Excerpts from latest analyst reports

Maybank KE maintains 'buy' call on Midas

Analyst: Wei Bin

Following a meeting with management recently, we believe that Midas is on track for recovery in the medium term once it overcomes the lingering difficulties that will persist in the next few quarters.

Potential contract wins from upstream customers such as CSR and CNR, China’s two largest train makers, will help restore the company’s profit back to a more normal level. Midas has also been working hard to diversify its revenue base, including moving up the value chain into the fabrication business, strengthening its foothold in the power industry and venturing further overseas.

Though such diversification and building of new factories will eat into margins in the short term, they will ensure Midas’s sustainability in the long term.

More years to go for China’s high-speed rail. As far as we know, there are no major changes to China’s original plan to build 16,000km of high-speed rail lines by 2020. The fatal railway accident and corruption scandal in 2011 put a spanner in the works and only about half of the targeted length has been completed so far. This means a reacceleration of construction is possible in the next few years.

Expect earnings recovery from 2H13. Assuming the Ministry of Railways issues a new round of high-speed train tenders early next year, we expect Midas may be able to record earnings recovery in 2H13 or 1H14, give and take six months for delivery. In our view, Midas’s current share price will be supported by 0.8x FY13F P/BV. Maintain BUY and TP of SGD0.48.

Recent story: Kevin Scully: Another positive development for MIDAS

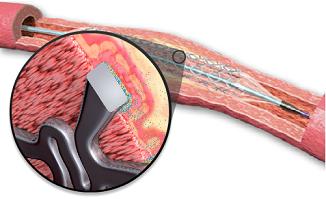

Barclays initiates coverage of Biosensors with 'overweight' and $1.50 target

Analyst: Jason Mann, M.D., Ph.D.

We initiate coverage of Biosensors with an Overweight rating and PT of S$1.50. We recommend this stock for three reasons:

1) the company's leading position in China's coronary stent market (20% revenue market share) with expansion in other emerging markets (>20% y/y revenue growth), driving base case revenue/net income CAGRs of 15%/17% in FY12-15E;

2) strong R&D offering true innovation, which we expect to sustain the company's competitive advantage and protect margins; and

3) compelling valuation at 13x FY13E P/E (10x ex-cash), a 25% discount to medical device peers.

We see downside support from the share buyback programme and solid balance sheet (25% of market cap in cash).

Management is actively pursuing M&A and we see its early bond repayment (one month early in November 2012) as providing it with more flexibility for M&A, which adds potential upside risk to our estimates.

Recent story: DMX, SINO GRANDNESS, BIOSENSORS: More than 50% upside?