Three big plays in China's pharmaceutical sector, which are all HK-listed, reported invigorating 2011 full-year results. NT Pharma's bottom line surged ahead 98.9% to 255.8 mln yuan, China Medical System Holdings' net profit soared 103% to 62.4 mln usd, and Tong Ren Tang's grew 28.6% to 254.7 mln yuan.

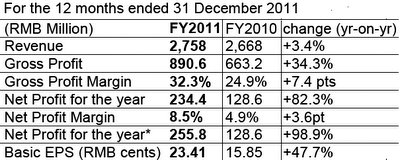

LAST YEAR, China NT Pharma Group Company Ltd (HK:1011), a leading third party pharmaceutical sales and promotion services provider in the PRC, said its 2011 net profit surged 98.9% year-on-year to 255.8 mln yuan after its top line rose 3.4% to 2.8 bln yuan.

The Hong Kong-listed firm’s gross profit margin improved to 32.3% from 24.9% in 2010.

Basic earnings per share for China NT Pharma rose 47.7% to 23.41 RMB cents.

The Board said it believes more resources should be retained for the further development of the group and does not recommend the payment of a final dividend for the year.

Turnover of pharmaceutical promotions and sales jumped 38.9% to 1.36 bln yuan for the year.

The strong sales increase was mainly driven by Libod, an oncology drug the group launched in March 2011 as the nationwide exclusive distributor.

NT Pharma began to restructure the vaccine business by gradually exiting the vaccine supply business in Mainland China and putting more focus on the vaccine promotions and sales businesses which has higher margins and returns.

As such, turnover generated from vaccine promotions and sales grew by 93.0% to 689 mln yuan.

The remaining turnover was mainly generated from of the sales of the drug manufacturing arm of the group, Suzhou First Pharmaceutical Co, and 49 generic drugs.

NT Pharma’s network of pharmaceutical promotions and sales increased by about 300 hospitals from a year earlier to over 3,800 hospitals at the end of 2011.

The group also started to tap into the huge retail market network in China by establishing a sales team for community hospitals and retail pharmacies in the fourth quarter of the year.

Mr. Ng Tit, Chairman and CEO of NT Pharma said: “With the government gradually imposing more reforms on the healthcare sector, we have defined our long term growth strategies in accordance with the changing landscape of the industry. All these initiatives will enable the group to enter into a new stage of high and sustainable growth, with tangible results achieved in the near future.

“We also plan to work with R&D companies who focus on developing high-end therapeutic vaccines to develop new and high-end products.”

China NT Pharma was established in 1995, is headquartered in Hong Kong, and listed on the main board of the Hong Kong Stock Exchange on 20 April 2011. NT Pharma has a large third party promotion network in China covering 3,800+ hospitals and 35,000+ physicians. The Group produces NT branded products through its wholly owned subsidiary, Suzhou First Pharmaceutical Company Ltd which is GMP-certified and had obtained approvals from the SFDA 175 drugs licenses to manufacture and sell pharmaceutical products.

See also:

Ex-SGX Listco SIHUAN, SINO BIOPHARM: Downturn-Resistant Firms Get ‘Buy’ Call Initiations

Photo: CMS

IN 2010, Shenzhen-based China Medical System marketed, promoted and sold nine products via its direct network and 10 products via its agency network All sales were made within the Mainland China market.

“We principally consolidated the existing market, continuously established new market segments and extended the rural market coverage to achieve stable growth in 2011,” the company said.

CMS also continued to promote its several in-house developed and manufactured products.

“Last year, despite the volatile market conditions in China, China Medical System achieved significant growth. We benefited from the pursuit of two core development strategies: the introduction and development of products and expansion of our marketing and promotion network.

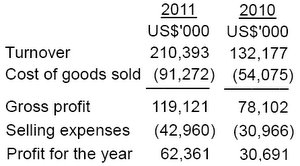

“In addition, we acquired products and expanded the network through mergers and acquisitions,” CMS said. Its revenue jump was 59% to over 210 mln usd while net profit soared 103% to 62.4 mln usd.

“We've continued to expand our agency network, and selected additional high quality independent third party sale representatives or agents to join our growing agency network.”

As of end-year 2011, the direct network of the firm had close to 1,200 sales, marketing and promotion professionals while the agency network had close to 1,000 independent third party sales representatives or agents.

Aside from enlarging the number of sales representatives and agents, CMS has also expanded its geographical network coverage and hospital coverage.

As of end-year 2011, the sales coverage of the Group spanned over 14,600 hospitals throughout China, of which around 8,600 hospitals were covered by the direct network and over 7,800 hospitals were covered by the agency network.

Danish anti-anxiety drug Deanxit and German liver medicine Ursofalk continued to be the top two sales contributors for CMS last year.

Country Doctor

But CMS was more than willing to play the role of the country doctor, as still well over half of Mainland China’s 1.3 bln people hail from the countryside.

“Last year, CMS vigorously expanded its rural market coverage through the marketing and promotion network, and continued to penetrate the rural areas to fill the group’s market absence in the rural market and to tap the existing potential of these regions with expectations of further growth,” the company said.

CMS mainly engages in M&As with the intention of winning distribution rights in the PRC. It keeps its eyes open for attractive assets both at home and abroad with the aim of controlling the distribution of popular drugs in the world's most populous country.

CMS, incorporated in December 2006, first listed on London’s AIM market in June 2007. Then in September 2010, CMS listed on Hong Kong’s main board and was simultaneously delisted from London’s AIM.

See also:

CMS Doubles Profit, Boosting Drugs

BOCOM: Hiking Tong Ren Tang's Target

Ubiquitous drugmaker and retailer Tong Ren Tang (HK: 1666) saw 2011 revenue and net profit grow 22.6% and 28.6%, respectively, to 1.94 bln yuan and 254.7 mln yuan.

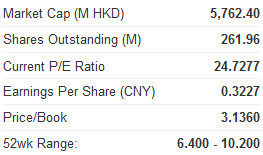

Bocom International said it is raising its target price on the manufacturer and retailer of Traditional Chinese Medicines (TCM) to 10.54 hkd from 10.00.

"Profit growth accelerated significantly and was noticeably faster than the previous year. And EPS stood at 0.043 yuan, a little higher than our forecast of 0.42," Bocom said.

Without considering the possible IPO of TongRenTang Guoyao, Bocom said it estimates the EPS for FY12 - FY14 at 0.54/0.67/0.84 yuan, respectively.

"We slightly raise our target price, representing 16x FY12E PE, equivalent to the average PE of the comparables. However, as the share price is near our target price, we downgrade the stock to 'LT‐Buy' from 'Buy'."

Tong Ren Tang engages in the manufacture and sale of Chinese medicines in the PRC. The company is also involved in purchasing, processing, and selling Chinese medicinal raw materials and agricultural by-products; producing ointment; and the medical research and development activities. It also engages in the technological development and sale of biological products, Chinese and western medicines, and cosmetics and health food; and sale of medicinal products. The company was incorporated in 2000 and is based in Beijing.

See also:

HAIER, SHANGHAI PHARMA Among Stocks On Cusp Of Comeback?