This article has just been published on Calvin Yeo's blog (www.investinpassiveincome.com) and is reproduced with permission.

THIS IS something which is too interesting not to post about. World renowned shortist Carson Block has made public statements doubting Olam’s accounting methods.

The words are indeed very harsh, ranging from comments like “Olam will fail” and recovering for investors will be negligible”. He seems to think that the company will not have anything left for equity shareholders.

This makes for an interesting case study as I take a quick look to see if any of these allegations are true.

There are 3 points made.

1. High leverage

2. Aggressive accounting on biological gains

3. Booking profits on transactions before it is clear how they would work out.

Let’s first separate the facts from opinions. 1 and 2 are facts. The 3rd remains an opinion based on public information, unless he knows something which we do not.

Although the research firm of Carson Block Muddy Waters has made headlines with uncovering the Sino Forest accounting fraud, not all of its allegations turn out to be 100% factual.

Leverage

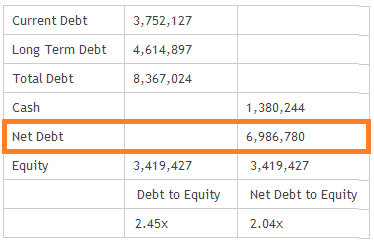

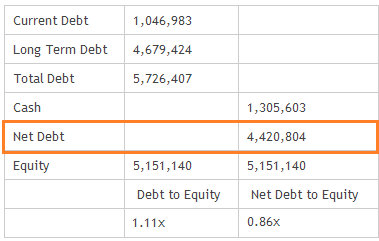

Looking at the Sep 30 balance sheet, Debt to Equity ratio is extremely high at 2.45x while Net Debt to Equity ratio is also extremely high at 2.04x.

High leverage ratios are not good for a company as the company may be overextending itself. It also increases the risks of shareholders not getting much left after creditors get their money back.

The probability of Olam reducing its leverage is also low as Olam has been running on negative free cash flow for the past 3 years.

Aggressive Accounting on Gains

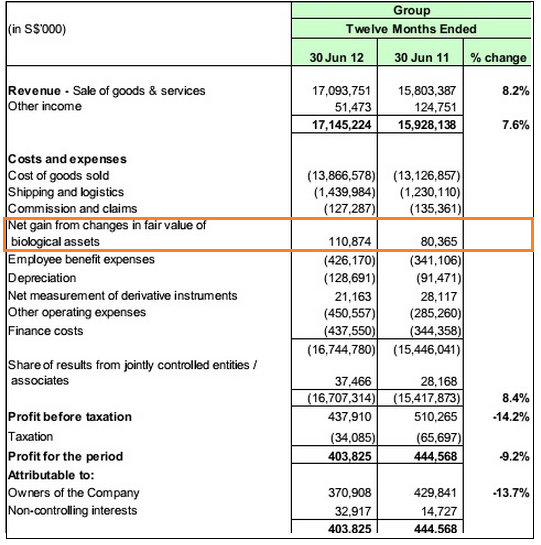

We can see from the above income statement that gains from biological assets are 110,874 in FY2012 which seems to be a small amount compared to revenue but makes up 27% of the profits. Therefore, profits would have been 27% lower if not for the bio gains. In FY 2011, bio gains make up 18% of the profits.

Biological Gains and Booking Profits and Transactions Before They Know How It will Turn Out

Biological gains refer to gains that a company will make over time once a plantation starts producing. They are a valid accounting standard used by agricultural companies.

So there is a certain amount of grey area here as the gains are booked ahead of time and no one is sure how these transactions will turn out. Since bio gains is a significant portion of profits, it affects the company dramatically.

So when Muddy Waters refer to booking profits ahead of certainty, are they referring to these bio gains or something else? If it is bio gains, then it is a requirement to understand the accounting standards. If it is something else, then there may be more than meets the eye.

Overall, it is good that there are firms like Muddy Waters who keep a check on public companies to make sure they do not try to defraud public investors, over leverage themselves or whatnots. They may not be a charity, but they are still providing some value in my opinion.

Even if not all Muddy Waters allegations turn out to be true, that should put the Olam management on alert so they would be less inclined to try anything funny. Why target Olam and not Noble and Wilmar?

From the short analysis above, Olam has almost double the leverage than its peers and bio gains also make up a much larger proportion of its net profits as compared to Noble. I will wait for the Muddy Water research report before commenting any further.