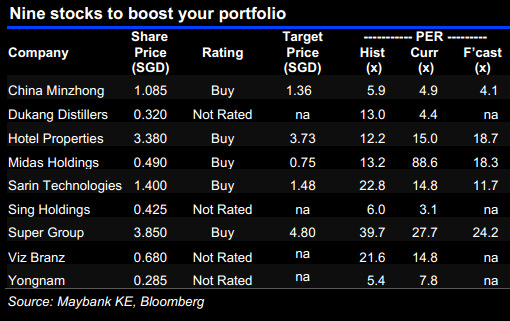

Maybank Kim Eng yesterday issued a 46-page report which argues the case for the privatisation for 9 "small caps straddling across various sectors, with favourable chances for positive corporate actions."

It adds: "Being prudent investors however, our choices also reflected attractive underlying valuations as well as positive growth potential, which will be supportive of further share price appreciation even in a non-event, meaning we would be comfortable holding on to these stocks in the long term even if a corporate action does not pan out."

The full report can be accessed here. We reproduce excerpts regarding 2 stocks: Dukang Distillers and China Minzhong, as follows:

Analyst: Wei Bin

Analyst: Wei BinWhy privatise? In our view, Dukang could be privatised for the following reasons:

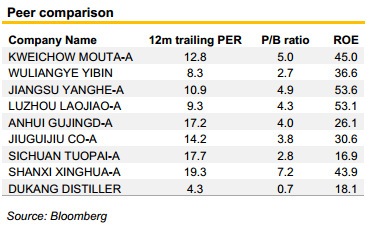

1) Cheap valuation: Dukang is currently trading at 4.3x 12m trailing PER and 0.7x of its FY6/12 book value, which is very undemanding to us especially when compared with other A-share listed peers.

2) Share price close to IPO price: The current share price is about the same as its IPO price of SGD0.31.

In Luoyang city, investors checking out a store that sells Dukang spirits. The product banner is displayed at the top of the shelves. File photo3) Cash rich: The company has very healthy operating cash flow and is in a net cash position of CNY671m. In fact, its net cash balance accounts for 51% of the company’s total market cap.

In Luoyang city, investors checking out a store that sells Dukang spirits. The product banner is displayed at the top of the shelves. File photo3) Cash rich: The company has very healthy operating cash flow and is in a net cash position of CNY671m. In fact, its net cash balance accounts for 51% of the company’s total market cap.4) The consolidation of baijiu industry. Chinese baijiu market is still quite fragmented currently but might go through a consolidation process going forward.

The rich cultural value inside Dukang brand could make it a very attractive M&A target.

The rich cultural value inside Dukang brand could make it a very attractive M&A target.

Who will privatise the company?

Dukang’s most likely potential buyer will be its founder or management, in our view. In light of recent privatisation bids such as Synear’s delisting offer by its founder Li Wei, we cannot rule out the possibility that Dukang’s management or founder will follow a similar path.

Recent story: DUKANG DISTILLERS: 2Q2013 net profit jumps 52.5% to Rmb 144m

2. Minzhong’s current cheap valuation also makes it a good candidate to be privatised.

The stock is trading at 4.4x PER and 0.9x P/BV vs Indofood’s corresponding valuations of 18.6x and 2.8x. In our view, the huge valuation gap between the duo will benefit Indofood’s shareholders if an acquisition eventuates.

Recent story: DUKANG DISTILLERS: 2Q2013 net profit jumps 52.5% to Rmb 144m

Analyst: Wei Bin

Is privatisation possible? We cannot rule out the possibility that Indofood will some day privatise Minzhong. Our reasons are as follows:

Is privatisation possible? We cannot rule out the possibility that Indofood will some day privatise Minzhong. Our reasons are as follows:

1. Minzhong’s integrated vegetable processing capacity is what has attracted Indofood, in our view. Indofood raised its stake in the company to 29% only two weeks after first acquiring a 15% holding. This shows its eagerness to secure a bigger control of the company. However, we do not think 29% is the end of the story. Indofood will likely continue to increase its holdings or

even privatise Minzhong if it wants absolute control of the company.

2. Minzhong’s current cheap valuation also makes it a good candidate to be privatised.

The stock is trading at 4.4x PER and 0.9x P/BV vs Indofood’s corresponding valuations of 18.6x and 2.8x. In our view, the huge valuation gap between the duo will benefit Indofood’s shareholders if an acquisition eventuates.

3. Minzhong’s shareholding structure is also favourable for a privatisation. Indofood already owns 29% of the company, followed by Templeton (14%) and CMIA (5%). Management owns about 5% of the company.

We understand that CMIA, as a p re-IPO investor, has been investing in Minzhong since 2004 and given the nature of private equity firms, it is a natural progression for them to liquidate their investments post IPO and return the capital to their investors.

Thus, it should not be too difficult for Indofood to take over CMIA’s share in the future. With the top four shareholders accounting for 51% of the company, privatisation would seem a lot more feasible in our view.

Recent story: COMFORTDELGRO, SMRT, CHINA MINZHONG: What analysts now say

We understand that CMIA, as a p re-IPO investor, has been investing in Minzhong since 2004 and given the nature of private equity firms, it is a natural progression for them to liquidate their investments post IPO and return the capital to their investors.

Thus, it should not be too difficult for Indofood to take over CMIA’s share in the future. With the top four shareholders accounting for 51% of the company, privatisation would seem a lot more feasible in our view.

Recent story: COMFORTDELGRO, SMRT, CHINA MINZHONG: What analysts now say