Terence Wong

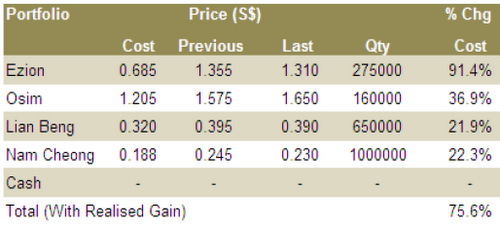

My Model Portfolio was flat for the week.

Offshore marine plays Nam Cheong and Ezion fell hard over the week, but the portfolio was saved by strong runs by OSIM and Elite KSB.

The latter surged by over 10% last Thursday after announcing that the deal to buy over its core business went through (what I have been betting on for the past five months).

I walked away with 43% gains after selling all 400,000 shares at S$0.595 apiece.

Year-to-date, the portfolio is up 50.5%, more than doubling STI's 14.9% and FSTS' 22.0%.

Recent story: TERENCE WONG: My portfolio is up 44% since the start of the year

For how the portfolio started out, read: TERENCE WONG: 'What I would buy with $1 m'