THE NEWSFLOW of late from mainboard-listed JES International Holdings is strong and looking good.

The shipbuilding group based in China yesterday evening (Oct 30) announced that it had entered into a shipbuilding contract for one unit of UT 755 LN Platform Support Vessel (PSV) through its wholly owned subsidiaries, JES Universal Co. Private Limited and Jiangsu Eastern Heavy Industry Co. Ltd.

This is the Group’s second contract since it expanded its shipbuilding business into the offshore oil & gas industry. The first order for a PSV was announced on 8 October 2012.

The second contract was secured from the same customer based in Norway, and is also scheduled for delivery at the end of FY2014.

JES said it has also entered into contracts for the construction of two additional PSVs, which shall only become effective in the coming months.

JES shall make further announcements as and when the contracts become effective.

“We are building up a decent momentum in our expansion into the offshore space. The repeat order, along with 2 additional units to be effective in the coming months, represents our customers’ confidence in our capability to build offshore support vessels of global standards.

"This is an encouraging start to our move into the offshore space, and we shall endeavour to secure more contracts to build a strong presence for ourselves in the offshore space,” said Jin Xin, Chairman and CEO of JES.

Based on a recent stock price of 14.5 cents, JES stock trades at 9.8 X PE and sports a market cap of S$169 million.

Recent story: JES INTERNATIONAL, VIZ BRANZ: Latest Happenings....

Excerpts from DMG report

DMG says: "The Sheng Siong Show goes on"

Analyst: Melissa Yeap

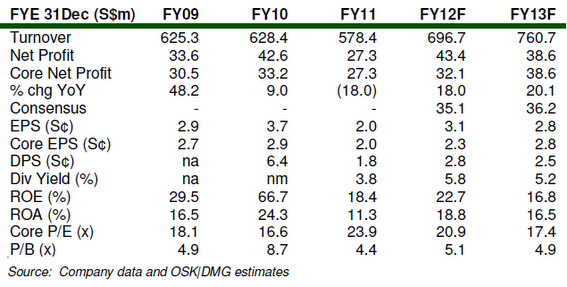

We came away from the Group’s 3Q12 results briefing with some positive takeaways:

1) Despite growing retail space by +15% by end of this FY12, management is confident of achieving +10% next year in line with our estimates.

2) Capex this year has been lower than expected due to the takeover of five rival supermarkets out of its eight new store openings,

3) New 24-hour Geylang store has outperformed, achieving operational profitability from day one,

4) We expect 90% dividend payout.

Maintain BUY with a TP of S$0.53, pegged to 19x FY13F P/E (-1SD from its historical mean trading band).

First 24-hour Geylang store outperforms, achieving operational profitability from day one.

We note that management was very happy with the outperformance of its first 24-hour store in Geylang. The store has achieved operational profitability since day one.

Competition is slight in the area with more mom and pop stores lining the street.

Recent story: BIOSENSORS, CSE GLOBAL, SHENG SIONG: What analysts now say.....