SFC Analyst: CHOW SANG SANG Started ‘Buy’

Securities & Futures Commission (SFC) licensed independent analyst Yu Kwan Lung has initiated Chow Sang Sang Jewelry (HK: 116) with a “Buy” recommendation and a target price of 21.4 hkd.

The stop-loss price is 15.66 hkd.

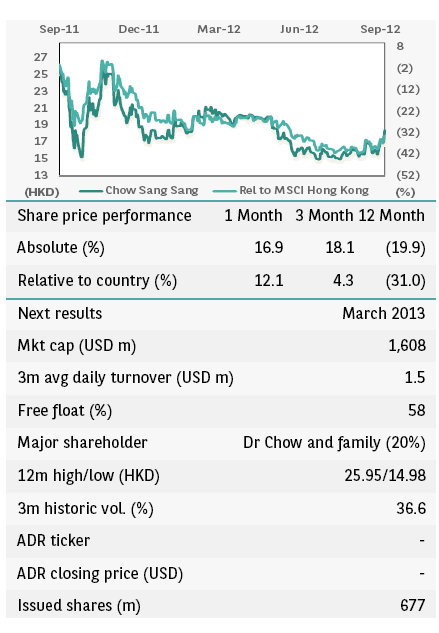

Chow Sang Sang was recently trading at around 18 hkd.

“Reading from the trend of the share price, the 50-day moving average is at 15.66 hkd. It also dances above the 10-day moving average which suggests it will head north,” Yu said.

He added that measured by the Stochastic Oscillator Index, Chow Sang Sang “unveils a buying signal.”

“Analyzing the share price movement, the long-term high ( 31/10/2011 ) is at 25.45 hkd and the recent low ( 26/7/2012 ) is 14.88 hkd. It seems poised to resume an upward trend.”

Chow Sang Sang has one of the longest brand histories among Hong Kong jewelry companies with a strong brand and sizable market shares (top three in Hong Kong, top 15 in Mainland China).

Stripping out the holding gain/loss, net profits saw 10.6% YoY growth in 1H12.

See also:

Pearls & Properties: CHOW SANG SANG ‘Buy’, HOUSING ‘Outperform’

CHOW SANG SANG, LENOVO Both ‘Outperform’

HK & PRC Retail Rundowns; CHOW SANG SANG Looking Golden

HSBC: Hikes CHOW SANG SANG Target to 17.8 hkd

HSBC has raised its target price on Chow Sang Sang Jewelry (HK: 116) to 17.8 hkd from 16.7 previously.

HSBC also raised its 2012 earnings forecast for Chow Sang Sang by 9%

However, it is downgrading the retailer to “Underweight” from “Neutral.”

“(Washington’s) QE3 brings less benefits to jewelry retailers compared to QE2 and it is hard for sales to grow,” HSBC said.

Despite the overall weakness in gold prices as well as jewelry demand, CSS still registered a solid same store sales growth (SSSG) of around 16% YoY in the April-June quarter in Hong Kong and outperformed the overall Hong Kong market growth of 6.8% YoY.

The brokerage also cut its call on jewelry play Luk Fook (HK: 590) to “Underweight” from “Neutral.”

See also:

CHOW SANG SANG Sales Surge; Move Over, India?

CHOW SANG SANG Kept At ‘Buy’, HK Property Initiated ‘Outperform’