Bocom: MAGIC Started ‘Buy’

Bocom International said it is initiating coverage of China’s top beauty mask brand Magic Holdings (HK: 1633) with a “Buy” recommendation.

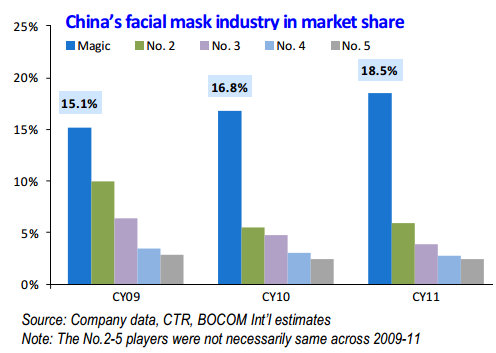

“Magic’s success reshaped China’s beauty mask industry. Founded in 2005, Magic has grown into a leader in China’s mass-market beauty mask industry, with the largest market share of 15.1%/16.8%/18.5% across 2009-11,” Bocom said.

More than five MG-branded beauty masks – Magic’s flagship brand -- were sold every second in FY12.

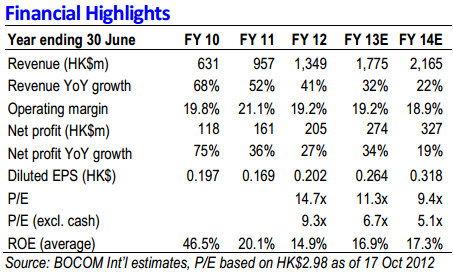

“In 3Q12, Magic maintained its above-industry growth rate, with an impressive sales growth of around 30% YoY. We anticipate Magic to achieve a net profit CAGR of 24% in FY12-15E, driven by a revenue CAGR of 24% on its POS expansion and the right product offerings,” the research house said.

Acquisition candidate?

On top of Magic’s earnings growth prospects, Bocom is upbeat on Magic’s potential share price gain from the acquisition angle.

“In our opinion, Magic could be appealing to some global skincare player(s) who intend to penetrate China’s mass market with broadened product offerings and price ranges.

“Magic’s charm lies in (1) its leading market share with further gain in a rapidly-expanding segment; (2) its favorable shareholding structure; and (3) its attractive valuation (10x CY13 P/E and 6x P/E excl. cash).”

Bocom is assigning Magic a first-time target price of 3.50 hkd based on 12x CY13 P/E. (recent share price: 2.89 hkd)

“Our target represents a 50% discount to Hengan (24x), the bellwether of the China Personal Care Sector, given Magic’s shorter trading history, single product portfolio and smaller business scale,” the note to investors said.

This also implies a 25% discount to Magic’s own average P/E (16x) since listed and is at the low-end of the China Consumer Staples peer group.

“In the blue-sky scenario, we assume Magic will be approached by a global skincare player in mid-2014 when the company’s sales exceed 2 billion hkd.

“Given Magic’s compelling risk/return profile, we urge investors to buy in before the stock re-rates. Magic is one of our favorite small-cap stocks in the China Consumer Staples Sector,” Bocom added.

See also:

BEHIND THE MASK: MAGIC’S PRC Market Share A Thing Of Beauty

Supply-Side Pride As MING FAI Named HK ‘Outstanding Enterprise’

MING FAI Targets 2,000 PRC Cosmetics Stores This Year

NATURAL BEAUTY Gets ‘Buy’ Initiation; ESPRIT ‘Sell’ After Mgmt Shakeup

Bocom: ELECTRONICS ‘Outperform’

Bocom International says it rates Hong Kong-listed electronics plays as “Outperform” and is also initiating coverage of the PC and semiconductor sub-sectors.

“Our positive view on the electronics sector remains intact. We continue to hold a positive view on the electronics sector in 2013.

“The smartphone segment is the most promising segment in 2012, which echoes our affirmative view on the sector outlook,” Bocom said.

The research house said its sector picks “have remarkably outperformed the market” with AAC Tech (HK: 2018) as its sector pick in the first half (29% gain vs. 5.5% in HSI) and Sunny Optical (HK: 2382) as its sector pick in the second half (79.4% gain vs. 11.7% in HSI).

“We believe the robust growth momentum of smartphones would continue in 2013. In addition, the global PC industry and semiconductor industry are expected to rebound in 2013.

“As a whole, we expect a promising 2013 outlook for the electronics sector.”

The global PC industry is experiencing a slowdown, weathering a rough second quarter and an even worse third quarter.

As a result, the global PC industry is expected to record a flat growth in 2012.

“The uncertainty about product updates should be largely addressed by the end of this year and may be accompanied by a modest improvement on the economic front, leading to a forecasted 6.5% rebound in 2013,” Bocom said.

The smartphone segment remains the most promising segment in the electronics universe.

“With the continuing demand from mobile internet and advances in 3G/4G wireless communications technologies, global smartphones will continue to post strong growth in the coming years,” Bocom added.

The research house said it holds a cautiously optimistic view on the 2012 outlook of the global semiconductor industry given the recent soft leading indicators.

SIA forecasts the global semiconductor industry to see a flat growth in 2012 but a stronger 2013, mainly driven by wireless applications.

Lenovo (HK: 992), “Buy,” Target 7.90 hkd (recently: 6.3 hkd)

Bocom initiated PC giant Lenovo Group with a "Buy" recommendation.

“Lenovo possesses a strong market position in the global PC industry and is on its way to becoming a market leader for the first time.

“We believe Lenovo will further consolidate its market position and expand its market share at the cost of its competitors,” Bocom said.

See also:

Why LENOVO Isn't Celebrating Being No.1

Not All Hong Kong Shares Stuck In Neutral

CANCELLING OUT: Why Hong Kong Shares Stuck In Neutral

BUYER’S MARKET? 12 Consumer Plays Eyeing HK IPOs