Click on the above 64-second slideshow on the gong ceremony at SGX to mark SIIC's upgrade to the mainboard as well as its name change from Asia Water Technology. (For higher resolution, click on the slideshow, then move your mouse cursor over the base of the slideshow, and click on 'Change Quality'.)

SHARES OF SIIC Environment (known as Asia Water Technology until last week) jumped 28% in the week before its upgrade to the mainboard of the Singapore Exchange last Friday (Nov 30).

The shares moved from 6 cents on Nov 23 to close at 7.7 cents on Nov 30, giving the company a market cap of about S$389 million.

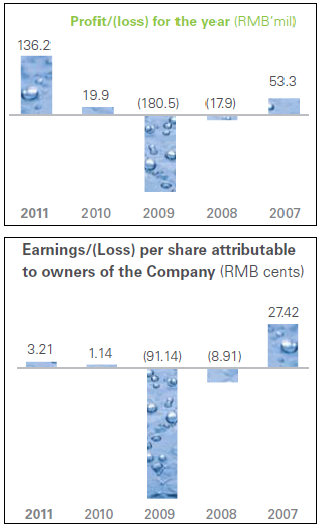

For some history: SIIC had a few tough years prior to Shanghai Industrial Holding (SIHL) acquiring a 77% stake in its enlarged share capital in 2010.

The white knight, SIHL, is a Hong Kong listed company which is majority controlled by a PRC state-owned enterprise.

SIHL is a sizeable entity with its recent market capitalization weighing in at about HK$27.4 billion. It had sales of HK$15.0 billion in FY2011.

Aside from water assets, SIHL owns businesses in consumer products, real estate and pharmaceutical.

In August 2011, SIHL sold a 20.78 % stake in SIIC Environment to China Energy Conservation & Environmental Protection (Hong Kong) Investment.

SIIC Environment has returned to financial health and business expansion via:

a. A S$72 million rights issue in 2011.

b. Acquisition of stakes in Wenling Hanyang, Wuhan Hanxi, and United Environment in 2011.

As a result of the acquisitions, SIIC Environment's total daily design capacity tripled to ~3.2 million tonnes from ~1.0 million tonnes in 2009. This is spread over 39 water projects in 12 provinces across China.

In China, there are only 10 players with daily treatment of more than 5 tonnes.

SIIC Environment has invested more than RMB4 billion in 39 projects. In the next 2-3 years, it will invest RMB2-3 billion more, said the executive chairman, Zhou Jun, at a press briefing last Friday (Nov 30). There are three ways it will spend the money:

a. New M&A activities;

b. Upgrade existing projects to meet new stringent criteria for discharge; and

c. Some existing projects will enter into new phases of expansion.

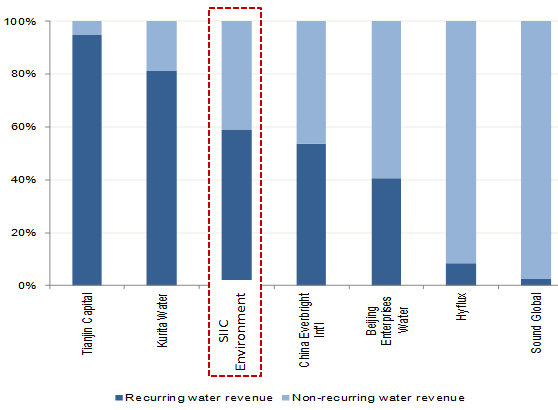

While revenue in this industry can be lumpy during the initial phases of a project, the recurring revenue rises eventually.

SIIC Environment says its recurring water revenue is close to 60% of its revenue (see chart above).

When it comes to hard cold cash, SIIC has a positive and a negative:

> Positive: In 9M2012, SIIC generated RMB131.3 million of operating cashflow compared to a negative RMB16 million in 9M2011.

> Negative: Its bank borrowings has gone up to RMB2 billion, compared to RMB1.5 billion as at end-Dec 2011.

And, given its expansion mode, in 9M2012, it used up RMB237.4 million in investing activities, which largely accounts for its drop in cash balance to RMB287.6 million at end-Sept 2012 (compared to RMB332.9 million a year earlier).

Here are some highlights of the Q&A session during last Friday's press conference:

Q: Your press release talks about Shanghai Industrial (SIHL) being committed to grow its water and environmental protection business and SIHL intends to consolidate its water-related assets to be held under SIIC. Can you give us an idea of the size of these assets and the timeline for it?

Zhou Jun: SIIC Environment currently has treatment capacity of 3.2 million tonnes. It can support a 10-million population, or twice the size of Singapore. SIHL has 8.5 million tonne capacity which can cater to the needs of 30-40 million people. In the past, SIHL has acquired water assets via M&A, and injected the assets into SIIC Environment.

SIHL will continue to do so to grow SIIC into a tier-1 water play. There are a number of Singapore-listed water companies with operations in China but in terms of scale, I believe none has more than 1-million tonnes in capacity. SIIC is the largest among them.

Q: Early this year, there were reports of Asia Water planning for a dual-listing in Hong Kong, Is that still going on?

Zhou Jun: We have been thinking of dual listing and SIHL is well known in the investment community in HK. Dual listing is possible but subject to various considerations including professional recommendation and the performance of SIIC.

We hope to see more trading liquidity for our stock and a bigger market cap -- all these will be advantages in the plan for a dual listing.

Q: What's the time table for a dual listing?

Zhou Jun: The time line will depend on the size of our company, for example. The current market cap of about S$300 million is small and will not match up to the reputation of our parent company, SIHL. We will look into this more seriously at the end of 2013.

Q: The company has not paid a dividend for the past 4 years. Is this going to continue?

Zhou Jun: The company was not in a healthy state previously and later we went on a rapid expansion phase and needed capital. As a reference, our parent company has a 35-40% payout policy. We will continue to expand but when we reach a steady growth stage, we will pay dividends. It won't be long before we pay dividends again.