters of the fiscal year 2013/14 is only flat Y-o-Y, from 9,050 units sold in 2Q-4Q12 to 8,900 units in 2Q-4Q13,” Credit Suisse said.

The government will need to sell 7,550 units in 1Q14 through the Land Sale Programme and 7,880 units through MTRC tenders in the coming quarters in order to meet the FY13/14 target of 25,800 units.

“In FY13/14, the most aggressive players in land acquisitions have been Wheelock, Chinachem and COLI and we expect developers to continue to replenish land banks but at more conservative prices,” the Swiss research house said.

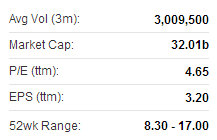

Goldman Sachs: ‘Buy’ Calls on LONGFOR, GREENTOWN

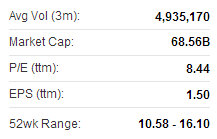

After visiting one of China’s most wealthy provinces, Goldman Sachs has “Buy” calls on Longfor, Greentown, R&F, KWG, Shimao, CRL, Country Garden, Evergrande, Vanke, Poly, CMP and Gemdale.

Longfor recently 12.60 hkd“We held a fieldtrip to Hangzhou/Ningbo/Wenzhou, the three top-ranked cities in Zhejiang province (in terms of 2012 GDP).

Longfor recently 12.60 hkd“We held a fieldtrip to Hangzhou/Ningbo/Wenzhou, the three top-ranked cities in Zhejiang province (in terms of 2012 GDP).“Despite the rising inventory in Hangzhou/Ningbo on an overall basis, we found projects located in main areas of these two cities could see more price increase in the coming months,” Goldman Sachs said.

That said, the research house added that some developers expect volume to be largely flat in October from 3Q levels.

In addition, projects in Cixi (a County level city in Ningbo) have seen decreasing average sales prices (ASP) since 2011.

Greentown recently 14.84 hkdIn Wenzhou, Vanke also expects around a 5% ASP drop in the coming year as they feel a lower ASP is needed to boost local first-time/upgrade demand, while Hangzhou has been a target city for wealthy families from Wenzhou/Taizhou.

Greentown recently 14.84 hkdIn Wenzhou, Vanke also expects around a 5% ASP drop in the coming year as they feel a lower ASP is needed to boost local first-time/upgrade demand, while Hangzhou has been a target city for wealthy families from Wenzhou/Taizhou.“Local developers in the three cities we met all expect land bidding to stay strong for the remaining part of the year and they are still actively looking for potential opportunities, but will be more selective than before,” Goldman Sachs added.

Sell ideas include Yanlord, PCRT and Risesun with upside risks being better-than-expected economic conditions and/or policy loosening.

Bocom: HONG KONG PROPERTY ‘Market Perform’

Bocom Research is keeping its “Market Perform” call on Hong Kong’s listed real estate plays.

Bocom has a 'Buy' call on Henderson Land. Photo: Henderson“Primary market volume rebounded by around 50% to close to 900 units in September, led by end-user demand for small-ticket units.

Bocom has a 'Buy' call on Henderson Land. Photo: Henderson“Primary market volume rebounded by around 50% to close to 900 units in September, led by end-user demand for small-ticket units.“As for those larger-ticket units, we believe the developers have chosen to delay their launches to wait for a better market window, rather than selling them at low prices,” Bocom said.

The research house expects developers to start “testing the waters” in the market, after property prices stabilized over the past few weeks.

“Nevertheless, we expect sales momentum to remain slow, as the developers are under no pressure to trade prices for volume.

“We maintain our view that the developers’ asset value should remain solid, although we agree sector valuation may continue to stay at the lower end of the 5-year range of 30%-50% NAV discount, given the slower property sales pace and little upside in property prices.”

See also:

CHINA PROPERTY: What Analysts Now Say